Form 926, officially titled “Return by a U.S. Transferor of Property to a Foreign Corporation,” is a U.S. Internal Revenue Service (IRS) document used by taxpayers to report certain transfers of property to foreign corporations. Under U.S. tax law, individuals and entities who transfer property, including stock, securities, or other assets, to foreign corporations are required to disclose such transfers. This form plays a critical role in ensuring compliance with the complex tax rules governing cross-border transfers, preventing U.S. taxpayers from avoiding taxes by moving assets overseas without proper reporting. The IRS uses Form 926 to track and monitor such transfers, and failure to file this form when required can result in significant penalties. Form 926 applies to U.S. citizens, corporations, partnerships, estates, and trusts that transfer property to a foreign corporation, whether the property is tangible or intangible. Depending on the nature of the transaction, the form may need to be filed even if no immediate tax is owed. The goal is to provide the IRS with the necessary information to assess potential tax implications under Section 367 of the U.S. tax code, which governs the tax treatment of outbound property transfers.

Who Must File Form 926?

Any U.S. person (which includes individuals, corporations, partnerships, estates, and trusts) that transfers property to a foreign corporation must file Form 926. Specific instances that trigger the requirement to file include when a taxpayer transfers property under Section 367 of the Internal Revenue Code (IRC) or when they hold 10% or more of the total voting power or value of the foreign corporation’s stock after the transfer. This filing is crucial for U.S. taxpayers to disclose certain outbound transactions, such as the exchange of stock in a domestic corporation for stock in a foreign one, or the transfer of intellectual property to a foreign subsidiary. Failure to comply with this reporting requirement can lead to significant penalties, so understanding the circumstances in which this form is necessary is essential for avoiding costly mistakes.

How to File Form 926?

Filing Form 926 requires providing detailed information about the taxpayer, the nature of the transfer, and the foreign corporation involved. The form includes sections for disclosing the type of property transferred, its value, and whether the transfer is subject to certain tax rules, like the gain recognition under Section 367(a). Taxpayers must include the form with their annual income tax return for the year the transfer occurred. It is essential to retain documentation supporting the transfer, including any agreements, valuations, and financial records, as the IRS may request this information during an audit or inquiry. If the taxpayer fails to file, penalties can be substantial, often amounting to 10% of the fair market value of the transferred property, capped at $100,000 unless the failure is due to intentional disregard.

How to Complete Form 926?

Here are line-by-line instructions for filling out this IRS form:

