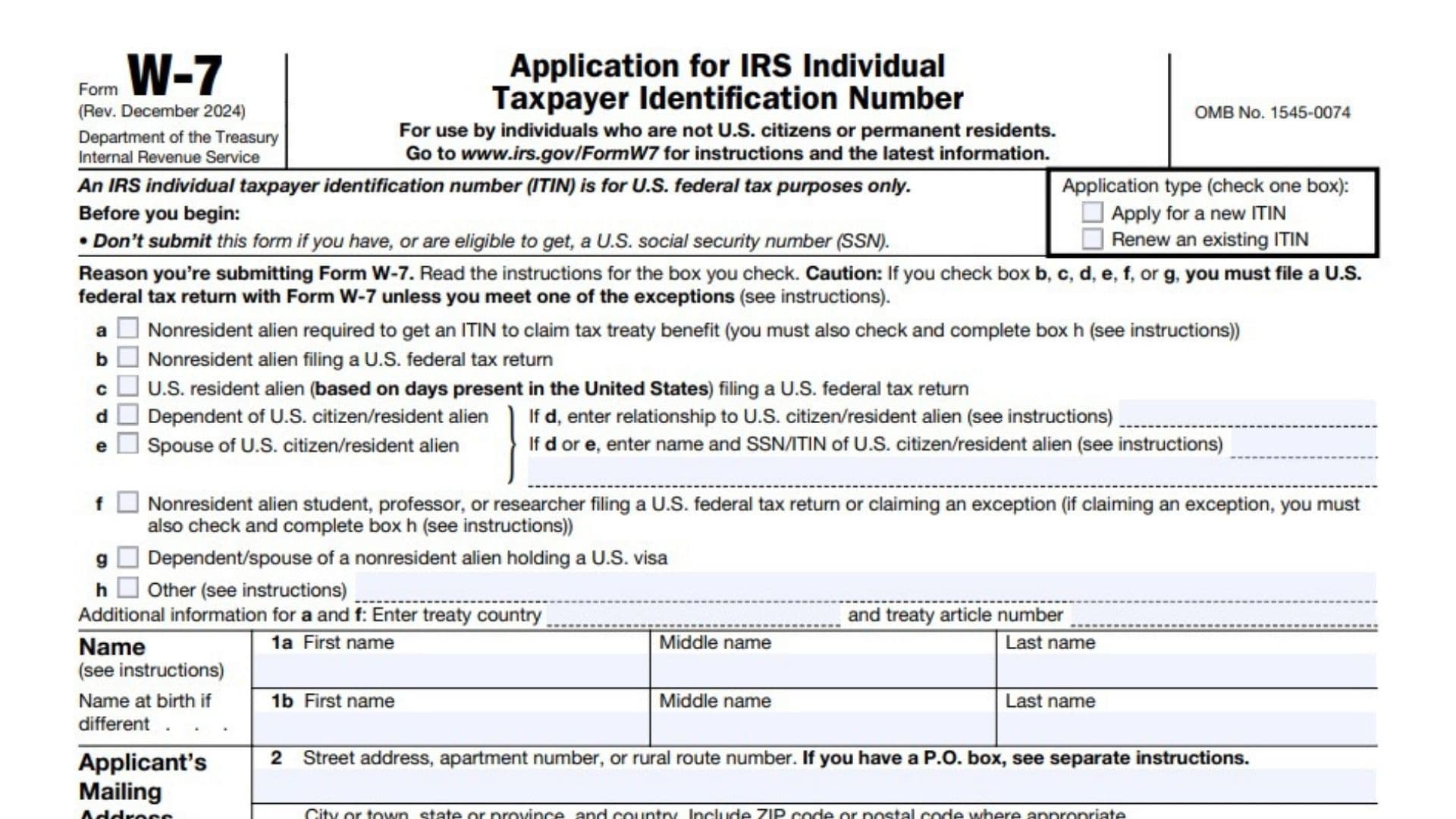

The IRS Form W-7, officially titled Application for IRS Individual Taxpayer Identification Number (ITIN), is used by individuals who are not U.S. citizens or permanent residents but need a taxpayer identification number for federal tax purposes. An ITIN allows these individuals to file taxes, claim refunds, or meet U.S. tax reporting obligations—even without a Social Security Number (SSN).

According to the IRS, you should not file Form W-7 if you already have, or are eligible for, an SSN. This form serves as an essential tool for nonresident aliens, resident aliens under U.S. tax law, dependents or spouses of U.S. citizens or residents, and visa holders who have tax obligations in the United States.

Filing Form W-7 ensures that everyone who earns income in the U.S. can comply with tax laws, receive tax credits, and build proper tax records with the IRS. Whether you’re applying for a new ITIN or renewing an existing one, accuracy and clarity are crucial—every line on this form has a specific purpose and requirement.

