International Tax Forms

International tax forms are for U.S. citizens living abroad and foreign nationals with U.S. income. These forms help report foreign income and avoid double taxation. Key forms include Form 2555, 1116, and 5471.

-

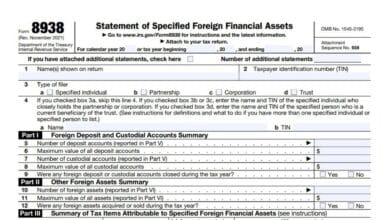

Form 8938

Form 8938 is an IRS form that U.S. taxpayers use to report specified foreign financial assets if their total value…

-

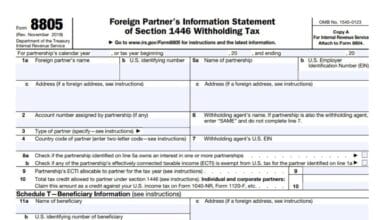

Form 8805

Form 8805, titled “Foreign Partner’s Information Statement of Section 1446 Withholding Tax,” is an IRS form used by partnerships to…

-

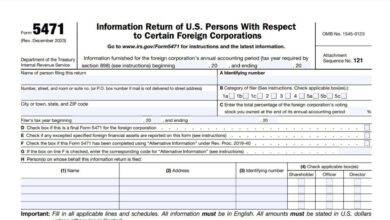

Form 5471

Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, is a critical tax form required by…

-

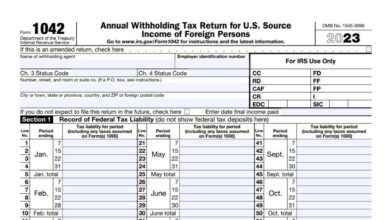

Form 1042

IRS Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons. This form is required to…

-

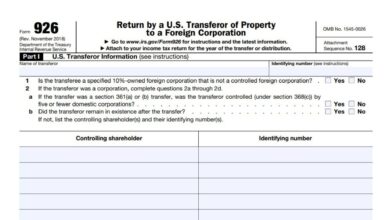

Form 926

Form 926, officially titled “Return by a U.S. Transferor of Property to a Foreign Corporation,” is a U.S. Internal Revenue…

-

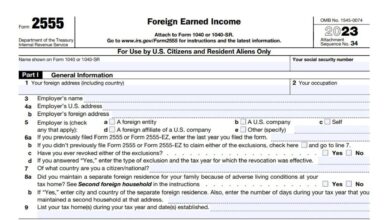

Form 2555

Form 2555, known as the Foreign Earned Income form, is designed to help U.S. citizens and resident aliens who meet…

-

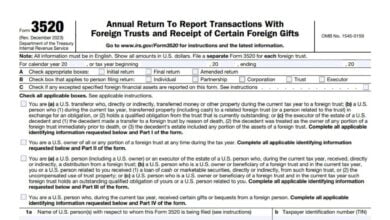

Form 3520

Form 3520 is used to report various transactions with foreign trusts and large foreign gifts, providing the IRS with information…

-

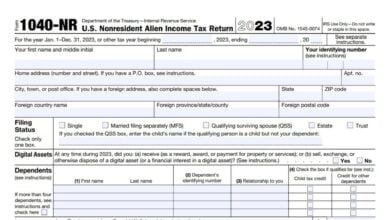

Form 1040-NR

Form 1040-NR, known as the U.S. Nonresident Alien Income Tax Return, is used by nonresident aliens who have U.S. source…