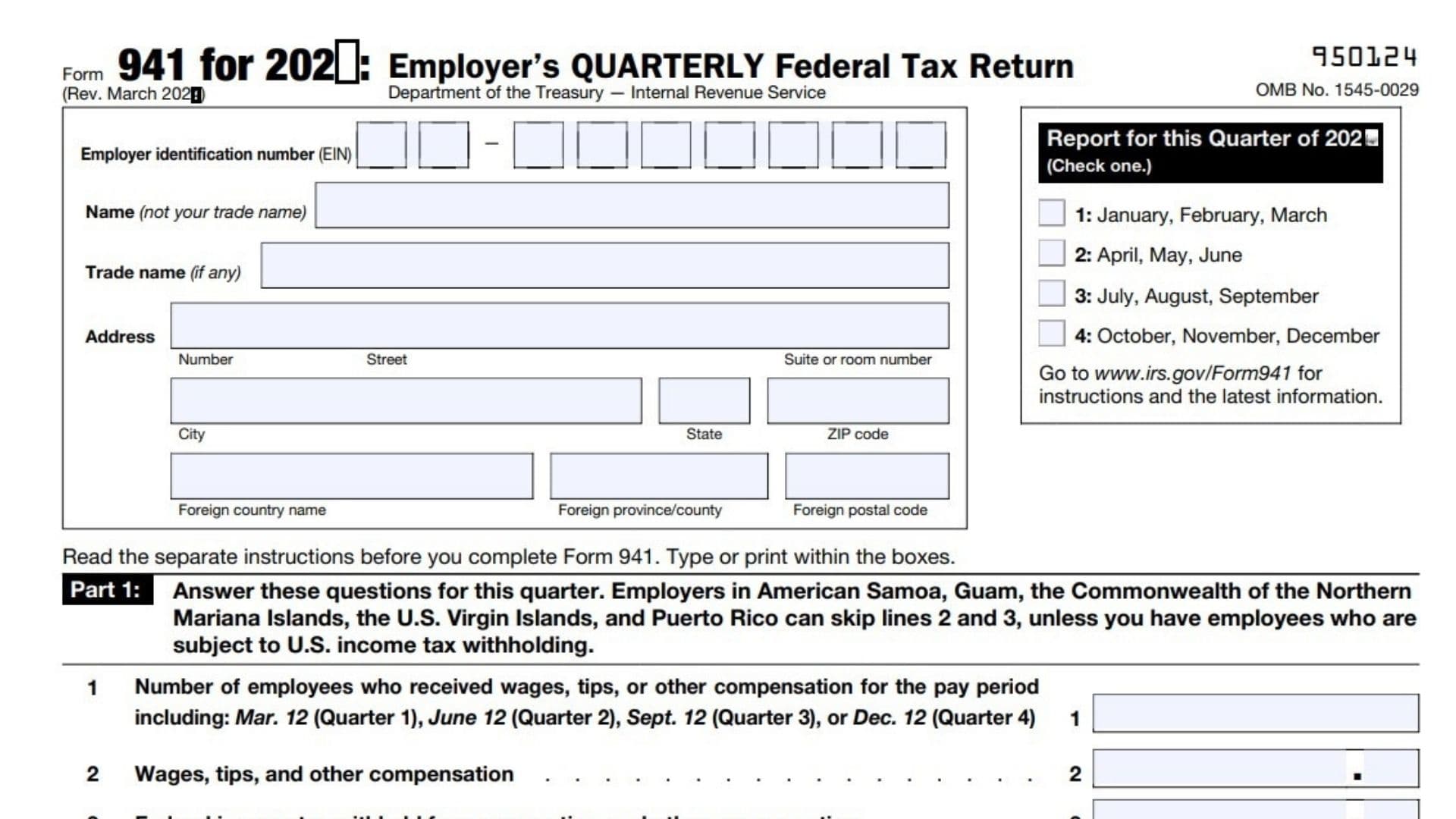

Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a tax form that is required to be filed by most businesses with employees on a quarterly basis. The form is used to report the federal income taxes, Social Security and Medicare taxes withheld from employee paychecks, and the employer’s matching payments for those taxes. Filing this form correctly is vital for businesses, as failure to file may result in hefty penalties from the IRS.

