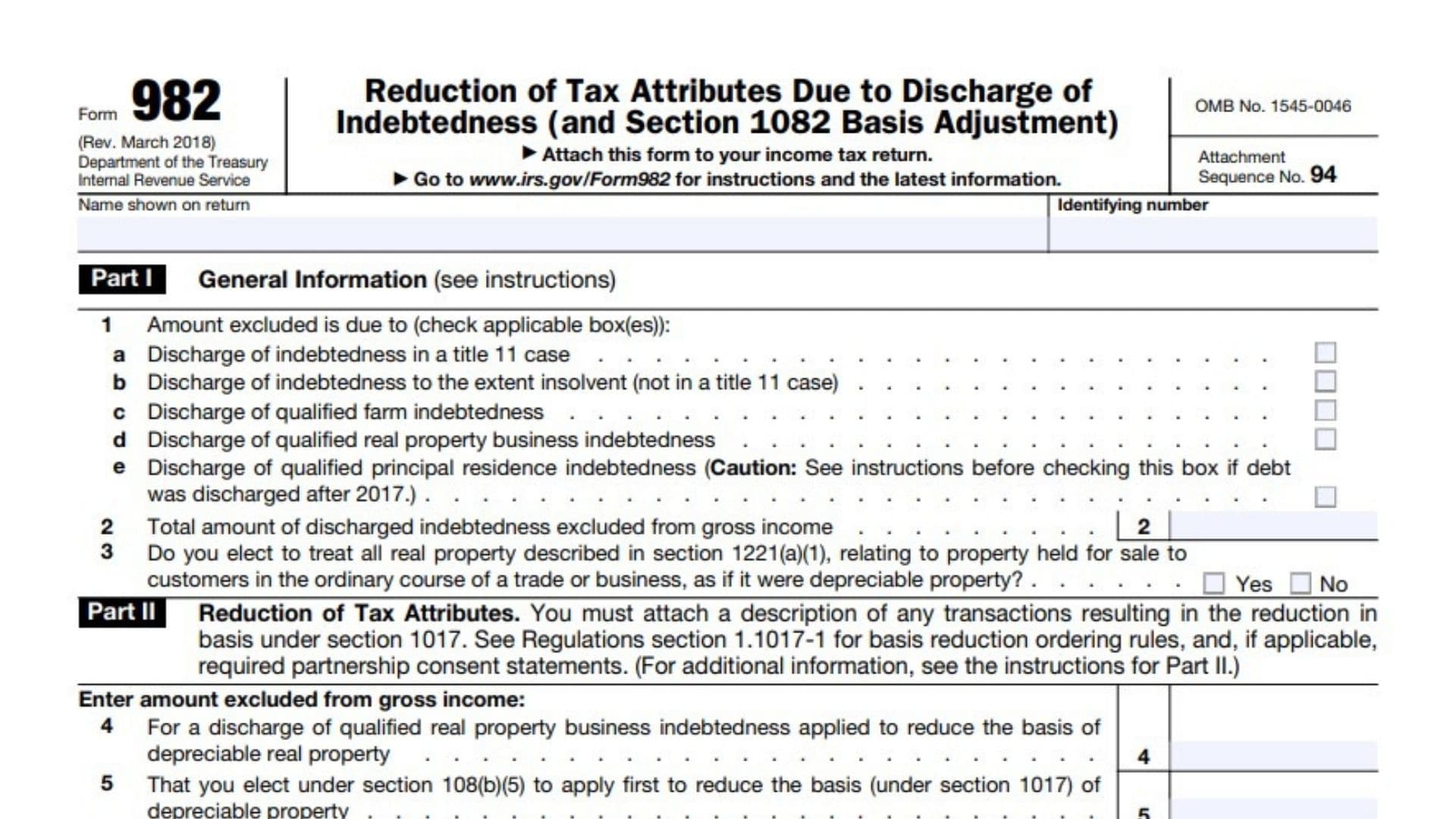

IRS Form 982, “Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment),” is a specialized tax form used by individuals and corporations who have had certain debts canceled or forgiven. When a debt is discharged, the IRS generally treats the canceled amount as taxable income. However, under specific circumstances—such as bankruptcy (Title 11 cases), insolvency, qualified farm or real property business indebtedness, or qualified principal residence indebtedness (with limitations)—the taxpayer can exclude this income from their taxable income. In exchange for this exclusion, the taxpayer must reduce certain tax attributes, such as net operating losses, credits, or the basis of property, as outlined by the Internal Revenue Code. Form 982 is the official document for reporting the exclusion and specifying which tax attributes are reduced, ensuring compliance with the IRS rules and preventing double tax benefits.

