IRS Form 970, “Application To Use LIFO Inventory Method,” is used by businesses and individuals to formally elect the Last-In, First-Out (LIFO) inventory method for valuing inventory under section 472 of the Internal Revenue Code. The LIFO method allows businesses to account for inventory by assuming that the most recently acquired items are sold first, which can reduce taxable income in times of rising prices by matching current costs with current revenues. Filing Form 970 is a critical step for any taxpayer wishing to use LIFO, as the election is irrevocable without IRS consent. The form must be filed with the tax return for the first year the LIFO method is used, and it requires detailed disclosures about inventory, methods, and compliance with IRS regulations. This ensures the IRS can verify proper application of LIFO and monitor any subsequent changes or recapture events. The form is also used by C corporations undergoing S corporation conversions or asset transfers, which may trigger LIFO recapture rules.

How to File Form 970?

- When to File: File Form 970 with your tax return for the first tax year you intend to use the LIFO method. If you forgot to file, you can submit an amended return within 12 months of the original filing date, attaching Form 970 and marking it “Filed pursuant to section 301.9100-2.”

- Where to File: Attach Form 970 to your federal income tax return and file it at the same address as your return.

- Attachments: Include all required statements and analyses as specified in the form instructions.

- Signature: The form must be signed by the filer or authorized representative.

How to Complete Form 970?

Below are detailed instructions for every line and section of Form 970:

Name and Identification Number

- First Line: Enter the name and identification number (SSN or EIN) of the filer (the applicant or representative).

- Second Line (if applicable): If filed on behalf of an applicant, enter the applicant’s name and identification number.

