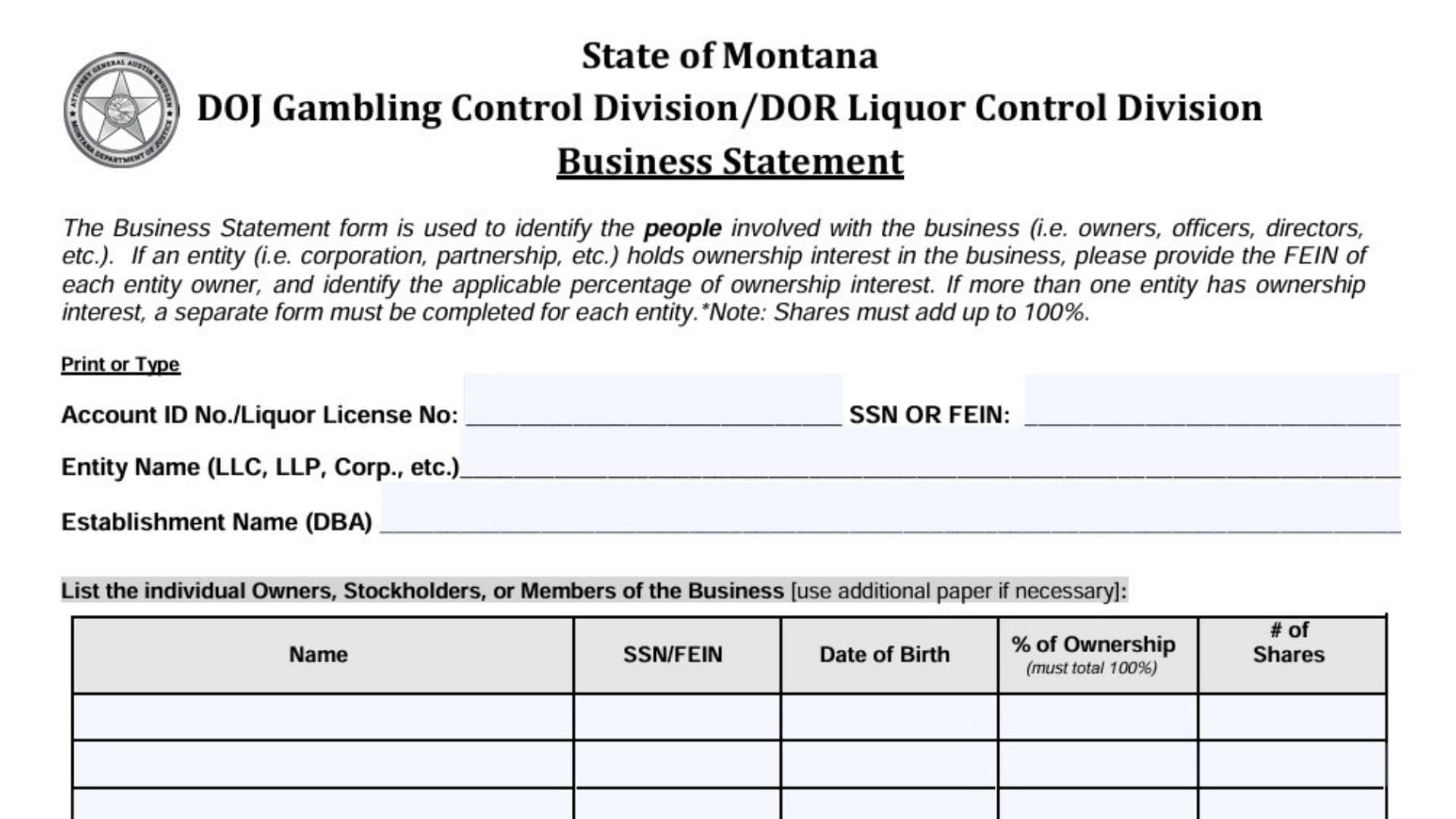

Form 30, officially titled the Montana Business Statement, serves as the state’s mandatory disclosure document for businesses seeking or maintaining gambling or liquor licenses through the Montana Department of Justice (DOJ) Gambling Control Division and Department of Revenue (DOR) Liquor Control Division. This critical form identifies every individual and entity with an ownership stake, management authority, or controlling interest in your licensed establishment, ensuring regulators maintain a complete and transparent record of who operates businesses handling alcohol and gaming activities. The form requires detailed reporting of owners, stockholders, members, officers, directors, and managers, along with their personal identification numbers, birthdates, and exact ownership percentages that must total precisely 100%. Beyond simple identification, the Business Statement triggers mandatory background checks for new individuals, requiring submission of fingerprint cards, a Personal/Criminal History Statement (Form 10), and a $30 processing fee unless the person was disclosed within the past two years. Whether you are adding a new partner, removing a departing shareholder, or updating your corporate structure, Form 30 ensures Montana regulators have current information to maintain public safety and regulatory compliance.

