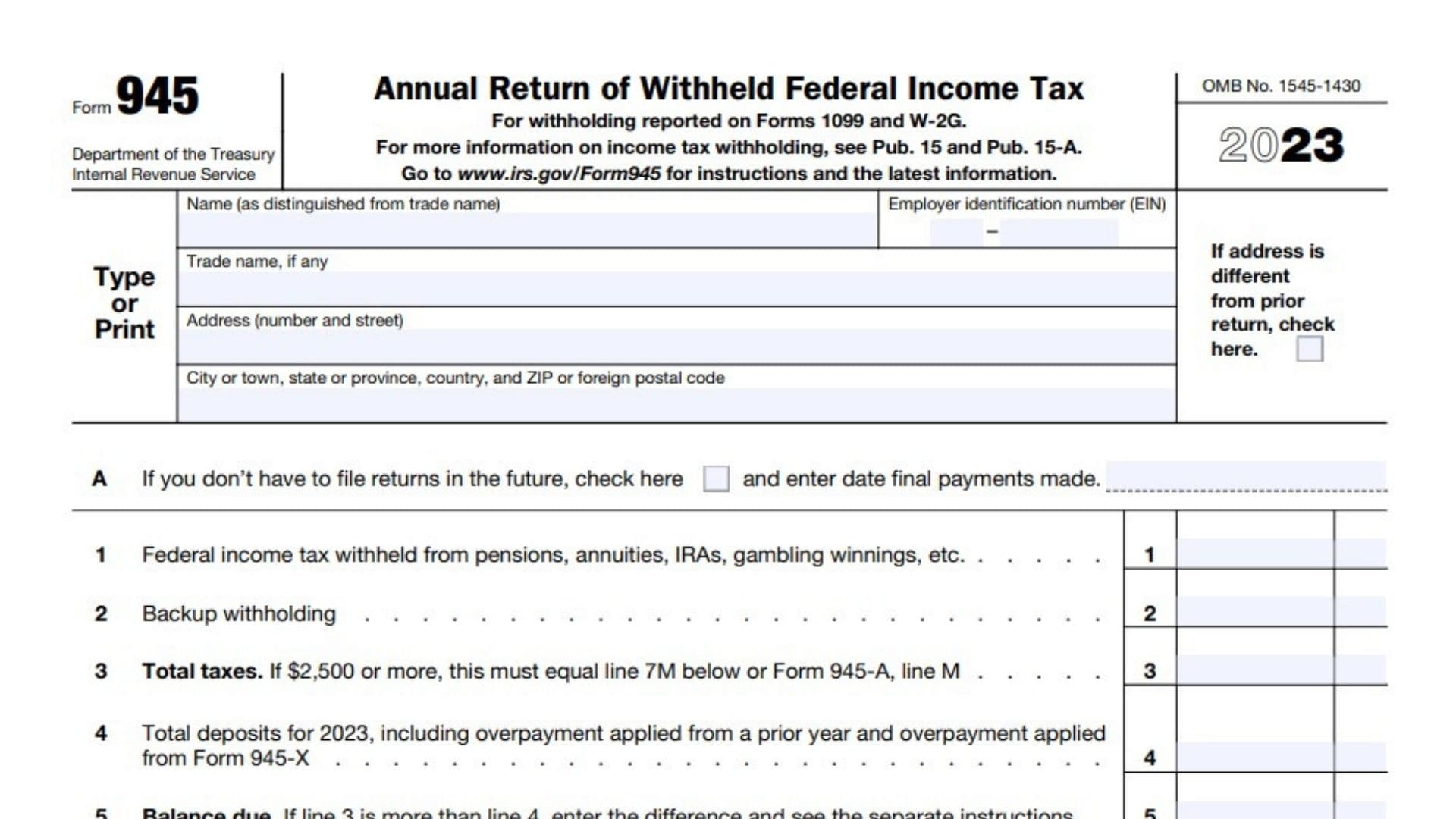

Form 945, known as the Annual Return of Withheld Federal Income Tax, is used to report federal income tax withheld from nonpayroll payments. This includes pensions, annuities, IRAs, military retirement, gambling winnings, Indian gaming profits, and backup withholding. Properly filing Form 945 is essential for businesses and other entities that handle these types of payments. Accurate reporting ensures compliance with IRS regulations and helps avoid penalties. The form must be filed by January 31 of the year following the calendar year in which the taxes were withheld. Businesses must also ensure that they deposit withheld taxes according to the IRS deposit schedules.

Who Must File Form 945?

Any business or entity that withholds federal income tax from nonpayroll payments must file Form 945. This includes organizations that handle pensions, annuities, IRAs, gambling winnings, and other types of nonwage income subject to withholding. The form consolidates all nonpayroll withholding into a single annual filing.

How to File Form 945?

To file Form 945, follow these steps:

- Obtain the Form: Download Form 945 from the IRS website or use tax preparation software.

- Payment Methods: Payments for any balance due can be made via Electronic Federal Tax Payment System (EFTPS), credit card, debit card, check, or money order.

- Submission Options: Submit the completed form electronically for faster processing and confirmation. If mailing, send it to the IRS address specified in the instructions.

How to Fill Out Form 945?

Filling out Form 945 involves providing detailed information about the nonpayroll payments made and the federal income tax withheld. Follow these steps:

- Enter Employer Information: Begin by providing your business name, address, and Employer Identification Number (EIN). Ensure all information is accurate to avoid processing delays.

- Report Nonpayroll Payments and Withheld Taxes:

- Line 1: Enter the total nonpayroll payments subject to federal income tax withholding.

- Line 2: Report the total federal income tax withheld.

- Adjustments: Make any necessary adjustments for prior periods or corrections (Lines 3-6).

- Calculate Tax Liability:

- Line 7: Enter the total tax liability for the year.

Sign the form.

Additional Information

Due Date: File by January 31 of the year following the calendar year in which the taxes were withheld.

Extensions: If you cannot file on time, request an extension by filing Form 4868.

Penalties: Late filing or payment may result in penalties and interest. The penalty for late filing is 5% of the unpaid tax per month, up to 25%. The penalty for late payment is 0.5% per month, up to 25%.