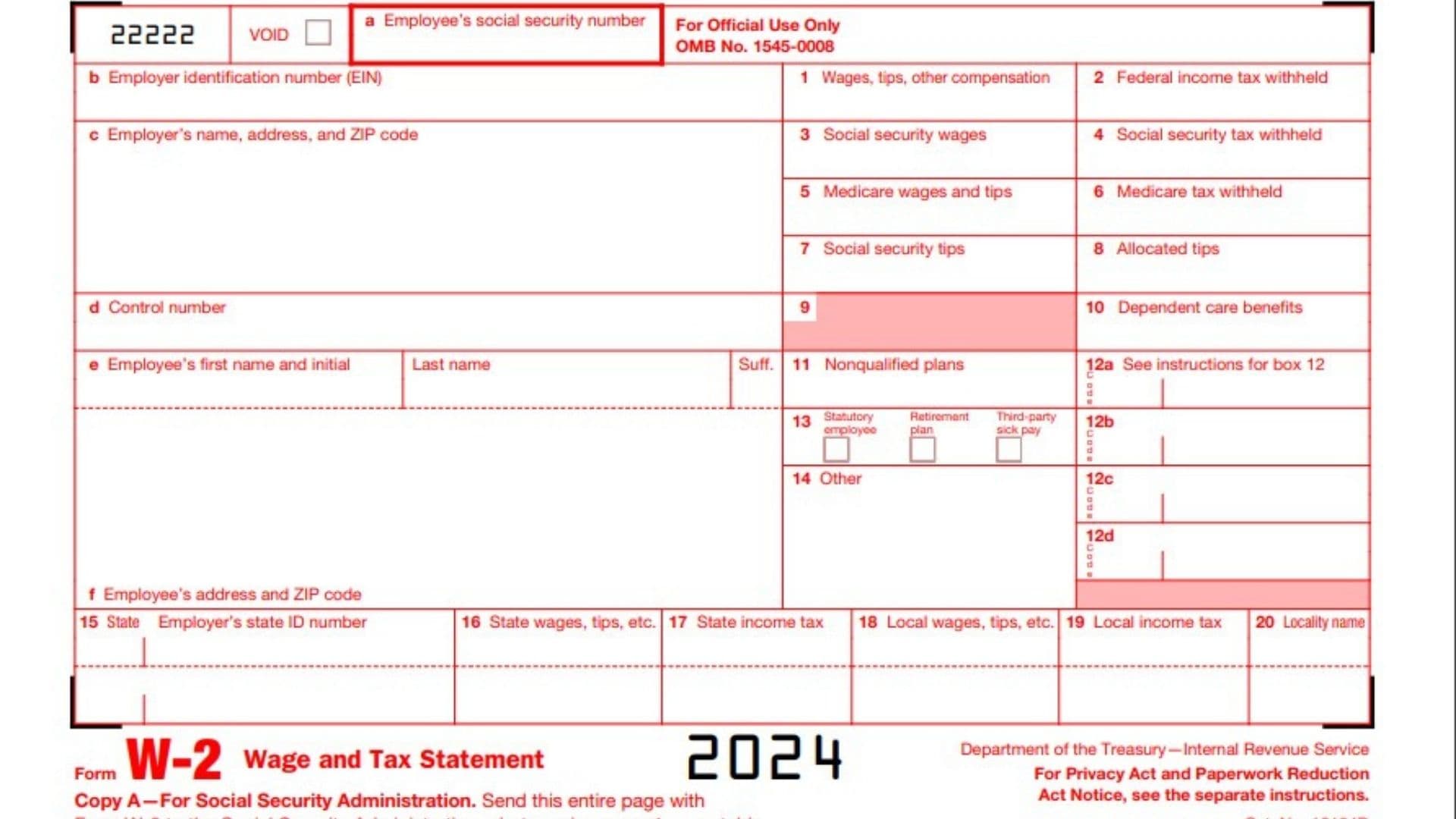

IRS Form W-2, Wage and Tax Statement, is a form that employers provide to employees and the IRS to report annual wages and the amount of taxes withheld from their paycheck. It details income earned, federal and state tax withholdings, Social Security and Medicare contributions, and other benefits like retirement plan contributions. Employees use the W-2 form to file their tax returns, as it provides essential information about their income and tax liability. Employers are required to send out Form W-2 by January 31st each year to both employees and the IRS to ensure accurate reporting and compliance with tax laws.

Who Must File Form W-2?

Employers are responsible for filing the W-2 form. If you are an employer who pays wages to an employee (including cash, tips, and fringe benefits), you are required to file a W-2 form for each employee who meets the following criteria:

- The employee worked for you during the calendar year.

- The employee received $600 or more in wages or had income tax, Social Security tax, or Medicare tax withheld from their pay.

- The employee’s wages are subject to income tax withholding, Social Security tax, or Medicare tax.

How to File the Form W-2?

Employers must file W-2 forms with both the IRS and the Social Security Administration (SSA). Here are the steps to file the W-2 form:

- Obtain the official W-2 form by ordering paper forms from the IRS or using electronic filing options provided by the IRS or payroll software.

- Complete the W-2 form for each employee, providing accurate information about their wages, withholdings, and other relevant details.

- Send Copy A of the W-2 form and Form W-3 (Transmittal of Wage and Tax Statements) to the SSA by the designated deadline. The deadline for filing paper forms is typically the last day of February, while electronic filing deadlines extend to the end of March.

- Provide Copies B, C, and 2 to Employees: Distribute Copy B (Federal Copy), Copy C (Employer Copy), and Copy 2 (Employee Copy) to the respective employees. The deadline for providing these copies to employees is usually January 31st.

- Keep Copy D for Record Keeping: Retain Copy D (Employer Copy) for your records.

How to Complete Form W-2?

When filling out the W-2 form, employers must ensure accuracy and completeness. Here’s an overview of the sections on the W-2 form and the information required:

- Provide the employee’s name, address, Social Security number, and other pertinent details.

- Box 1: Report the total wages, tips, and other compensation paid to the employee during the tax year.

- Box 2: Enter the amount of federal income tax withheld from the employee’s wages.

- Box 3: Report the employee’s Social Security wages, generally the same as the amount reported in Box 1.

- Box 4: Enter the Social Security tax withheld from the employee’s wages, up to the applicable wage base limit.

- Box 5: Report the employee’s Medicare wages and tips, which are usually the same as the amount in Box 1.

- Box 6: Enter the Medicare tax withheld from the employee’s wages.

- Box 7: Enter Social Security tips.

- Box 8: Allocated tips

- Box 10: Enter Dependent care benefits

- Box 11: Enter Non-qualified plans.

- Boxes 12a-12d: Check Form W-2 Reference Guide for Box 12 Codes

- Box 13: Check the appropriate box:

- 1. Statutory employee. 2. Retirement plan 3. Third-party sick pay

- Box 14: Other

- Box 15: Enter Employer’s state ID number

- Box 16: Report the employee’s state wages, which may differ from the federal wages due to state-specific regulations.

- Box 17: Enter the state income tax withheld from the employee’s wages.