This application is a formal request document submitted by property owners in Montana who wish to receive a tax exemption or a reduction in their tax rate for projects involving the remodeling, reconstruction, or expansion of existing buildings or structures. The primary purpose of this form is to incentivize development by offering tax relief on the increased value that results from significant property improvements. It applies to various categories of real estate, including residential, commercial, and industrial properties. To qualify for these benefits for the current tax year, the owner of record or their authorized representative must file the paperwork by a specific statutory deadline. The process involves a collaboration between local governing bodies and the Department of Revenue, who will verify if the project increases the property’s taxable value by a required percentage (typically 2.5% or 5%, depending on the scenario) to grant the exemption or rate reduction.

How To File This Application

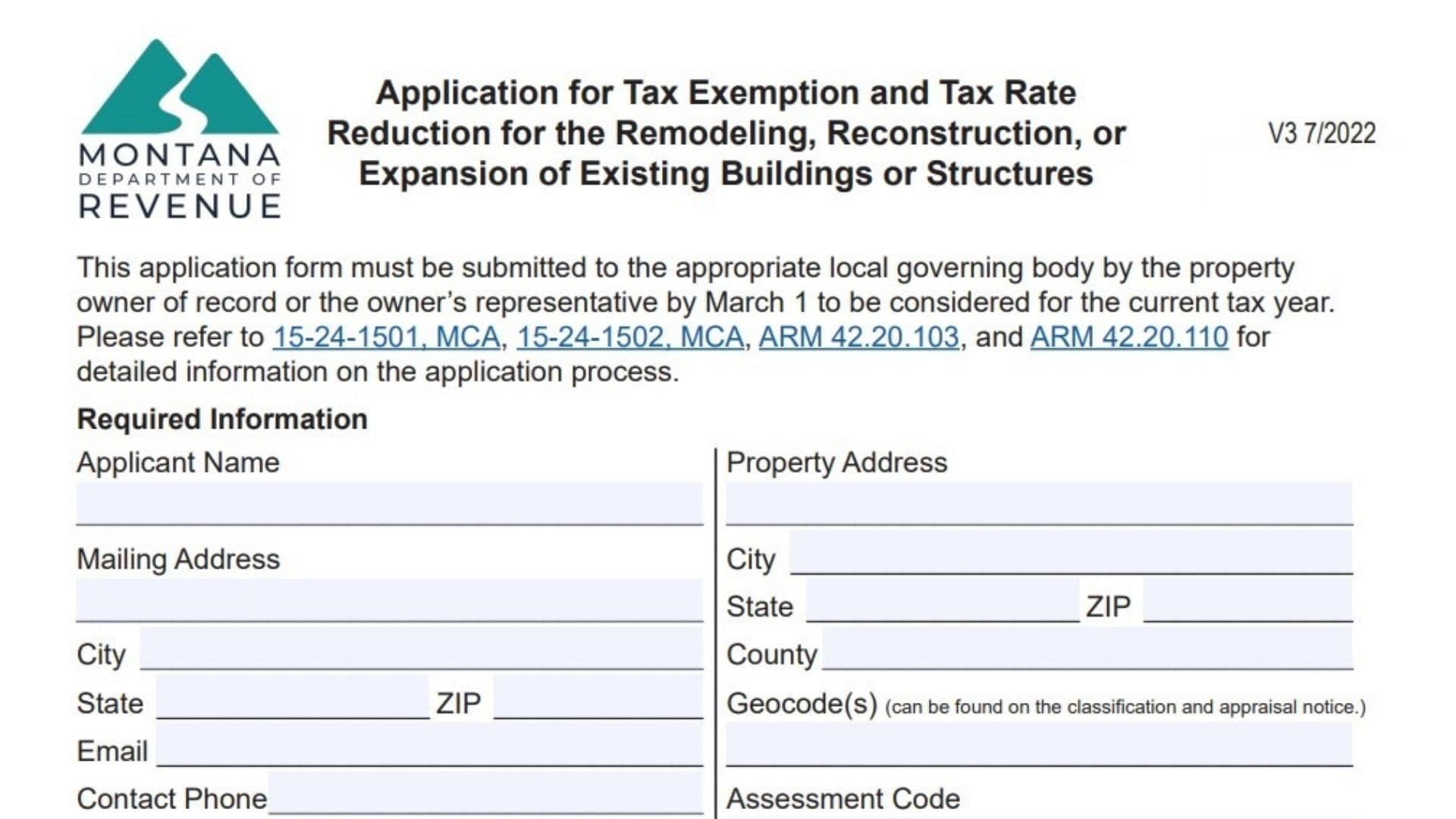

You must submit the completed application directly to your appropriate local governing body, such as your city council or county commission, not to the Department of Revenue. The strict deadline for submission is March 1 to be considered for the current tax year. After you submit the form, the local governing body is responsible for forwarding it to the Department of Revenue field office by April 1.

How To Complete The Required Information Section

Applicant Name

Enter the full legal name of the property owner or the authorized representative who is submitting the application.

Mailing Address

Provide the complete mailing address where you want to receive official correspondence regarding this application. This includes the street or PO Box, city, state, and ZIP code.

Contact Information

Enter a valid email address and a contact phone number. These will be used if the local governing body or Department of Revenue needs to reach you with questions about your project.

Property Address

List the physical address of the property where the remodeling or expansion is taking place, including the city, state, ZIP code, and the county.

Geocode And Assessment Code

You must enter the Geocode and Assessment Code for the property. These unique identifiers are typically found on your property classification and appraisal notice.

How To Complete The Remodeling, Reconstruction, Or Expansion Information Section

Property Type

Indicate the type of property being improved by checking the box for Residential, Commercial, or Industrial.

Commercial Property Use

If you selected “Commercial” as your property type, you must answer the specific question asking if the buildings or structures were used in a business at any time during the six months prior to the date of this application. Check “Yes” or “No.”

Project Dates

Enter the specific date the remodeling, reconstruction, or expansion will start and the date it is expected to be completed. Note that the construction period generally cannot exceed 12 months. Extensions may be approved by local government bodies, but not for commercial properties where you checked “Yes” regarding prior business use.

First Building Permit Date

Write down the date you received the first building permit associated with this project.

Estimated Cost

Enter the total estimated dollar amount for the remodeling, reconstruction, or expansion work.

Brief Description

Provide a short summary of the work being done. If the space on the form is not enough to describe the project, you should attach a separate sheet with the full details.

Signature Section

Signature And Date

The property owner or their representative must sign the form and provide the date of signature to certify the application is correct.

Printed Name And Title

Clearly print the name of the person who signed the form and their title (e.g., Owner, Agent).