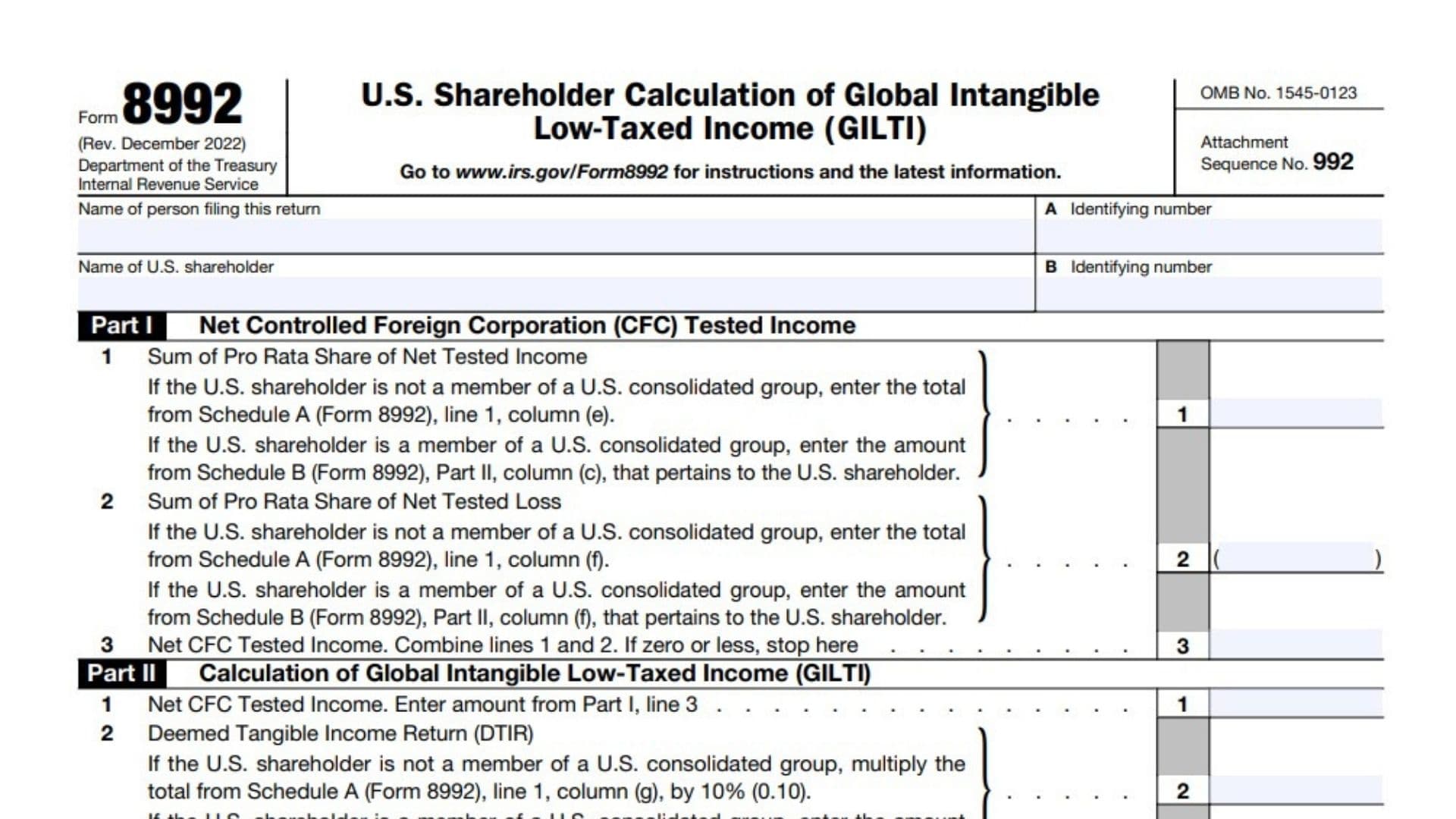

IRS Form 8992, titled “U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI),” is a tax form required for U.S. shareholders of Controlled Foreign Corporations (CFCs). This form is used to calculate the total GILTI that is subject to U.S. taxation. GILTI is a provision introduced under the Tax Cuts and Jobs Act (TCJA) in 2017, designed to discourage multinational corporations from shifting profits to low-tax jurisdictions. The form ensures that U.S. shareholders are taxed on their share of the CFC’s income exceeding a deemed return on tangible assets. By completing this form, taxpayers report their pro-rata share of tested income, tested loss, and other calculations to determine the GILTI inclusion amount. This inclusion plays a critical role in global tax compliance and has significant implications for international businesses.

How to File Form 8992

To file Form 8992, you must attach it to your U.S. income tax return (e.g., Form 1120 for corporations, Form 1040 for individuals, or Form 1065 for partnerships). You should also complete any necessary schedules, such as Schedule A or Schedule B, if applicable, to provide detailed calculations for your pro-rata share of tested income, tested loss, and other relevant items. Ensure you review the form’s instructions on the IRS website (irs.gov/Form8992) to comply with the latest requirements.

How to Complete Form 8992

Part I: Net Controlled Foreign Corporation (CFC) Tested Income

- Line 1: Sum of Pro Rata Share of Net Tested Income

- If you are not part of a U.S. consolidated group, enter the total from Schedule A (Form 8992), line 1, column (e).

- If you are part of a U.S. consolidated group, enter the amount from Schedule B (Form 8992), Part II, column (c), that relates to you.

- Line 2: Sum of Pro Rata Share of Net Tested Loss

- For non-consolidated group members, enter the total from Schedule A (Form 8992), line 1, column (f).

- For consolidated group members, enter the amount from Schedule B (Form 8992), Part II, column (f), that pertains to you.

- Note: This amount should be entered as a negative value (in parentheses).

- Line 3: Net CFC Tested Income

- Combine the amounts from Line 1 and Line 2. If the result is zero or less, stop here and do not proceed to Part II.

Part II: Calculation of Global Intangible Low-Taxed Income (GILTI)

- Line 1: Net CFC Tested Income

- Enter the amount from Part I, Line 3.

- Line 2: Deemed Tangible Income Return (DTIR)

- For non-consolidated group members, multiply the total from Schedule A (Form 8992), line 1, column (g), by 10% (0.10).

- For consolidated group members, enter the amount from Schedule B (Form 8992), Part II, column (i), that relates to you.

- Line 3a: Sum of Pro Rata Share of Tested Interest Expense

- If you are not part of a consolidated group, enter the total from Schedule A (Form 8992), line 1, column (j).

- If you are part of a consolidated group, leave this line blank.

- Line 3b: Sum of Pro Rata Share of Tested Interest Income

- For non-consolidated group members, enter the total from Schedule A (Form 8992), line 1, column (i).

- For consolidated group members, leave this line blank.

- Line 3c: Specified Interest Expense

- For non-consolidated group members, subtract Line 3b from Line 3a. If the result is zero or less, enter “0”.

- For consolidated group members, enter the amount from Schedule B (Form 8992), Part II, column (m), that pertains to you.

- Line 4: Net DTIR

- Subtract Line 3c from Line 2. If the result is zero or less, enter “0”.

- Line 5: GILTI

- Subtract Line 4 from Line 1. If the result is zero or less, enter “0”. This is the final GILTI amount to be included in your taxable income.