IRS Form 9465, known as the Installment Agreement Request, is a form taxpayers can use to set up a payment plan for outstanding federal taxes. If you owe taxes that you cannot pay in full, this form allows you to arrange monthly payments over time. Using an installment agreement can help avoid more severe collection actions, such as wage garnishments or liens, as long as you adhere to the agreed payment schedule. Here’s why Form 9465 is important:

- Who Can File: Individuals, self-employed taxpayers, and businesses no longer in operation can use this form.

- Simplified Application: If you owe $50,000 or less, you can apply online through the IRS website, which may lower your user fee.

- Flexibility: It offers options for direct debit, payroll deduction, or manual payments.

- Avoiding Penalties: While penalties and interest continue to accrue, this agreement can prevent harsher collection measures.

You can submit this form with your tax return or as a stand-alone request after receiving a tax bill.

How to File Form 9465?

- Obtain the Form: Download Form 9465 from the IRS website or obtain a physical copy.

- Gather Information: Collect relevant details such as your tax return(s), amounts owed, and financial information.

- Decide Payment Terms: Determine how much you can realistically pay each month while aiming to minimize interest and penalties.

- Submit the Form: Attach Form 9465 to your tax return if filing together, or mail it separately to the IRS address provided in the instructions.

How to Complete Form 9465?