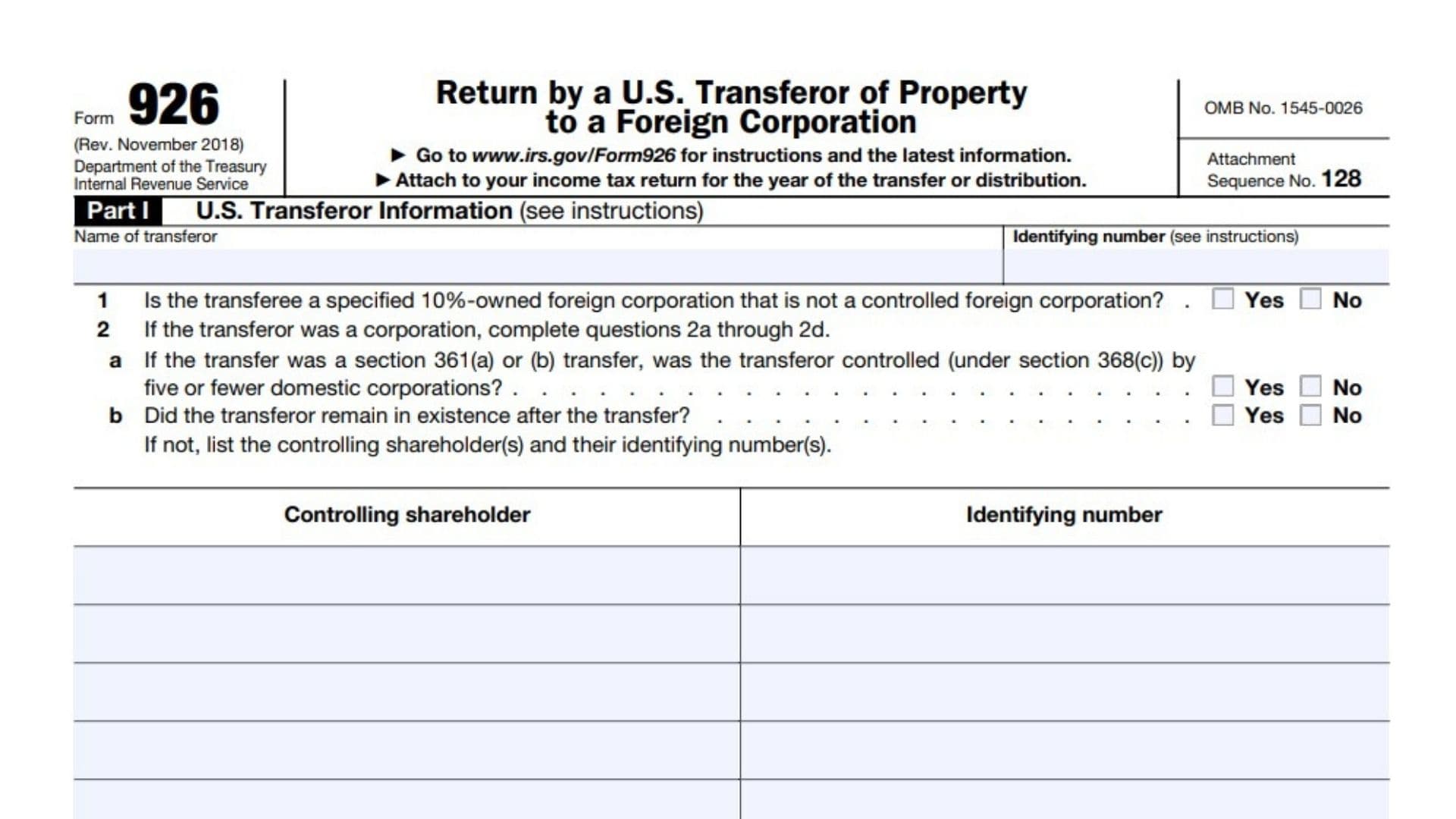

Part I – U.S. Transferor Information

Line 1: Enter the name of the U.S. transferor.

Line 2: Enter the U.S. transferor’s identifying number (SSN or EIN).

Line 3: If the transferor is a corporation, enter the principal business activity code.

Line 4: Check the applicable box for the U.S. transferor’s filing status.

Part II – Transferee Foreign Corporation Information

Line 5: Enter the name of the transferee foreign corporation.

Line 6: Enter the transferee foreign corporation’s identifying number, if any.

Line 7: Enter the foreign corporation’s reference ID number, if applicable.

Line 8a: Enter the address of the transferee foreign corporation.

Line 8b: Enter the country code for the country of incorporation or organization.

Part III – Information Regarding Transfer of Property to a Foreign Corporation

- Line 9: Enter the date of transfer.

- Line 10: List the type of nonrecognition transaction (e.g., section 351).

- Line 11: Describe the property transferred.

- Line 12: Enter the fair market value of the property transferred.

- Line 13: Enter the cost or other basis of the property transferred.

- Line 14: Enter the gain recognized on the transfer, if any.

- Line 15: Indicate whether the transfer resulted in a transfer of substantially all of the assets of a U.S. trade or business.

- Line 16: If the answer to line 15 is “Yes,” describe the trade or business.Line 17a: List the property transferred that qualifies for nonrecognition treatment.

- Line 17b: Enter the fair market value of the property listed on line 17a.

- Line 17c: Enter the cost or other basis of the property listed on line 17a.

- Line 18: Indicate whether the transfer involved the transfer of assets which qualify as an “active trade or business” under Regulations section 1.367(a)-2(d)(2).

- Line 19: Indicate whether the transfer involved the transfer of assets which qualify for the exception provided in section 367(a)(3)(C).

- Line 20: Indicate whether the transfer involved the transfer of assets that qualify for the active trade or business exception under Regulations section 1.367(a)-2(d)(2) and constitute more than 10% of the value of the assets transferred.

- Line 21: Indicate whether the transfer involved the transfer of assets that qualify for the exception provided in section 367(a)(3)(C) and constitute more than 10% of the value of the assets transferred.

- Line 22: Indicate whether the transfer involved a transfer of intangible property subject to section 367(d).

- Line 23: Indicate whether the transfer involved unpatented, proprietary technological information subject to section 367(d).

- Line 24: Indicate whether the transfer involved property described in section 936(h)(3)(B).

- Line 25: Indicate whether the transfer involved property subject to section 367(d) pursuant to Temp. Regulations section 1.367(d)-1T(b).