If you have any questions about how to file this form, be sure to reach out to a qualified tax professional for assistance. In addition, you can make your quarterly tax payments online using the Electronic Federal Tax Payment System (EFTPS). This is the preferred method for filing both your return and paying your owed taxes.

How to Complete Form 941?

Start filling out Form 941 by Entering EIN, Name, Trade Name, and address.

Part 1 – Answer the questions

Line 1: Enter the number of employees who received wages, tips, for the pay period. Q1, Q2, Q3, Q4 included.

Line 2: Wages, tips, and other compensation

Line 3: Federal income tax withheld from wages, tips, and other compensation

Line 4: Check this box and go to line 6 if no wages, tips, and other compensation are subject to social security or Medicare tax.

Fill out Every Column

Line 5a: Taxable social security wages

Line 5a (i) Qualified sick leave wages

Line 5a (ii) Qualified family leave wages

Line 5b: Taxable social security tips

Line 5c: Taxable Medicare wages & tips

Line 5d: Taxable wages & tips subject to Additional Medicare Tax withholding

- Line 5e: Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d to figure Total social security and Medicare taxes.

Line 5f: Section 3121(q) Notice and Demand—Tax due on unreported tips

Line 6: Add lines 3, 5e, and 5f to figure Total taxes before adjustments.

Line 7: Current quarter fractions of cents adjustment

Line 8: Current quarter sick pay adjustment

Line 9: Current quarter tips and group-term life insurance adjustment.

Line 10: Combine lines 6 through 9. This is Your Total Taxes after Adjustments.

Line 11a: Qualified small business payroll tax credit for increasing research activities. Attach Form 8974.

Line 11b: Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

Line 11c: Reserved for future use

Line 11d: Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before October 1, 2021

Line 11e: ——

Line 11f: ——

Line 11g: Add line 11a, line 11b, and line 11d to figure your total nonrefundable credits.

Line 12: Subtract line 11g from line 10 to figure your total taxes after adjustments and nonrefundable. credits

Line 13a: Total deposits for this quarter ( overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter, included.)

Line 13b: ——

Line 13c: Refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

Line 13d: ——

Line 13e: Refundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before October 1, 2021

Line 13f: ——

Line 13g: Add Line 13a, Line 13c, and Line 13e to figure Your Total deposits and refundable credits.

Line 13h: ——

Line 13i: ——

Line 14: Enter the difference if line 12 is > Line 13g. This is your Balance Due.

Line 15: If Line 13g is > Line 12, enter the difference

Part II – Your deposit schedule and tax liability info for this quarter

Line 16: There are three check boxes in this line:

- Check Box 1: Line 12 on this return is less than $2,500, or line 12 on the return for the prior quarter was less than $2,500, and you didn’t incur a $100,000 next-day deposit obligation during the current quarter.

- Check Box 2: You were a monthly schedule depositor for the entire quarter. Enter your monthly tax liability and total liability for the quarter, then go to Part 3.

- Check Box 3: You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Go to Part 3.

Line 17: If your business has closed or you stopped paying wages, check the box and enter the final date you paid wages. Also attach a statement to your return.

Line 18: Checkbox. If you’re a seasonal employer and you don’t have to file a return for every quarter of the year, check the box.

Line 19: Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021

Line 20: Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021

Line 21: ——

Line 22: ——

Line 23: Qualified sick leave wages for leave taken after March 31, 2021, and before October 1, 2021

Line 24: Qualified health plan expenses allocable to qualified sick leave wages reported on line 23

Line 25: Amounts under certain collectively bargained agreements allocable to qualified sick leave wages reported on line 23

Line 26: Qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021

Line 27: Qualified health plan expenses allocable to qualified family leave wages reported on line 26

Line 28: Amounts under certain collectively bargained agreements allocable to qualified family leave wages reported on line 26

Part IV – May we speak with your third-party designee?

- Yes or NO question. Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS?

If Yes, Enter Designee’s name and phone number, and Select a 5-digit personal identification number (PIN) to use when talking to the IRS.

Part V – SIGN the form