The Montana Disabled Veteran Property Tax Relief Application Form is used by disabled veterans or the surviving spouses of deceased veterans to apply for property tax relief in Montana. This program offers a reduced property tax rate for veterans who are 100% disabled due to a service-connected disability. It also applies to the unmarried surviving spouses of veterans who were 100% disabled or died as a result of a service-connected disability. The benefit is granted only for the primary residence of the veteran or surviving spouse.

How to File Montana Disabled Veteran Property Tax Relief Application Form

- Obtain the Form: The application form can be downloaded from the Montana Department of Revenue website or accessed via the local Department of Revenue office.

- Complete the Form: Follow the line-by-line instructions below to complete the form accurately.

- Submit the Form: After completing the form, submit it to the Montana Department of Revenue. The application must be postmarked or hand-delivered by April 15.

How to Complete Montana Disabled Veteran Property Tax Relief Application Form

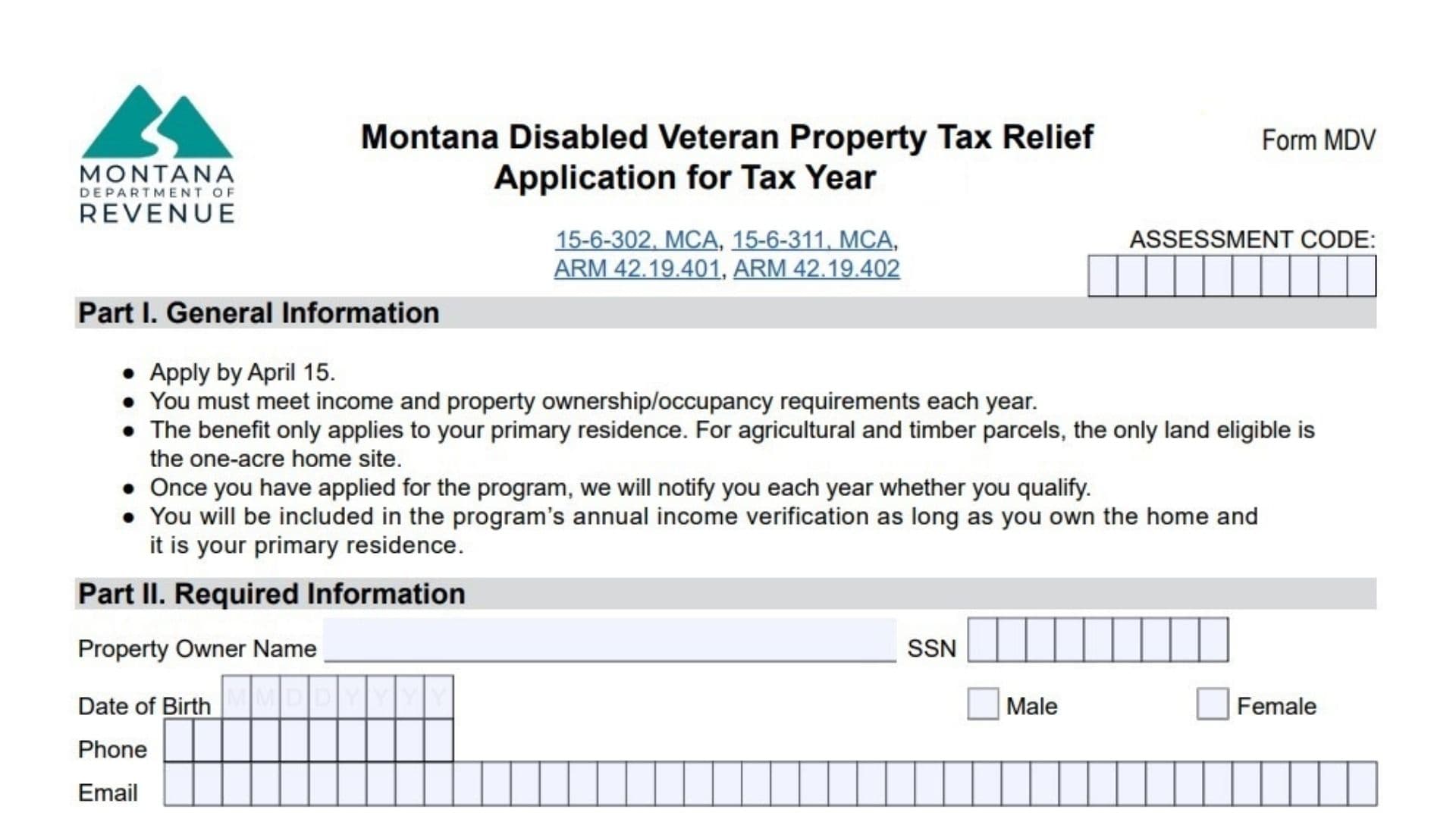

Part I. General Information

- Deadline: The application must be submitted by April 15 of each year.

- Eligibility: You must meet income and property ownership/occupancy requirements each year to remain eligible for the program.

- Property Type: The benefit applies only to your primary residence. For agricultural and timber parcels, only the one-acre home site is eligible.

- Income Verification: Once you apply, you will be included in the program’s annual income verification process for future years.

Part II. Required Information

- Property Owner Name: Enter the full legal name of the property owner.

- SSN: Enter your Social Security Number.

- Date of Birth: Enter the date of birth (MM/DD/YYYY).

- Phone: Provide a phone number where you can be reached.

- Email: Enter your email address.

- Spouse’s Name: Enter your spouse’s full name, if applicable.

- Spouse’s SSN: Enter your spouse’s Social Security Number.

- Spouse’s Date of Birth: Enter your spouse’s date of birth.

- Phone (Spouse): Provide your spouse’s contact phone number.

- County: Indicate the county where the property is located.

- Applicant’s Mailing Address: Enter the mailing address, including city, state, ZIP code, and county.

- Applicant’s Primary Residence Physical Address: Provide the physical address of your primary residence.

- Montana Income Tax Return: Answer whether you filed a Montana income tax return for Tax Year 2025:

