IRS Form 972, “Consent of Shareholder To Include Specific Amount in Gross Income,” is a tax form used by shareholders who agree to report a consent dividend as taxable income, even though they do not actually receive a cash distribution of the consented amount. This process allows a corporation to claim a deduction for consent dividends under Section 565 of the Internal Revenue Code. When a shareholder consents, they must include the specified amount in their gross income as if it were an actual dividend, increasing their tax basis in the corporation’s stock by the same amount. The corporation, in turn, can deduct this amount as a consent dividend on its tax return. This mechanism is often used in closely held corporations to achieve certain tax planning goals without distributing cash to shareholders. The completed Form 972 is sent to the corporation, which attaches it and Form 973 to its income tax return for the year in which the deduction is claimed. The shareholder must report the consent dividend in the same tax year that the corporation claims the deduction.

How to File Form 972?

- Complete Form 972 as the consenting shareholder.

- Send the filled form to the corporation claiming the consent dividend deduction by the due date of the corporation’s tax return for the relevant tax year.

- The corporation attaches Form 972 and Form 973 to its income tax return.

- The shareholder must include the consent dividend as taxable income on their own tax return for the same tax year the corporation claims the deduction.

How to Complete Form 972?

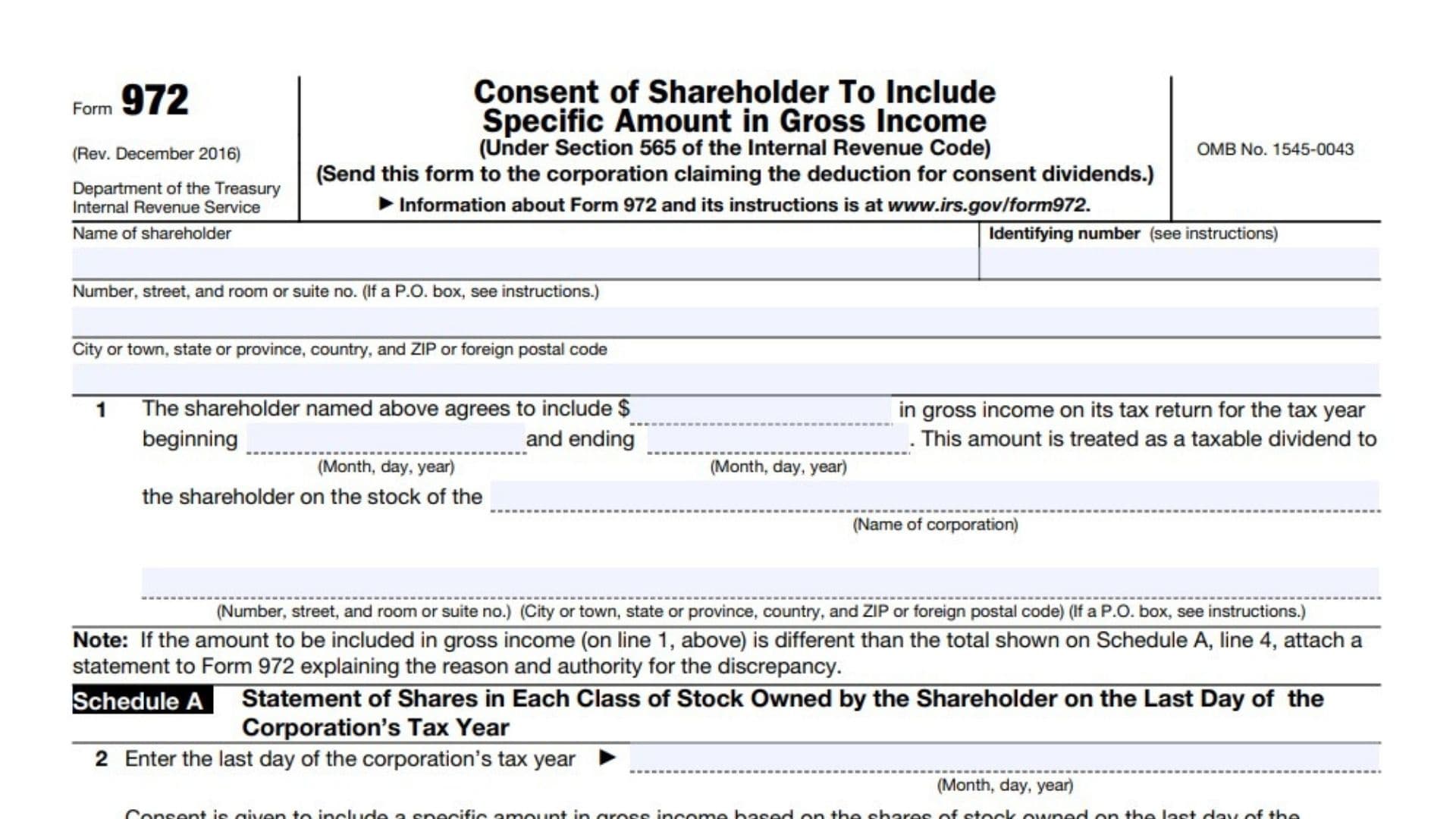

Top Section: Shareholder Identification

- Name of shareholder

Enter your full legal name as the shareholder. - Identifying number (see instructions)

- Individuals: Enter your Social Security Number (SSN).

- Other entities (corporations, partnerships, trusts, etc.): Enter your Employer Identification Number (EIN).

- Number, street, and room or suite no. (If a P.O. box, see instructions.)

Provide your complete mailing address, including any room, suite, or unit number.- If mail is not delivered to your street address, use your P.O. box instead.

- City or town, state or province, country, and ZIP or foreign postal code

Enter the city, state or province, country, and ZIP or foreign postal code for your address.

Line 1: Consent Statement

