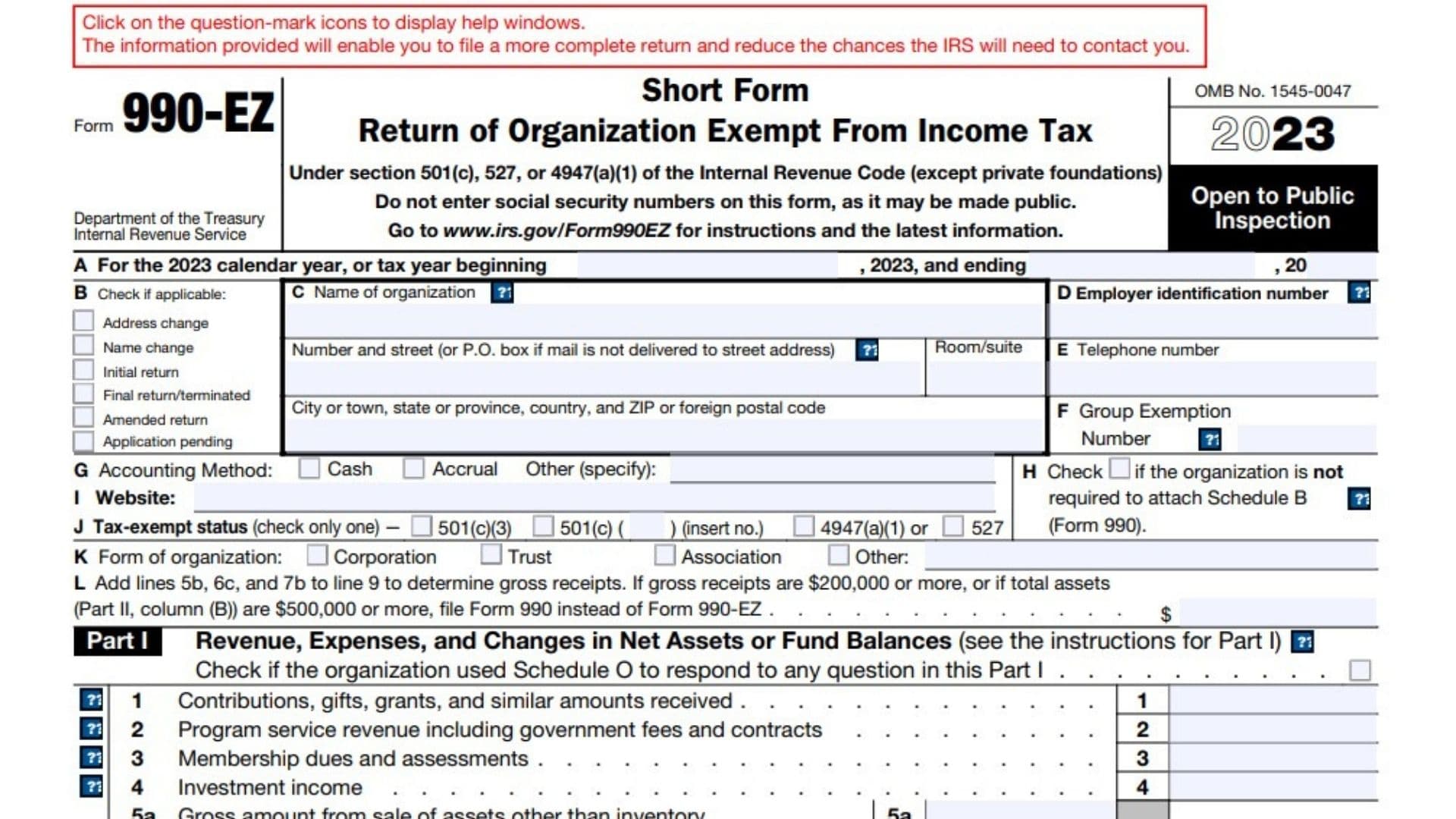

Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, is used by tax-exempt organizations to provide the IRS with financial and operational information. Properly managing this form ensures compliance with IRS regulations and helps maintain the organization’s tax-exempt status, thereby supporting its mission and transparency. The primary purpose of Form 990-EZ is to provide the IRS with detailed information about the financial activities, governance, and programs of tax-exempt organizations with gross receipts of less than $200,000 and total assets of less than $500,000. This form helps ensure transparency and accountability in the operations of these organizations and aids in the IRS’s oversight.