How to File Form 982?

- Attach Form 982 to your federal income tax return for the year the debt was canceled.

- Gather all documentation related to the discharged debt, including lender statements and bankruptcy or insolvency records.

- Complete the form as detailed below and retain copies for your records.

- If you are a corporation, ensure you also attach any required descriptions of transactions and consent statements.

How to Complete Form 982

Header Section

- Enter your name (as shown on your return).

- Enter your identifying number (typically your Social Security Number or Employer Identification Number).

Part I: General Information

Line 1:

Check all applicable boxes to indicate the reason for the exclusion:

- 1a: Discharge of indebtedness in a Title 11 (bankruptcy) case.

- 1b: Discharge of indebtedness to the extent insolvent (not in a Title 11 case).

- 1c: Discharge of qualified farm indebtedness.

- 1d: Discharge of qualified real property business indebtedness.

- 1e: Discharge of qualified principal residence indebtedness (only check if the debt was discharged in a year when this exclusion is allowed; see IRS instructions for post-2017 limitations).

Line 2:

Enter the total amount of discharged indebtedness you are excluding from gross income.

Line 3:

If you elect to treat all real property described in section 1221(a)(1) (property held for sale to customers in the ordinary course of business) as depreciable property, check “Yes” or “No.”

Part II: Reduction of Tax Attributes

Note: You must attach a description of any transactions resulting in basis reduction under section 1017. Follow the ordering rules in Regulations section 1.1017-1.

Line 4:

For a discharge of qualified real property business indebtedness, enter the amount applied to reduce the basis of depreciable real property.

Line 5:

Enter the amount you elect under section 108(b)(5) to apply first to reduce the basis of depreciable property.

Line 6:

Enter the amount applied to reduce any net operating loss (NOL) that occurred in the tax year of the discharge or carried over to the tax year of the discharge.

Line 7:

Enter the amount applied to reduce any general business credit carryover to or from the tax year of the discharge.

Line 8:

Enter the amount applied to reduce any minimum tax credit as of the beginning of the tax year immediately after the tax year of the discharge.

Line 9:

Enter the amount applied to reduce any net capital loss for the tax year of the discharge, including any capital loss carryovers to the tax year of the discharge.

Line 10a:

Enter the amount applied to reduce the basis of nondepreciable and depreciable property if not reduced on line 5. Do not use this line for discharge of qualified farm indebtedness.

Line 10b:

If you checked line 1e (qualified principal residence indebtedness), enter the amount applied to reduce the basis of your principal residence.

Line 11a:

For a discharge of qualified farm indebtedness, enter the amount applied to reduce the basis of depreciable property used or held for use in a trade or business or for the production of income (if not reduced on line 5).

Line 11b:

Enter the amount applied to reduce the basis of land used or held for use in the trade or business of farming.

Line 11c:

Enter the amount applied to reduce the basis of other property used or held for use in a trade or business or for the production of income.

Line 12:

Enter the amount applied to reduce any passive activity loss and credit carryovers from the tax year of the discharge.

Line 13:

Enter the amount applied to reduce any foreign tax credit carryover to or from the tax year of the discharge.

Part III: Consent of Corporation to Adjustment of Basis of Its Property Under Section 1082(a)(2)

Complete this section only if you are a corporation.

- Enter the total amount excluded from gross income under section 1081(b).

- Enter the tax year beginning and ending dates.

- Enter the state of incorporation.

- By completing this section, the corporation consents to have the basis of its property adjusted under section 1082(a)(2). Attach a description of the transactions resulting in nonrecognition of gain under section 1081.