Who Must File Form 30?

You must complete and submit this form if you are:

- Applying for a new gambling license in Montana

- Applying for a new liquor license in Montana

- Making ownership or management changes to an existing licensed business

- Adding or removing owners, stockholders, officers, directors, or managers

How to Complete Montana Business Statement Form 30

Basic Business Identification

Top Section Fields

- Account ID No./Liquor License No.: Enter your existing license number if you have one. New applicants may leave this blank initially.

- SSN OR FEIN: Provide the Social Security Number (for sole proprietors) or Federal Employer Identification Number (for entities) associated with the business.

- Entity Name: Write the full legal name of your business entity (LLC, LLP, Corporation, Partnership, etc.).

- Establishment Name (DBA): Enter the “Doing Business As” name—the public-facing name customers recognize.

Section 1: Current Owners, Stockholders, Or Members

This table documents everyone who holds an ownership interest in your business. Use additional sheets if you have more than the spaces provided.

For Each Owner, Complete:

- Name: Full legal name (First, Middle, Last)

- SSN/FEIN: Individual’s Social Security Number or entity’s Federal EIN

- Date of Birth: MM/DD/YYYY format

- % of Ownership: Exact percentage of ownership interest (decimals allowed)

- of Shares: Total number of shares held (if applicable to your corporate structure)

Critical Rule: The ownership percentages in this section must add up to exactly 100%. If you have multiple entity owners (e.g., two corporations each owning 50%), you must complete a separate Form 30 for each entity, detailing that entity’s internal ownership structure.

Section 2: Owners To Be Removed

Use this section only if you are making changes to existing ownership. List individuals or entities that are exiting the business.

For Each Departing Owner:

- Name: Full legal name

- SSN/FEIN: Identification number

- Date of Birth: MM/DD/YYYY

- % of Ownership: Percentage they are relinquishing

- of Shares: Shares being transferred or retired

Section 3: Officers, Directors, Or Managers

This section identifies individuals with management authority, even if they have no ownership stake.

For Each Officer/Director/Manager:

- Name: Full legal name

- SSN/FEIN: Social Security Number or FEIN

- Date of Birth: MM/DD/YYYY

- Title: Specific role (President, Secretary, Treasurer, Managing Member, Operations Manager, etc.)

Section 4: Officers, Directors, Or Managers To Be Removed (Page 2)

If you are removing individuals from management roles, list them here with the same information fields as Section 3.

Required Supporting Documents

For each new individual listed in Sections 1 or 3 (unless they were disclosed in the past two years), you must submit:

- Two Fingerprint Cards: Obtain FBI-approved fingerprint cards from your local law enforcement agency

- Personal/Criminal History Statement (Form 10): Complete Montana’s background disclosure form

- $30 Background Check Fee: Pay via check or money order made payable to “Montana Department of Justice”

Note: Individuals previously disclosed within the last two years are exempt from re-submitting these materials.

Submission Address

Mail the completed form and all supporting documents to:

textGambling Control Division

615 South 27th Street, Suite A

Billings, MT 59101

Affirmation And Signature

Legal Certification

The person signing this form must read and understand the affirmation statement, which declares:

- You are authorized to submit this application on behalf of the business

- All information provided is true, accurate, and complete

- False statements may result in criminal prosecution under Montana Code Annotated §§ 45-7-202, 45-7-203, 45-7-208, 16-4-402

- False information may lead to revocation of gambling and/or liquor licenses

Signature Fields

- Signature Line: Sign your full legal name

- Date: Enter the current date

- Print Name and Title: Clearly print your name and official title with the business

Common Mistakes To Avoid

❌ Ownership percentages don’t total 100% – Double-check your math

❌ Missing background materials for new individuals

❌ Using outdated fingerprint cards – Must be current

❌ Incomplete entity disclosure – If a corporation owns your business, you must file a separate Form 30 for that corporation’s owners

❌ Forgetting to update removals – Always complete the “to be removed” sections when people exit

Timeline And Processing

- Processing Time: Typically 4-8 weeks for background checks

- Incomplete Forms: Will be returned, delaying your application

- Renewals: Must update Form 30 whenever ownership or management changes occur

Contact Information

Gambling Control Division Questions:

textPhone: (406) 444-1971

Website: dojmt.gov/gaming

Liquor Control Division Questions:

textPhone: (406) 444-6900

Website: mtrevenue.gov/liquor