IRS Form 940, officially titled “Employer’s Annual Federal Unemployment (FUTA) Tax Return,” is used by employers to report and pay federal unemployment taxes under the Federal Unemployment Tax Act (FUTA). The FUTA tax helps fund unemployment compensation programs for workers who lose their jobs. Employers — not employees — pay this tax.

In general, if you paid wages of $1,500 or more in any calendar quarter or had one or more employees for at least part of a day in 20 different weeks, you must file Form 940. The FUTA tax rate is typically 6.0% on the first $7,000 of wages paid to each employee, though most employers receive a credit of up to 5.4% for paying state unemployment tax, bringing the effective rate to 0.6%.

Form 940 must be filed annually, even if no tax is due, and the due date is January 31 of the following year. If you deposited all FUTA taxes on time, you get an extension to February 10.

How To File Form 940

You can file Form 940 in one of two ways:

- Electronically – Use approved IRS e-file providers or payroll services.

- By Mail – Send your paper form to the IRS address listed in the official instructions (varies by state and payment method).

If your FUTA tax due is over $500, you must deposit electronically using EFTPS (Electronic Federal Tax Payment System). If it’s $500 or less, you can pay it with the form using Form 940-V (Payment Voucher).

How To Complete Form 940

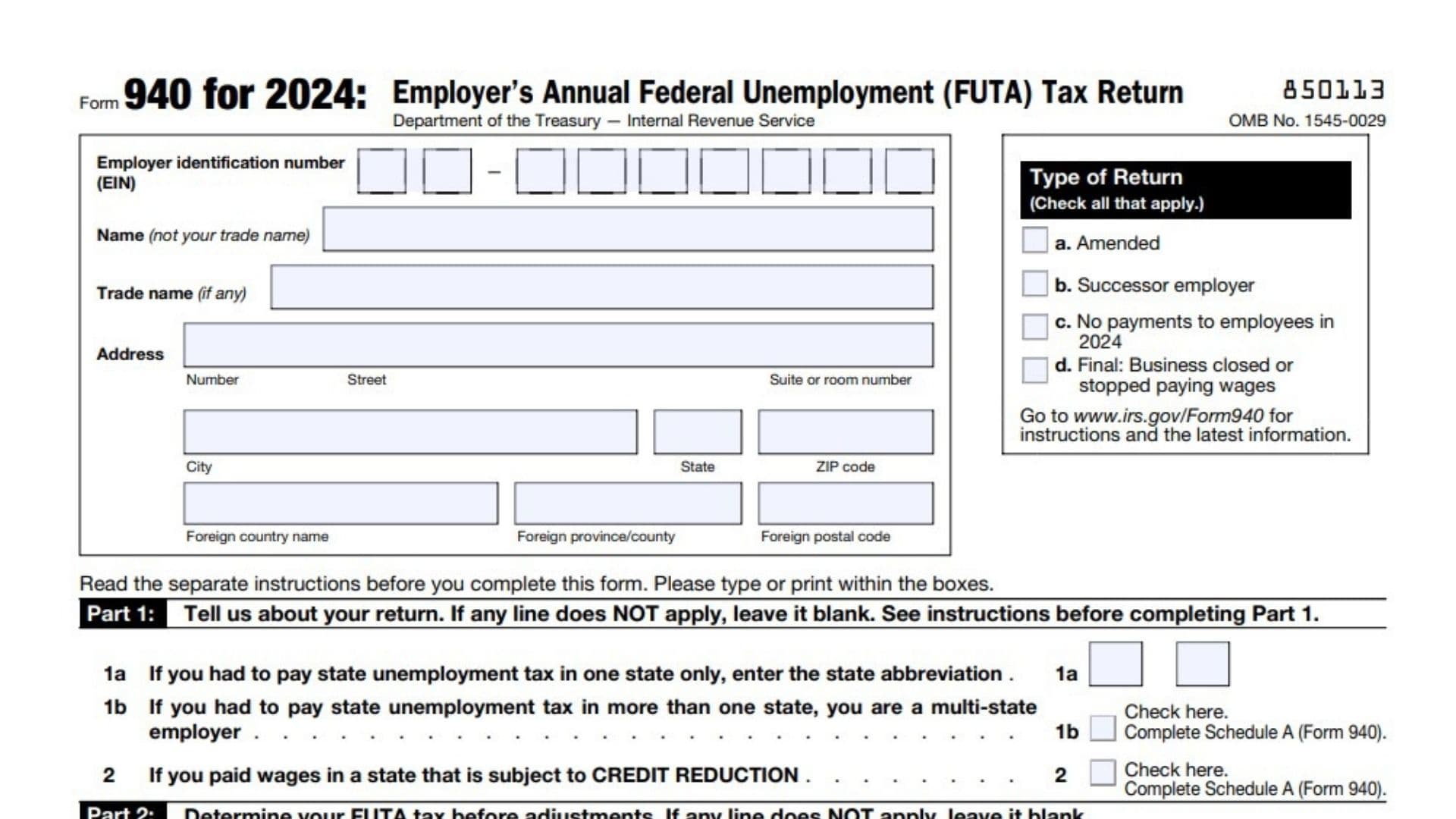

Entity Information Section (Top of Page 1)

- Employer Identification Number (EIN): Enter your 9-digit EIN assigned by the IRS.