How To File IRS Form W-7

- Prepare Required Documents

- Proof of identity (such as a passport or foreign national ID).

- Foreign status evidence (e.g., visa or birth certificate).

- A valid federal income tax return, unless you qualify for an exception.

- Attach Form W-7 to Your Tax Return

- Submit by Mail or Through an Acceptance Agent

- Mail your application and documents to:

IRS ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342. - Alternatively, you can use a Certified Acceptance Agent (CAA) or make an appointment at an IRS Taxpayer Assistance Center.

- Mail your application and documents to:

Complete Form W-7

Each section of Form W-7 (Rev. December 2024) is critical. Here’s how to complete it correctly, line by line:

BEFORE YOU BEGIN

- Do NOT file this form if you are eligible for a U.S. Social Security Number.

- The ITIN is only for federal tax purposes and does not authorize work or change your immigration status.

APPLICATION TYPE

Check one box only:

- Apply for a new ITIN – if you have never been assigned one.

- Renew an existing ITIN – if your previous ITIN has expired or is about to expire.

REASON YOU’RE SUBMITTING FORM W-7

Choose the option that best fits your situation:

a. Nonresident alien required to get an ITIN to claim a tax treaty benefit

- You must also complete box h and specify the treaty country and article number.

b. Nonresident alien filing a U.S. federal tax return

- Most common for individuals earning income in the U.S.

c. U.S. resident alien (based on days present in the U.S.) filing a tax return

- Applicable to those meeting substantial presence requirements.

d. Dependent of U.S. citizen/resident alien

- Enter the relationship (e.g., son, daughter, parent).

e. Spouse of U.S. citizen/resident alien

- Enter the name and SSN/ITIN of your spouse.

f. Nonresident alien student, professor, or researcher

- If claiming an exception, also complete box h.

g. Dependent/spouse of a nonresident alien holding a U.S. visa.

h. Other (Specify)

- If none of the above apply, describe your specific situation.

For boxes a or f, list your treaty country and treaty article number to support your claim.

NAME

1a. Enter your first name, middle name, and last name exactly as they appear on your identification documents.

1b. If your name at birth is different, provide it here.

APPLICANT’S MAILING ADDRESS

Line 2 – Write your current mailing address, including street, apartment number, city, state, ZIP, or postal code.

If you have a P.O. box, follow IRS instructions carefully; physical addresses are preferred.

FOREIGN (NON-U.S.) ADDRESS

Line 3 – Enter your foreign address as it appears in your home country, including city, state or province, and postal code.

Don’t use a P.O. box here.

BIRTH INFORMATION

Line 4 – Enter your date of birth (MM/DD/YYYY), country of birth, and optionally your city or province.

Line 5 – Check Male or Female.

OTHER INFORMATION

6a. Country(ies) of citizenship – List all countries of which you are a citizen.

6b. Foreign tax I.D. number (if any) – If your home country has issued one, include it here.

6c. Type of U.S. visa (if any), number, and expiration date – Enter your visa type (e.g., F-1, J-1, B-2) and expiration date.

6d. Identification documents submitted – Indicate the primary document type:

- Passport

- Driver’s license/State ID

- USCIS documentation

- Other (specify)

Also list:

- Issuing country

- Document number

- Expiration date (MM/DD/YYYY)

- Date of entry into the U.S.

6e. Have you previously received an ITIN or IRSN?

- Check No/Don’t know to skip line 6f.

- Check Yes if you have, and complete line 6f.

6f. Enter ITIN and/or IRSN and the name under which it was issued.

Provide the exact name associated with the previous number.

6g. Name of college/university or company – If you’re a student, professor, or researcher, include the name, city, state, and your length of stay in the U.S.

SIGN HERE

This section certifies your information is true and accurate.

- Signature of applicant – The applicant or authorized delegate must sign and date the form.

- Date (MM/DD/YYYY) – Include the exact date of signature.

- Phone number – Provide a current phone number for verification.

- Name of delegate – If someone else signs (parent, guardian, or power of attorney), list their name and relationship.

Accepted delegate roles:

- Parent

- Power of attorney

- Court-appointed guardian

ACCEPTANCE AGENT’S USE ONLY

To be completed by the Acceptance Agent (AA) or Certified Acceptance Agent (CAA):

- Signature, date, and contact information (phone and fax).

- Name, title, and company name.

- Employer Identification Number (EIN) and Preparer Tax Identification Number (PTIN).

- Office code (if applicable).

Final Steps Before Submitting

- Attach all required identification documents.

- Double-check all dates and spellings.

- Mail the completed form and tax return to the IRS ITIN Operation address.

- Keep a copy for your records.