Form 8996 is a tax form used by Qualified Opportunity Funds to annually certify their compliance with the investment standard requirements established by the Tax Cuts and Jobs Act of 2017. QOFs use this form to report the percentage of their assets invested in Qualified Opportunity Zone property and calculate any penalties if they fail to maintain the required 90% investment standard.

How to Complete Form 8996?

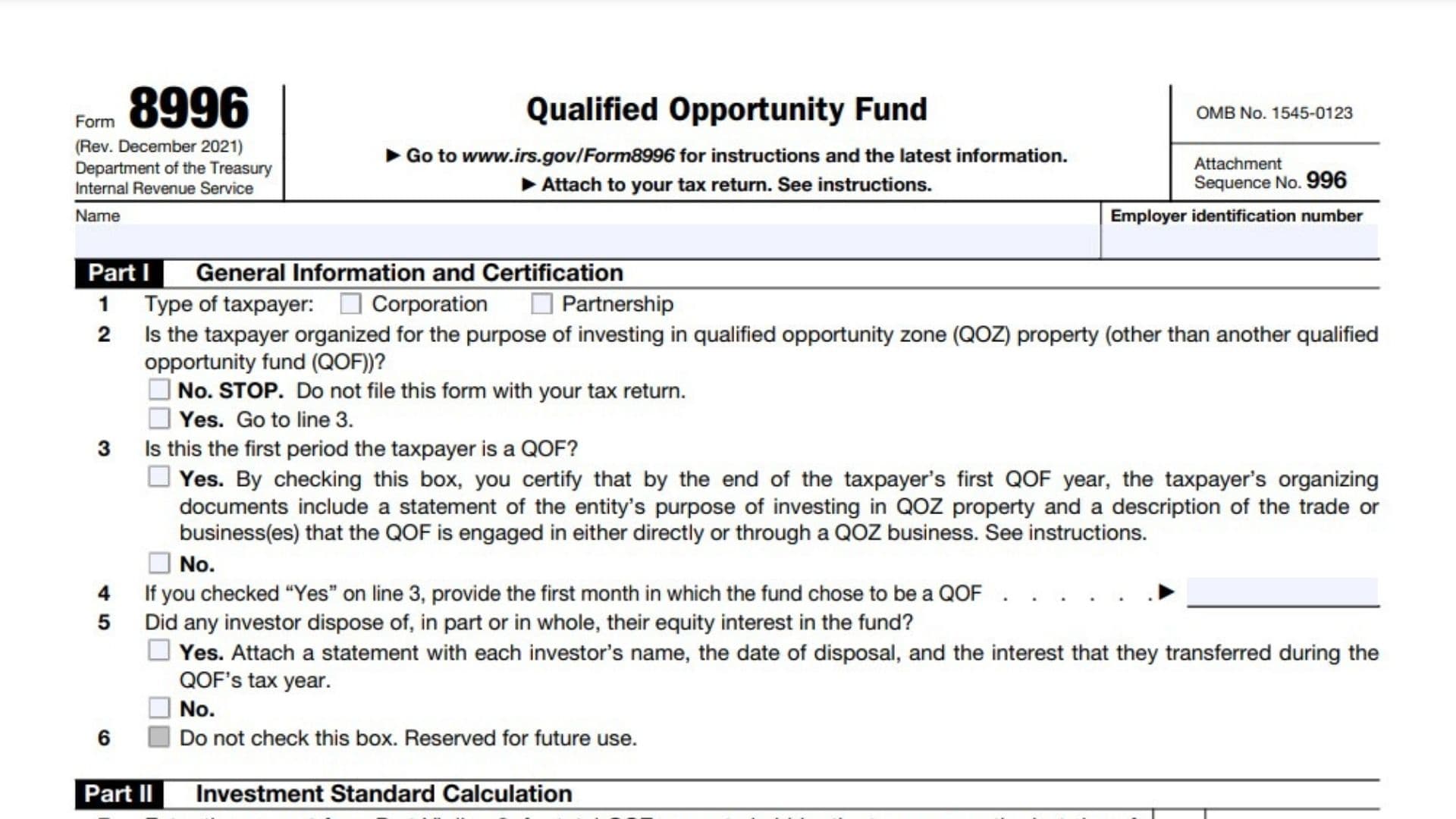

Part I – General Information and Certification

- Line 1: Check the appropriate box to indicate the type of taxpayer:

Corporation

Partnership

- Line 2: Answer whether the taxpayer is organized to invest in QOZ property

If No: Stop filing

If Yes: Proceed to Line 3

- Line 3: Indicate if this is the first period as a QOF

If Yes: Check box to certify organizing documents include required statements

If No: Proceed to Line 4

- Line 4: If Line 3 is Yes, enter the first month the fund chose to be a QOF

- Line 5: Indicate if any investor disposed of their equity interest

If Yes: Attach required statement with investor details

If No: Proceed to next section

Part II – Investment Standard Calculation

- Line 7: Enter total QOZ property from Part VI, Line 2 (first 6-month period)

- Line 8: Enter total assets for first 6-month period

- Line 9: Divide Line 7 by Line 8

- Line 10: Enter total QOZ property from Part VI, Line 3 (end of tax year)

- Line 11: Enter total assets at end of tax year

- Line 12: Divide Line 10 by Line 11

Part III – Qualified Opportunity Fund Average and Penalty

- Line 13: Add Lines 9 and 12

- Line 14: Divide Line 13 by 2.0

- Line 15: Determine if Line 14 is ≥ 0.90

If Yes: Enter 0

If No: Complete Part IV to calculate penalty

Part IV – Penalty Calculation

For each month (columns a through l):

- Enter total assets on last day of month

- Multiply Line 1 by 0.90

- Enter total QOZ property on last day of month

- Subtract Line 3 from Line 2 (if negative, enter 0)

- Enter underpayment rate

- Multiply Line 4 by Line 5

- Divide Line 6 by 12.0

- Add all monthly amounts from Line 7

Part V – QOZ Business Property – Directly Owned or Leased by Taxpayer

- List each QOZ location:

- Column (a): QOZ number.

- Columns (b) and (c): Owned and leased property values at the end of the first 6-month period.

- Columns (d) and (e): Owned and leased property values at the year’s end.

Part VI – QOZ Stock or Partnership Interests

- For each QOZ business:

- Column (a): QOZ number.

- Column (b): EIN of the QOZ business.

- Columns (c) to (h): Investment value and tangible property held in each QOZ at the end of the first 6-month period and year’s end.

Part VII – Continuation of QOZ Stock or Partnership Interests

- Enter additional investments if more lines are needed, following the same format as Part VI.