- Name (not trade name): Enter the legal business name.

- Trade Name: If your business operates under a different trade name, enter it here.

- Address: Fill in your complete business address, including city, state, and ZIP. If foreign, also include province/county and postal code.

Type Of Return (Check All That Apply)

Select all that apply:

- a. Amended – If correcting a previously filed return.

- b. Successor Employer – If you acquired another business during the year.

- c. No Payments to Employees in 2024 – If no wages were paid.

- d. Final: Business Closed or Stopped Paying Wages – If this is your final return.

PART 1 – Tell Us About Your Return

- Line 1a: If you paid state unemployment tax in one state only, enter that state’s two-letter abbreviation.

- Line 1b: If you paid in multiple states, check the box for “multi-state employer.” Complete Schedule A (Form 940).

- Line 2: If you paid wages in a state subject to credit reduction, check the box and complete Schedule A.

PART 2 – Determine Your FUTA Tax Before Adjustments

- Line 3: Enter total payments to all employees (gross wages).

- Line 4: Enter payments exempt from FUTA tax and check all that apply:

- 4a Fringe benefits

- 4b Group-term life insurance

- 4c Retirement/Pension

- 4d Dependent care

- 4e Other (specify)

- Line 5: Enter the total payments made to each employee in excess of $7,000.

- Line 6: Add lines 4 and 5.

- Line 7: Subtract line 6 from line 3. This equals your total taxable FUTA wages.

- Line 8: Multiply line 7 by 0.006 (0.6%). This is your FUTA tax before adjustments.

PART 3 – Determine Your Adjustments

- Line 9: If all taxable FUTA wages were excluded from state unemployment tax, multiply line 7 by 0.054 and enter the result.

- Line 10: If some wages were excluded or state taxes were paid late, use the worksheet in the IRS instructions. Enter the worksheet result.

- Line 11: If credit reduction applies, enter the total from Schedule A (Form 940).

PART 4 – Determine Your FUTA Tax And Balance Due Or Overpayment

- Line 12: Add lines 8 through 11. This is your total FUTA tax after adjustments.

- Line 13: Enter the FUTA tax you already deposited, including overpayments from prior years.

- Line 14: If line 12 is greater than line 13, subtract and enter the balance due.

- If over $500, deposit electronically.

- If $500 or less, you may pay with this form.

- Line 15: If line 13 exceeds line 12, enter the overpayment and check one:

- Apply to next return

- Send a refund

PART 5 – Report Your FUTA Tax Liability By Quarter

Complete this only if your total FUTA tax (line 12) exceeds $500.

- Line 16a: 1st Quarter (Jan 1–Mar 31) – Enter FUTA tax liability.

- Line 16b: 2nd Quarter (Apr 1–Jun 30).

- Line 16c: 3rd Quarter (Jul 1–Sep 30).

- Line 16d: 4th Quarter (Oct 1–Dec 31).

- Line 17: Add all quarters. This must equal line 12.

PART 6 – Third-Party Designee

If you want to allow another person (employee, preparer, or other) to speak with the IRS about this return:

- Check Yes and provide the designee’s name, phone, and a 5-digit PIN.

- Otherwise, check No.

PART 7 – Sign Here

You must sign and date the form. Provide:

- Your name and title

- Best daytime phone number

If prepared by a paid tax preparer:

- Include preparer’s name, signature, PTIN, firm name, EIN, address, phone, and indicate if self-employed.

Form 940-V – Payment Voucher

Use Form 940-V only if paying with your return (when total FUTA due is $500 or less).

- Box 1: Enter your EIN.

- Box 2: Enter the payment amount.

- Box 3: Enter business name and address (exactly as on Form 940).

- Make check or money order payable to “United States Treasury”, and write “Form 940” and “2024” on it.

- Detach the voucher and mail it with your payment and Form 940 to the IRS address listed in the official instructions.

Filing Tips and Deadlines

- File by: January 31, 2025 (or February 10 if all deposits were made on time).

- Keep copies of the return and all related worksheets for at least 4 years.

- Do not send cash with the form.