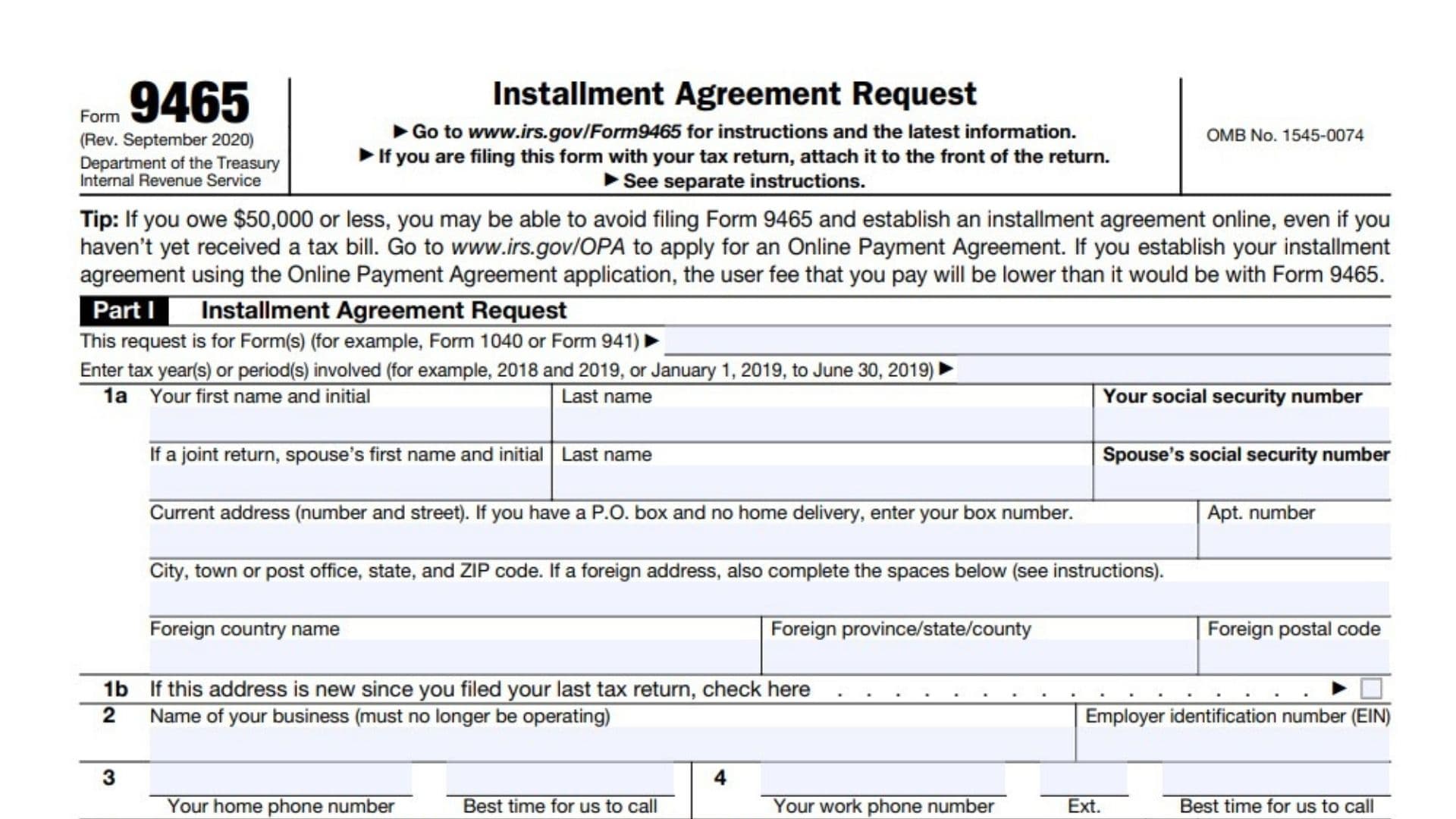

Part I: Installment Agreement Request

- Line 1a: Enter your name, Social Security Number (SSN), and address. If filing jointly, include your spouse’s name and SSN.

- If your address has changed since your last tax return, check the box in Line 1b.

- Line 2: For businesses no longer in operation, enter the business name and Employer Identification Number (EIN).

- Lines 3 & 4: Provide your home and work phone numbers and the best times for the IRS to contact you.

- Line 5: Enter the total amount you owe, as shown on your tax return or notice.

- Line 6: If you have additional balances due not listed on Line 5, enter them here.

- Line 7: Add Lines 5 and 6 to calculate the total amount owed.

- Line 8: Enter any payment you are making with this request. This reduces the amount on Line 7.

- Line 9: Subtract Line 8 from Line 7 to determine the remaining balance owed.

- Line 10: Divide the amount on Line 9 by 72 to calculate the minimum monthly payment amount.

- Line 11a: Enter the amount you propose to pay each month. Make it as high as possible to reduce interest and penalties.

- Line 11b: If you can increase your payment to match or exceed the amount on Line 10, enter the revised amount.

- If you cannot meet this minimum, check the box and attach Form 433-F, the Collection Information Statement.

- Line 11b: If you can increase your payment to match or exceed the amount on Line 10, enter the revised amount.

- Line 12: Specify the day of the month (no later than the 28th) you want your payment due.

- Line 13: For direct debit payments, enter your routing and account numbers.

- Line 13c: If you are a low-income taxpayer unable to make electronic payments, check the box to request reimbursement of your user fee.

- Line 14: If you want payments deducted from your payroll, check the box and attach Form 2159, the Payroll Deduction Agreement.

Part II: Additional Information

Complete this section only if all three conditions apply:

- You defaulted on an installment agreement in the past 12 months.

- You owe more than $25,000 but less than $50,000.

- The amount in Line 11a (or 11b) is less than the amount in Line 10.

- Line 15: Enter the county where your primary residence is located.

- Lines 16a & 16b: Indicate your marital status and whether you share household expenses with your spouse.

- Line 17: Enter the number of dependents you can claim on your current tax return.

- Line 18: Enter the number of household members who are 65 or older.

- Line 19: Select how often you are paid (e.g., weekly, bi-weekly, monthly).

- Line 20: Enter your net income per pay period (after taxes and deductions).

- Lines 21–22: If married, provide the same payment information for your spouse.

- Lines 23–24: Specify how many vehicles you own and your monthly car payment amount.

- Lines 25a–25c: Indicate whether you have health insurance, whether premiums are deducted from your paycheck, and the monthly premium amount.

- Lines 26a–26c: Indicate whether you make court-ordered payments, whether they are deducted from your paycheck, and the monthly payment amount.

- Line 27: Report any monthly child or dependent care expenses, excluding court-ordered payments.