- Enter the dollar amount you agree to include in your gross income as a consent dividend.

- Specify the tax year for which you will include this amount:

- Enter the beginning date (month, day, year) and ending date (month, day, year) of your tax year.

- Enter the name of the corporation whose stock is involved.

- Enter the corporation’s address: number, street, and room or suite number (or P.O. box if applicable), city or town, state or province, country, and ZIP or foreign postal code.

Note: If the amount you agree to include on line 1 is different from the total shown on Schedule A, line 4, you must attach a statement explaining the reason and authority for the discrepancy.

Schedule A: Statement of Shares in Each Class of Stock Owned by the Shareholder on the Last Day of the Corporation’s Tax Year

- Enter the last day of the corporation’s tax year (Month, day, year)

Write the exact last day of the corporation’s tax year.

- The consent is given to include a specific amount in gross income based on the shares owned on this date.

Class of stock

- List each class of stock you owned on the last day of the corporation’s tax year.

Number of shares

- Enter the number of shares you owned in each class.

Certificate numbers

- List the certificate numbers for the shares you own.

Amount of consent distribution allocable to each class of stock owned

- Enter the dollar amount of the consent distribution allocated to each class of stock.

- $

- Enter the total consent distribution for each class of stock (sum of the amounts in the previous column).

- Total consent distribution $

- Enter the total consent distribution for all classes of stock combined.

Signature Section

- Signature of consenting shareholder

Sign the form.- If the shareholder is a partnership, a partner must sign.

- If an estate or trust, the fiduciary or officer must sign.

- For a corporation, an authorized officer (president, vice president, treasurer, assistant treasurer, chief accounting officer, or tax officer) must sign.

- An attorney or agent may sign if specifically authorized by power of attorney (attach if not previously filed).

- Title

Enter your title or capacity (e.g., President, Trustee, Partner). - Date

Enter the date you sign the form.

Paperwork Reduction Act Notice

No action required; this section is informational only.