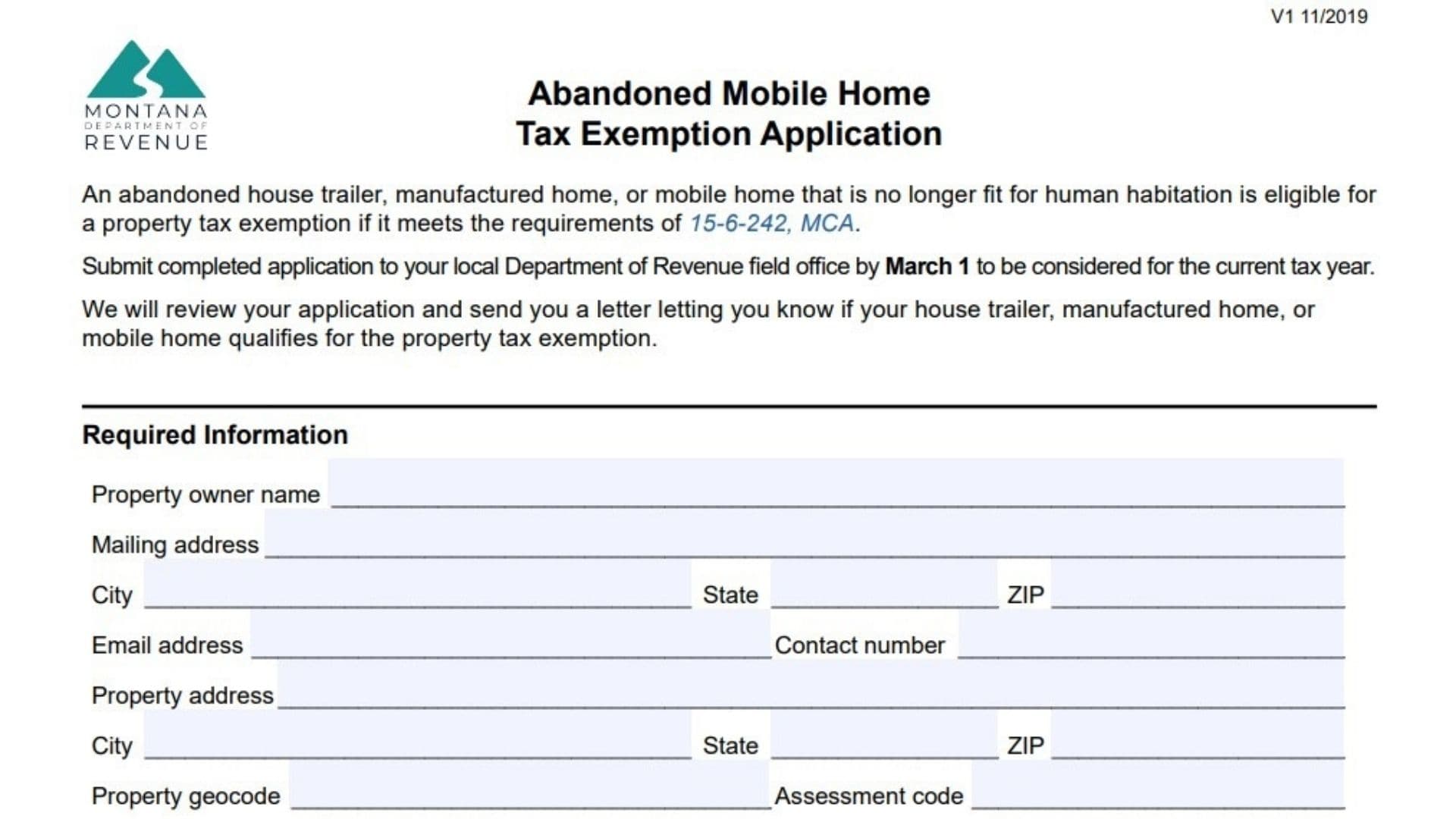

The Montana Abandoned Mobile Home Tax Exemption Application is a specific legal form designed for owners of house trailers, manufactured homes, or mobile homes that have fallen into disrepair and are no longer suitable for living. Under Montana law, specifically statute 15-6-242, MCA, these structures may be eligible for an exemption from property taxes if they meet strict criteria regarding their condition and usage. The application allows owners to formally request this relief by certifying that the unit is uninhabited due to its poor state and is not being used for other productive purposes like storage or livestock shelter. By submitting this document, the taxpayer initiates a review process where the Department of Revenue evaluates whether the property qualifies to be removed from the tax rolls for the current year. It is a critical tool for reducing the financial burden on owners holding unusable, abandoned mobile structures.

How To File The Application

To file for this exemption, you must submit the completed application to your local Department of Revenue field office. The deadline is strict: the form must be received by March 1 to be considered for the current tax year. You can find the specific mailing address for your local field office by visiting the official Montana Revenue website or by contacting their main office at (406) 444-6900. Once submitted, the department will review your claim and send you a formal letter indicating whether your mobile home qualifies for the tax exemption.

How To Complete The Application Form

Property Owner Information

Property Owner Name

Enter the full legal name of the individual or entity that owns the mobile home.

Mailing Address

Provide the complete mailing address where you receive correspondence. This is where the department will send the decision letter regarding your application.

City, State, ZIP

Fill in the city, state, and ZIP Code for your mailing address.

Email Address

Enter a valid email address where the department can reach you if they have questions.

Contact Number

Provide a telephone number where you can be easily contacted during business hours.

Property Location Details

Property Address

Enter the physical street address where the abandoned mobile home is actually located.

City, State, ZIP

Fill in the city, state, and ZIP Code for the physical location of the mobile home.

Property Geocode

Enter the specific property geocode assigned to the land or unit. You can typically find this on your previous tax bills or property assessment notices.

Assessment Code

Provide the unique assessment code for the mobile home. This is also found on tax documents and identifies the specific property record in the state’s system.

Required Information Questionnaire

Question 1: Habitation Status

You must answer “Yes” or “No” to whether the house trailer, manufactured home, or mobile home is uninhabited specifically because it is no longer fit for human habitation. This confirms the condition of the structure.

Question 2: Assessment Status

Indicate “Yes” or “No” regarding how the property is assessed. You need to confirm if the mobile home is assessed separately from the land it sits on and is not considered an “improvement” to real property. This distinction is vital for eligibility.

Question 3: Other Productive Use

Answer “Yes” or “No” to verify if the unit is being used for any other purpose. The question asks if the home has another productive use, such as storage for personal property or housing for livestock.

Affirmation And Signature

Signature Of Property Owner

The legal owner must sign the form on the line marked “Property Owner Signature.” By doing so, you are affirming under penalty of law that all information provided is true, correct, and complete.

Date

Enter the date on which you signed the application.