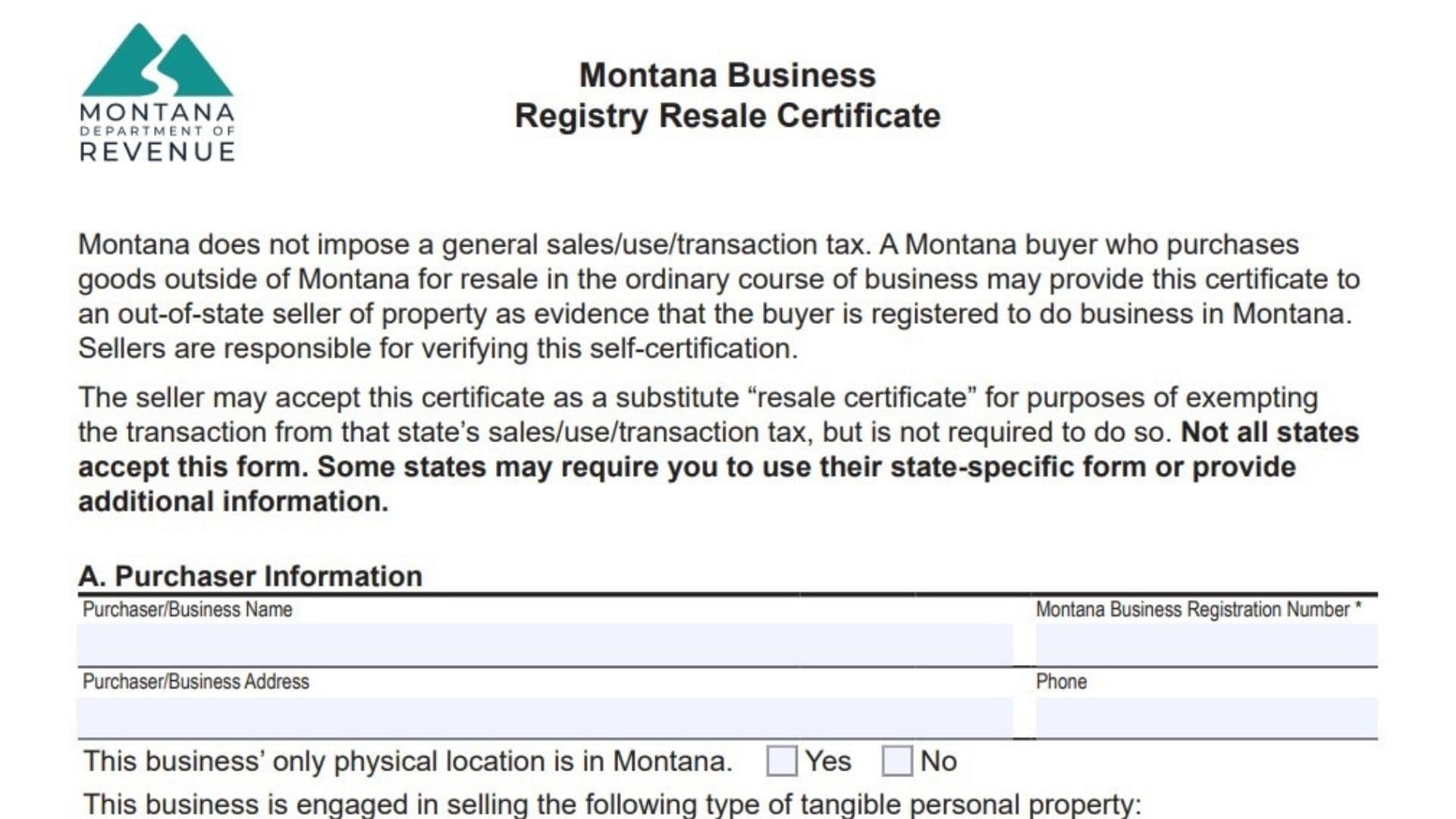

The Montana Business Registry Resale Certificate is a form used by businesses in Montana to certify that they are purchasing goods for resale. This certificate allows the purchaser to make purchases without paying sales tax, as the items will be resold in the regular course of business. It is used when the business intends to resell tangible personal property and is registered with the Montana Department of Revenue.

How to File the Montana Business Registry Resale Certificate

- Obtain the Form: The Montana Business Registry Resale Certificate can be obtained from the Montana Department of Revenue or directly from the business registration system online.

- Complete the Form: Follow the detailed line-by-line instructions below to fill out the certificate properly.

- Submit the Form: Once the form is completed and signed, it can be provided to sellers as evidence that the purchase is for resale and exempt from sales tax. The seller may require this certificate to process the transaction.

How to Complete Montana Business Registry Resale Certificate

A. Purchaser Information

- Purchaser/Business Name: Enter the full legal name of the business purchasing the property for resale.

- Montana Business Registration Number: Provide the business registration number assigned to your business by the Montana Department of Revenue. To verify your business registration, you can visit the Montana Secretary of State’s website (sos.mt.gov) and search under Business Services > Business Name Search.

- Purchaser/Business Address: Enter the physical address of your business. This address must be located in Montana.

- Phone: Provide a phone number where your business can be reached for any follow-up questions related to the certificate.

- Business Location in Montana: Indicate whether this business operates only in Montana. If yes, check the box marked “Yes,” otherwise check “No.”

- Type of Tangible Personal Property Sold: Indicate the types of tangible personal property that your business sells. This can include items such as clothing, electronics, furniture, etc.

B. Personal Property Information

- Description of Property to Be Purchased for Resale: Provide a brief description of the items or property you intend to purchase for resale. This description should clearly identify the types of products you plan to resell.

- Certification Statement: In this section, you are certifying that the listed items will only be resold in the regular course of your business and that you will not use these items for personal use. The certificate confirms that the goods will be held for resale or for demonstration and display purposes until sold. It also acknowledges that if the property is used for any other purpose than resale, you may be liable for use tax on the items.

Signature Section

- Signature of Person Signing for Business: The individual who is authorized to sign on behalf of the business must sign here.

- Date: Enter the date the form is signed.

- Name of Person Signing for Business: Print the name of the person who signed the certificate on behalf of the business.

- Title: Enter the title of the person who is signing the form (e.g., Owner, Manager, Director, etc.).

Important Notes

- Montana does not impose a general sales/use/transaction tax, but businesses in Montana may use this certificate to purchase items from out-of-state sellers for resale purposes.

- When purchasing goods from an out-of-state seller, businesses can provide this resale certificate to the seller as proof that the items are for resale and thus exempt from sales tax.

- Sellers are not required to accept this certificate, though many do. Some states may require a state-specific form, so check with the seller if you are making purchases across state lines.

Final Submission

Once the form is filled out and signed, it should be provided to the seller during your transaction. Keep a copy of the completed certificate for your records in case of future audits or inquiries by the Montana Department of Revenue.