- If Yes, you do not need to provide income documentation.

- If No, provide a copy of your 2025 federal income tax return or other income documentation (such as a Social Security statement or veterans’ benefits information).

- Mobile/Manufactured Home Ownership: If applying for a mobile or manufactured home, indicate whether you own the land the home is located on.

- If Yes, provide the geocode for the land.

Reminder: You must include your 100% disability letter from the U.S. Department of Veterans Affairs (VA) with this application.

Part III. Qualifying Criteria

- Eligibility for Tax Relief: This benefit applies to veterans who are 100% disabled due to a service-connected disability or the unmarried surviving spouses of such veterans. You must own or be under contract to purchase the home and live there as your primary residence for at least seven months of the year.

- Required Documentation: You must provide a letter from the VA verifying that you are rated or paid at the 100% disabled rate.

- Income Limits:

- For a single applicant, your Federal Adjusted Gross Income (FAGI) for Tax Year 2025 must be less than $62,598.

- For head of household or married applicants, the FAGI must be less than $72,229.

- For unmarried surviving spouses, the FAGI must be less than $54,573.

Part IV. Affirmation and Signature of Montana Disabled Veteran

- You must affirm that you have been honorably discharged from active service and are currently rated 100% disabled or paid at the 100% disabled rate due to a service-connected disability.

- You must also affirm that you own the property and have occupied it as your primary residence for at least seven months.

- Signature: Sign and date the form to certify the accuracy of the information.

Part V. Affirmation and Signature of Surviving Spouse of Montana Disabled Veteran

- The unmarried surviving spouse of a 100% disabled veteran must affirm that the deceased veteran was rated 100% disabled or paid at the 100% disabled rate, or died as a result of service-connected disability.

- The spouse must also affirm that they own the property and have occupied it as their primary residence for at least seven months.

- Signature: The surviving spouse must sign and date the form to certify the accuracy of the information.

Final Submission

Once the form is completed, ensure all sections are filled out accurately and submit it to the Montana Department of Revenue by April 15. If you have any questions, contact the Department at (406) 444-6900 or visit their website at revenue.mt.gov for more information.