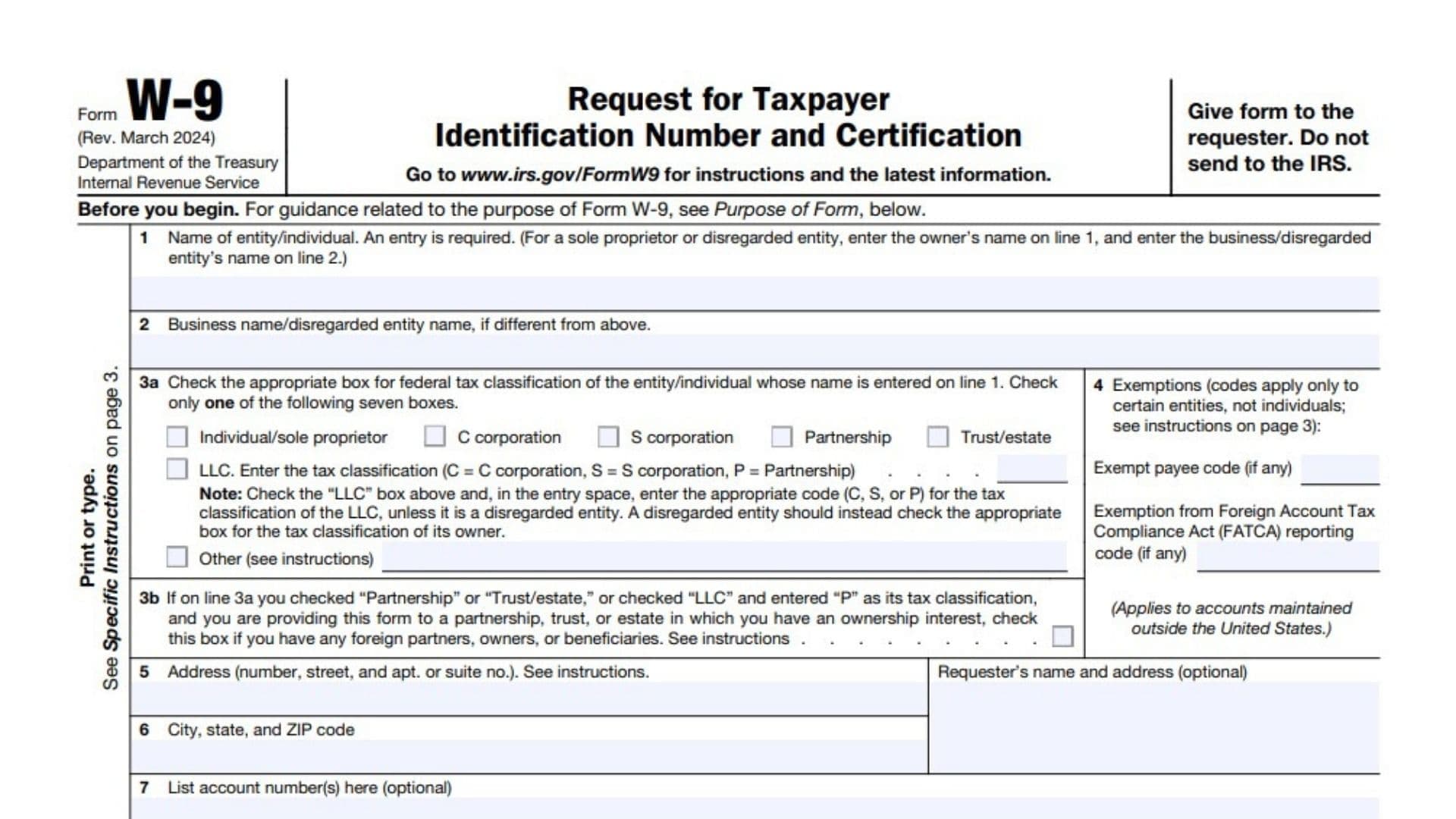

W-9 Form, also known as the Request for Taxpayer Identification Number and Certification, is a tax document used in the United States to collect information from individuals or entities (such as freelancers, independent contractors, and vendors) who are not employees but may receive payment from businesses or organizations. W-9 Form is used to gather the recipient’s taxpayer identification number (TIN) and other pertinent information for tax reporting purposes.

Form W-9 is not filed directly with the Internal Revenue Service (IRS). Instead, you provide the completed Form to the requesting party (such as a client, business, or organization) that requires your tax information. The entity receiving the Form will keep it on file and use the information provided to prepare and submit information returns, such as Form 1099-MISC, to report payments made to you.

Who Must File W-9 Form?

Independent contractors: If you provide services as a freelancer, consultant, or independent contractor, you may be required to fill out a W-9 form when receiving payment.

Vendors and suppliers: If you are a supplier or vendor providing goods or services to a business, you may need to submit a W-9 form before receiving payment.

Partnerships and LLCs: Members of partnerships, limited liability companies (LLCs), or other types of business entities may be asked to complete a W-9 form to provide their TIN to the business for tax reporting purposes.

Landlords: If you are a landlord renting out property, you may need to provide a W-9 form to your tenants if they are required to report rental payments on Form 1099-MISC.

How to Complete W-9 Form?

- Enter your name (business name).

- Enter your business name

- Select your federal tax classification by checking the appropriate box.

- Enter exempt payee code (if any). Also, enter exemption from FATCA reporting code (if any)

- Address section.

- City, state, and ZIP code.

- Optional section. List account number(s) here.

Taxpayer Identification Number (TIN)

- Provide your taxpayer identification number (TIN) in the “Social Security Number” or “Employer Identification Number” field, depending on your entity type.

- Sign and date the form.

It’s important to note that the information provided on the W-9 form should be accurate and up-to-date. If there are any changes to the information provided (such as a change in name or TIN), you may need to provide an updated W-9 form to the relevant parties.