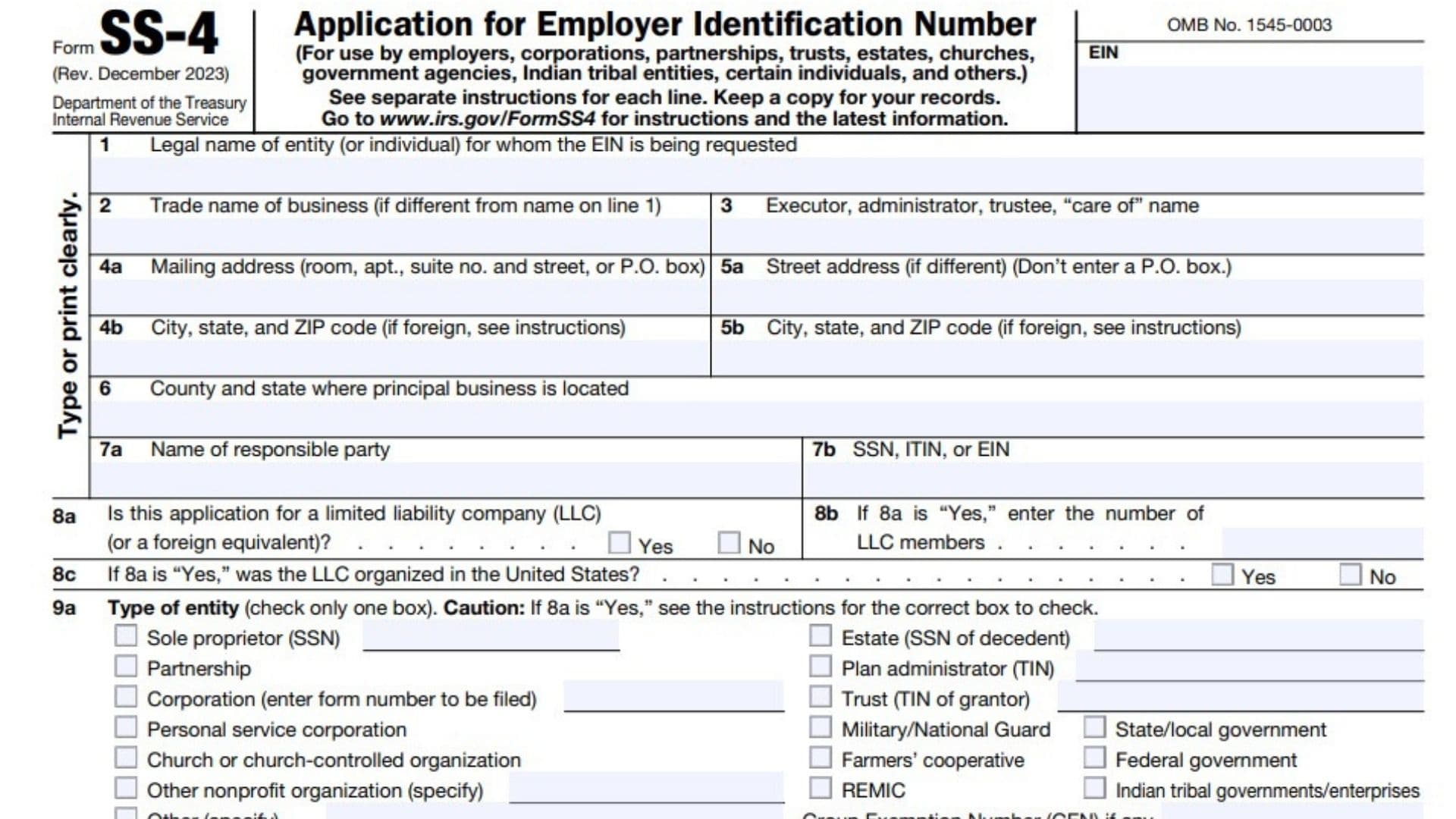

The SS-4 Form requires you to provide details about your business. For example, if you’re an LLC, you should provide the name of your LLC. The SS-4 Form also requires other details about the LLC, including its number of members and the entity type. Generally, lenders will require a copy of Form SS-4 as part of the loan application process. Gathering this information will help you fill out Form SS-4 in a timely fashion.

You can either file it electronically or submit it by mail. The former option is recommended, as it doesn’t require a fax number and is convenient. You should include a valid fax number if you prefer to file it by mail. The EIN number will be sent to the fax number you need to have handy.

What is an Employer Identification Number EIN?

An EIN is a nine-digit number that is used to identify employers and businesses. Filling out Form SS-4 allows you to obtain a tax ID for your business. Most companies can apply online for an EIN.

If you’re filling out the SS-4 Form online, there are plenty of fields to fill in. Once you’re finished, you’ll receive an EIN number. Then, you’ll be ready to send the completed Form to the IRS.

How to Complete Form SS-4?

There are three main sections to Form SS-4:

- General Information

- Business Type

- Other Business Information.

1. Section

- Business name

- Type of business,

- Number of employees.

- Social Security number.

2. Section

- Indicate the type of entity your business:

- ( For example, sole proprietor, partnership, corporation, estate, trust… )

3. Section

- The number of employees you expect to have in the next 12 months ( If you are not expecting to hire any new employees in the next 12 months, you can write “0” for this line)

- The date that your company first paid any wages or annuities

- enter the previous EIN of your business in the space provided.

- In addition to all this, you will also need to provide information about the reason for applying for an EIN. These reasons include starting a business, hiring workers, or purchasing an existing business.