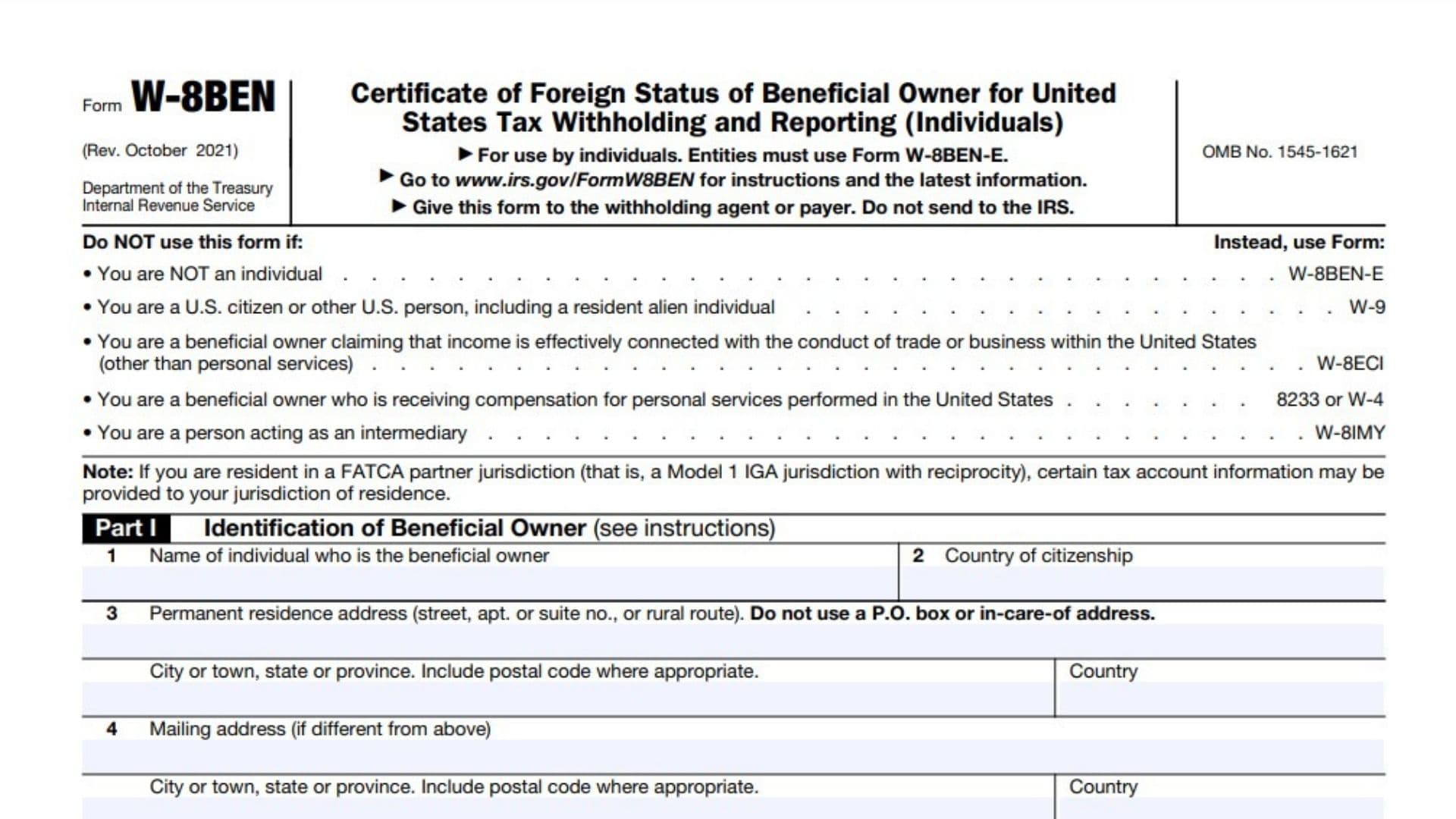

Form W-8BEN, titled “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals),” is used by non-U.S. individuals to confirm their foreign status and claim any applicable benefits under a tax treaty. This form helps reduce or eliminate U.S. tax withholding on income such as dividends, interest, or royalties that the individual earns from U.S. sources. Form W-8BEN is typically valid for three years unless there are changes in circumstances that would make the information on the form incorrect. After the three-year period, you must file a new form.

Purpose of Form W-8BEN

- Confirm foreign status: The form allows non-U.S. individuals to certify that they are not U.S. citizens or residents.

- Claim treaty benefits: It allows foreign individuals to claim reduced withholding tax rates (or exemption) on income paid to them under an applicable tax treaty between their country and the United States.

- Prevent unnecessary withholding: By submitting this form, the foreign person can avoid the higher default withholding tax rate of 30%.

Who Should File?

- Non-U.S. individuals receiving income from U.S. sources.

- Those seeking to claim treaty benefits to reduce or eliminate tax withholding.

Note: Foreign entities should not use Form W-8BEN but instead use Form W-8BEN-E.

When to File?

You should submit Form W-8BEN before receiving U.S.-sourced income. The form must be provided to the withholding agent (such as a bank or investment firm), not to the IRS.

How to Complete IRS Form W-8BEN?

Part I: Identification of Beneficial Owner

- Line 1: Name of individual

- Enter your full legal name as it appears on your official documents (such as a passport).

- Line 2: Country of citizenship

- Enter the name of the country in which you hold citizenship.

- Line 3: Permanent residence address

- Provide your permanent address in the country where you claim residence for tax purposes.

- Do not use a U.S. address or a P.O. Box.

- Line 4: Mailing address (if different from above)

- If your mailing address is different from your permanent residence address, enter it here.

- If you have the same address as in Line 3, you may leave this blank.

- Line 5: U.S. taxpayer identification number (SSN or ITIN)

- If you have a U.S. taxpayer identification number (TIN), such as a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), enter it here.

- If you do not have a TIN, you may leave this blank, but it may affect your eligibility for treaty benefits.

- Line 6: Foreign tax identification number (FTIN)

- Enter your foreign tax identification number issued by your country of residence.

- This helps confirm your identity for treaty benefits.

- Line 7: Reference number(s)

- This line is optional. You can provide an account or reference number to help the withholding agent identify you.

- Line 8: Date of birth

- Enter your date of birth in the format MM-DD-YYYY. Ensure the date matches your identification documents.

Part II: Claim of Tax Treaty Benefits

- Line 9: Country of residence for tax purposes

- Enter the name of the country where you claim tax residency. This must match the country that has a tax treaty with the U.S.

- Line 10: Special rates and conditions (if applicable)

- If you qualify for a reduced rate of withholding under a tax treaty, fill out this section.

- a) Article and paragraph: Enter the article and paragraph of the tax treaty that provides the reduced withholding rate.

- b) Type of income: Specify the type of income (e.g., dividends, interest, royalties) for which you are claiming the reduced withholding rate.

- c) Rate of withholding: Enter the reduced tax rate under the treaty, if applicable.

- d) Explanation: Provide a brief explanation of why you qualify for the treaty benefits.

Part III: Certification

- Signature

- Sign the form to certify that the information provided is accurate.

- Date

- Enter the date you signed the form.

- Print name of signer

- Clearly print your name.

- Capacity in which acting

- This line is applicable if someone else is signing on your behalf (e.g., legal representative, trustee). Most individuals can leave this blank.

Submitting the Form

- Who to submit to: You do not file Form W-8BEN with the IRS. Instead, submit it to the U.S. withholding agent or financial institution paying you the income.

- When to submit: You should submit the form before receiving the U.S.-sourced income.

- Expiration: The form is valid for three years or until circumstances change.