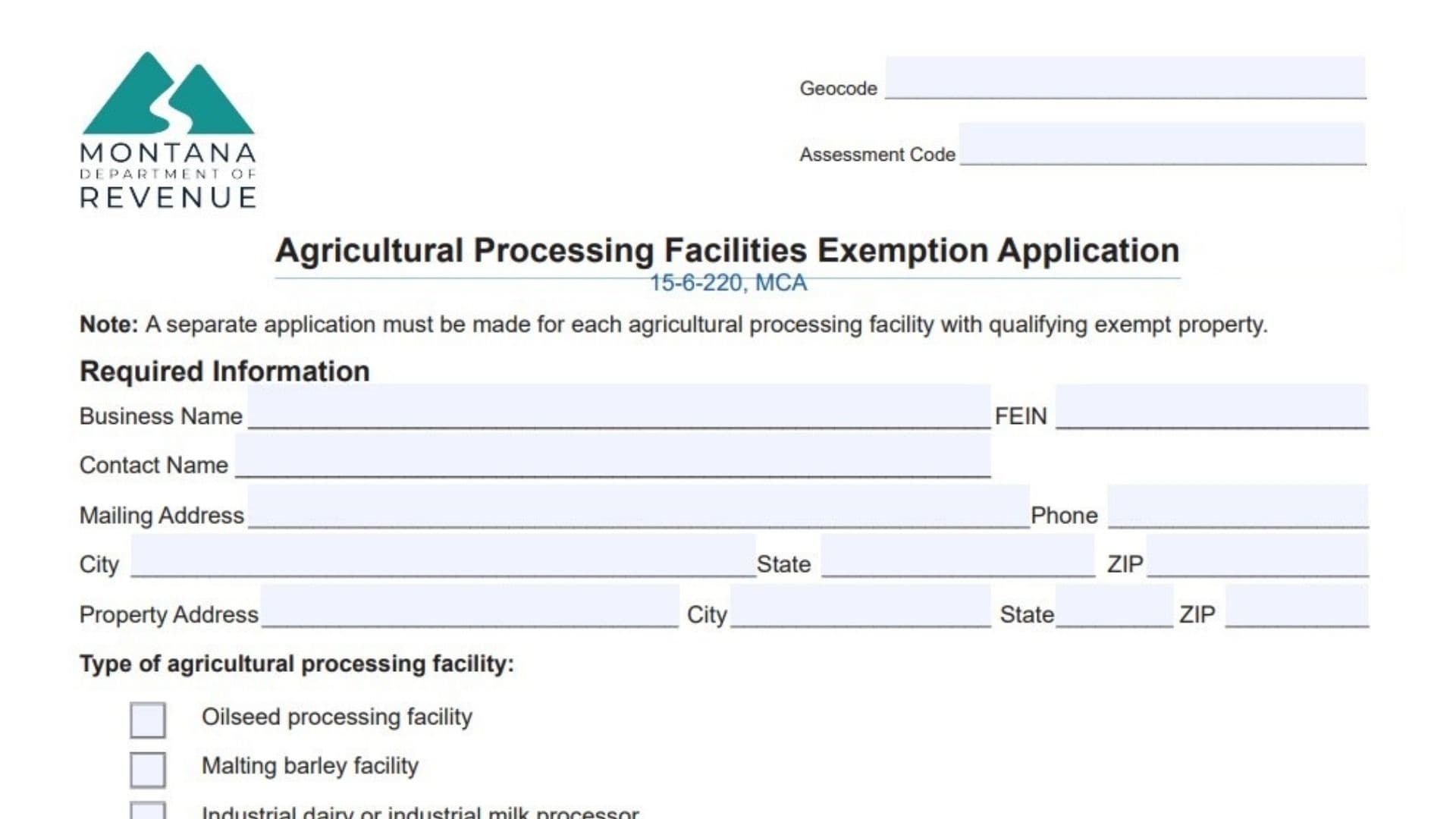

The Agricultural Processing Facilities Exemption Application is a specialized tax form administered by the Montana Department of Revenue. It allows qualifying businesses to request a property tax exemption for specific types of facilities and equipment used in processing agricultural products. The primary purpose of this form is to encourage the development and operation of value-added agricultural industries within the state, such as canola crushing plants, barley malting houses, and industrial dairy operations. By submitting this application under Montana Code Annotated (MCA) 15-6-220, business owners declare their eligibility for tax relief on the machinery, buildings, and land directly involved in these processing activities. It is important to note that if you own multiple facilities, a separate application must be filed for each individual site that contains qualifying exempt property. The department reserves the right to audit the facility and review records to ensure all claims are legitimate.

How To File The Application

Once you have completed and signed the form, you must mail the physical document to the Montana Department of Revenue at their PO Box in Helena. There is no fee explicitly listed for filing this specific exemption application. Ensure that you attach any necessary additional pages if the space provided for describing your exempt property is insufficient.

How to Complete Montana Agricultural Processing Facilities Exemption Form

The following instructions detail exactly how to fill out each section of the form to ensure your application is processed without delay.

Property Identification Codes

- Geocode: Enter the specific geocode assigned to your property. This is a unique 17-digit number used by the state to identify parcels of land.

- Assessment Code: Enter the assessment code for the property. This is often found on your property tax bill or assessment notice.

Required Business And Contact Information

- Business Name: Print the full legal name of the business entity that owns the facility.

- FEIN: Provide your Federal Employer Identification Number.

- Contact Name: Write the name of the primary person the department should contact regarding this application.

- Mailing Address: Enter the complete mailing address where you receive official correspondence.

- Phone: Provide a direct telephone number for the contact person.

- City, State, ZIP: Fill in the city, state, and ZIP code for the mailing address.

- Property Address: Enter the physical street address where the processing facility is located.

- City, State, ZIP: Fill in the city, state, and ZIP code for the physical property location.

Selecting The Type Of Agricultural Processing Facility

You must identify the specific nature of your operation. Check the single box that best describes your facility:

- Oilseed processing facility: Select this if your primary operation involves processing seeds into oil (e.g., canola, sunflower).

- Malting barley facility: Select this if you process barley into malt for brewing or food products.

- Industrial dairy or industrial milk processor: Select this if you operate a large-scale dairy processing plant.

- Ethanol manufacturing facility: Select this if your facility produces ethanol fuel from agricultural feedstocks.

- Pulse processing facility: Select this if you process pulse crops like lentils, chickpeas, or dry peas.

- Hemp processing facility: Select this if you process hemp. Note that this applies to machinery and equipment used in accordance with a license issued by the Department of Agriculture under Title 80, Chapter 18.

Describing The Exempt Property

- Description Field: In the blank lines provided, list the specific buildings, machinery, and equipment for which you are claiming the exemption.

- Additional Pages: If the provided space is not enough to list all your assets, you must attach separate sheets of paper with the full inventory and indicate here that you have done so.

Affirmation And Signature

This section legally binds you to the information provided.

- Declaration: Read the statement affirming that you are the property owner or their authorized agent and that the information is true under penalty of law.

- Applicant Signature: The owner or agent must sign their name on the designated line.

- Date: Write the date the application was signed.

- Printed Name: Clearly print the name of the person who signed the form.

- Title: Enter the official job title of the signer.

- Email Address: Provide a valid email address for digital communication.

Submission Address

Mail your completed application to:

Montana Department of Revenue

PO Box 8018

Helena, MT 59604-8018