Who Must File Form 990-EZ?

Form 990-EZ must be filed by tax-exempt organizations, including:

- Nonprofit Organizations: Charitable, educational, religious, and other nonprofit entities with gross receipts less than $200,000 and total assets less than $500,000.

- Small Tax-Exempt Organizations: Entities that are not required to file Form 990 but need to file an informational return.

- Other Eligible Organizations: Entities that meet the financial thresholds and choose to file Form 990-EZ instead of Form 990.

How To File Form 990-EZ?

Filing Form 990-EZ involves several steps and requires detailed information to ensure all necessary details are provided. The form must be filed annually with the IRS.

- Obtain Form 990-EZ: The form can be downloaded from the IRS website. Ensure you have the correct version for the tax year in which you are filing.

- Complete the form: Fill out the form with details of the organization’s financial activities, governance, and programs.

- Attach supporting documentation: Gather all required documents, such as financial statements, records of contributions and grants, and governance policies, to substantiate the information provided.

- Submit the form: File Form 990-EZ by the 15th day of the 5th month after the end of the organization’s accounting period. Ensure that the form and all supporting documentation are included.

How To Complete Form 990-EZ?

Filling out Form 990-EZ requires accurate and comprehensive information about the organization’s financial activities, governance, and programs. The form is divided into several parts, each addressing different aspects of the reporting requirements.

Part I – Revenue, Expenses, and Changes in Net Assets or Fund Balances:

Lines 1-20: Provide details of the organization’s revenue, expenses, and changes in net assets or fund balances during the tax year. This includes contributions, grants, program service revenue, investment income, and other sources of revenue.

Part II – Balance Sheets:

Lines 21-25: Report the organization’s assets, liabilities, and net assets at the beginning and end of the tax year.

Part III – Statement of Program Service Accomplishments:

Lines 28-31: Describe the organization’s program service accomplishments, including the number of persons benefited and the expenses incurred for each program.

Part IV – List of Officers, Directors, Trustees, and Key Employees:

Lines 32-34: Provide the names, titles, average hours per week devoted to the organization, and compensation of officers, directors, trustees, and key employees.

Part V – Other Information:

Part VI – Section 501(c)(3) Organizations Only:

Lines 46-47: Provide additional information required for Section 501(c)(3) organizations, such as lobbying activities and public support calculations.

Signature

Things to Consider When Filing Form 990-EZ

Understanding the specific rules and implications of filing Form 990-EZ is essential for tax-exempt organizations to ensure compliance with IRS regulations and accurately report their financial activities and governance.

Accurate Reporting: Ensure that all information reported on Form 990-EZ is accurate and complete. Incorrect or incomplete information can lead to penalties and delays in processing by the IRS.

Supporting Documentation: Provide thorough and detailed supporting documentation to substantiate the reported financial activities, governance, and programs. This includes financial statements, records of contributions and grants, and governance policies.

Timely Filing: Ensure that Form 990-EZ is filed by the specified due date (the 15th day of the 5th month after the end of the organization’s accounting period). Late filing can result in penalties and additional interest charges.

Record Keeping: Maintain accurate records of all financial activities, governance, and programs. Proper record-keeping helps ensure compliance and can be crucial in case of an IRS audit.

Professional Assistance: Due to the complexity of tax reporting and the specific requirements of Form 990-EZ, consider seeking assistance from a tax professional. A qualified advisor can help ensure that Form 990-EZ is completed accurately and submitted on time and can provide guidance on the implications of the organization’s financial activities and governance.

Legal and Financial Implications: Understand the legal and financial implications of reporting the organization’s financial activities and governance. This includes the impact on financial planning, tax liability, and compliance with IRS regulations.