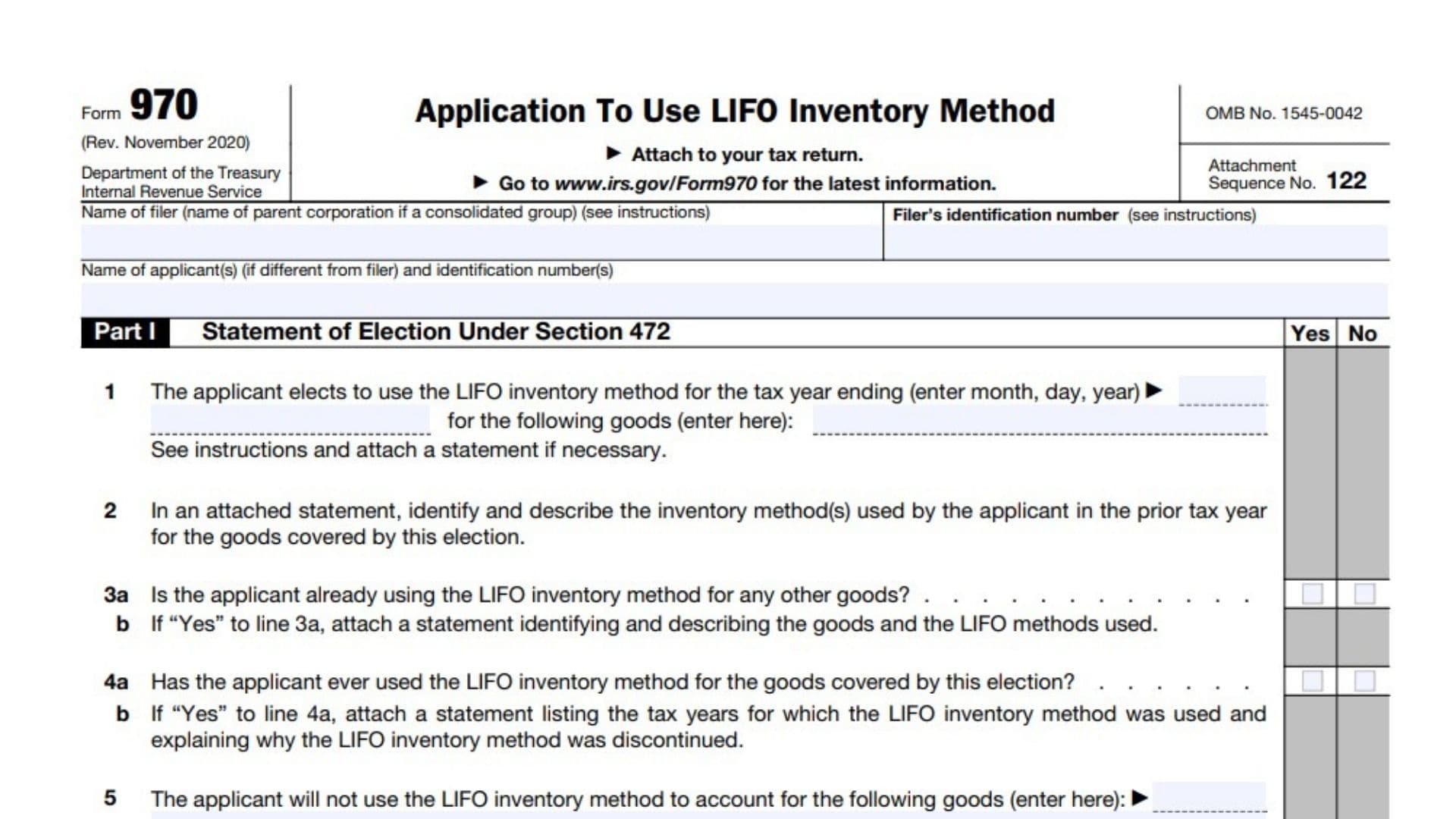

Part I – Statement of Election Under Section 472

Line 1:

- Enter the tax year in which you will first use the LIFO method.

- List the inventory items for which you are making the election (exclude items already under a previous LIFO election).

- Attach a detailed analysis of all inventories at the beginning and end of the first LIFO year and the beginning inventory of the preceding year, including the ending inventory reported on your previous tax return.

Line 2:

- Indicate the inventory method used for the tax year immediately preceding the LIFO election (e.g., FIFO, specific identification, average cost).

Line 3:

- State the inventory method that will be used for items not covered by the LIFO election.

Line 4:

- Specify the method you will use to determine the cost of inventory items (e.g., standard cost, actual invoice cost, joint product cost, or retail inventory method).

Part II – LIFO Inventory Methods

Line 5:

- Check the box for the LIFO method you are electing:

- Specific goods (unit) method

- Dollar-value method

- Inventory price index computation (IPIC) method

Line 6:

- If you checked “Specific goods (unit) method,” complete Part III.

- If you checked “Dollar-value method,” complete Part IV.

- If you checked “IPIC method,” complete Part V.

Part III – Specific Goods (Unit) Method

Line 11:

- Attach a list of the types or categories of goods to be compared in opening and closing inventories.

- Describe each type or category and identify the unit of measure (e.g., pounds, barrels, feet).

Line 12:

- Check the box for the method you will use to determine the cost of goods in closing inventories in excess of opening inventories:

- Actual cost of goods most recently purchased or produced

- Average cost of goods purchased or produced during the tax year

- Actual cost of goods purchased or produced in the order of acquisition

- Other (attach explanation)

Part IV – Dollar-Value Method

Line 13:

- Attach a statement describing your method of defining “items.”

Line 14a:

- Indicate whether any goods covered by this election were acquired at below-market prices (Yes/No).

Line 14b:

- If “Yes” to 14a, attach a statement explaining whether you account for below-market and market-priced goods as separate items. If not, explain and justify.

Line 15:

- Attach a statement describing your pooling method for goods covered by this election.

- If using more than one dollar-value pool, list and describe each pool’s contents.

Line 16:

- Identify or describe the method you will use to compute the LIFO value of each dollar-value pool (e.g., double-extension, link-chain, index).

- If using a method other than double-extension or IPIC, attach a detailed statement describing and justifying your method.

Line 17:

- Check the box for the method you will use to determine the current-year cost of goods in closing inventories and to value LIFO increments:

- Actual cost of goods most recently purchased or produced

- Average cost of goods purchased or produced during the tax year

- Actual cost of goods purchased or produced in the order of acquisition

- Other (attach explanation)

Part V – Inventory Price Index Computation (IPIC) Method

Line 18:

- Check the box for the IPIC method you will use to compute the LIFO value:

- Double-extension IPIC method

- Link-chain IPIC method

Line 19:

- Check the box for the BLS price index table you will use:

- Table 3 of the Consumer Price Index (CPI) Report

- Table 6 of the Producer Price Index (PPI) Detailed Report

- Other table of the PPI Detailed Report (attach explanation if selected)

Line 20:

- Indicate whether you will use the 10 percent method (Yes/No).

Line 21:

- If using a representative month for selecting BLS price indexes, enter the month elected for each dollar-value pool (attach a statement if necessary).

Part VI – Other Information

Line 22:

- Attach a statement describing your method for determining the cost of inventory items (e.g., standard cost, actual invoice cost, joint product cost, retail inventory method).

Line 23:

- Indicate whether you received IRS consent to change your method of valuing inventories for the tax year specified on line 1 (Yes/No).