Explanation of IRS Form 8990:

IRS Form 8990, “Limitation on Business Interest Expense Under Section 163(j),” is used by taxpayers to calculate the deductible amount of business interest expense. The form helps individuals, corporations, partnerships, and S corporations determine allowable interest deductions, especially for those affected by the limitations in Section 163(j) of the Internal Revenue Code. This section primarily limits business interest deductions based on a percentage of the taxpayer’s adjusted taxable income, with certain exceptions and specific requirements for pass-through entities.

How to Complete Form 8990?

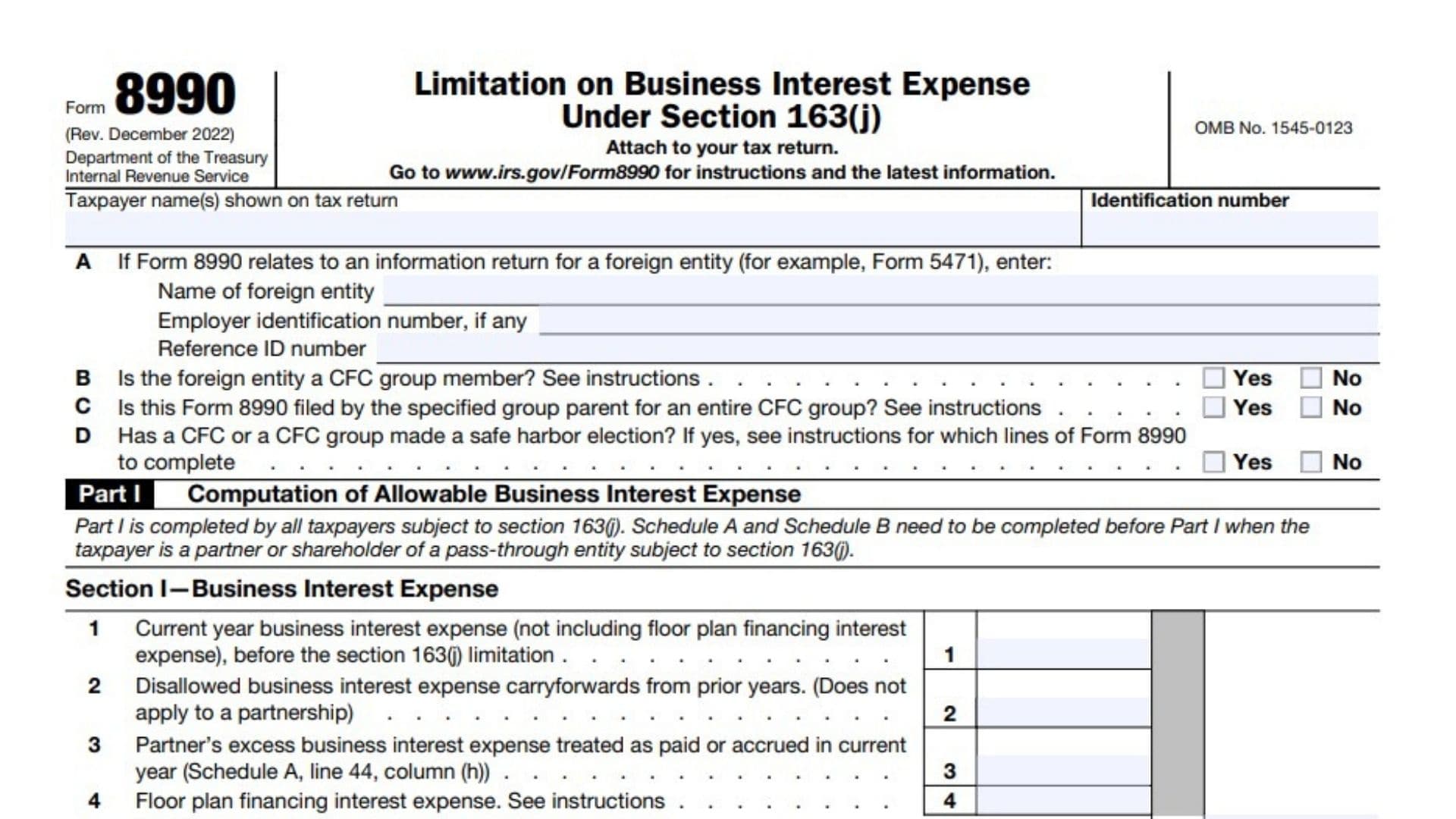

General Information Section (Top of the Form):

- Taxpayer Name(s): Enter the taxpayer’s name(s) exactly as shown on the tax return.

- Identification Number: Provide the taxpayer’s identification number (Social Security Number or Employer Identification Number).

- Question A: If this form pertains to an information return for a foreign entity (like Form 5471), enter the entity’s name, employer identification number, if applicable, and reference ID.

- Question B: Indicate “Yes” or “No” to confirm if the foreign entity is a Controlled Foreign Corporation (CFC) group member.

- Question C: Answer “Yes” or “No” if this form is filed by the specified group parent for an entire CFC group.

- Question D: Specify “Yes” or “No” if a CFC or CFC group has made a safe harbor election under IRS instructions.

Part I – Computation of Allowable Business Interest Expense:

Section I—Business Interest Expense:

- Line 1: Enter the current year’s business interest expense, excluding floor plan financing interest, before applying Section 163(j) limits.

- Line 2: Input any disallowed business interest expense carryforwards from prior years. This does not apply to partnerships.

- Line 3: Enter excess business interest expense from partnerships (refer to Schedule A, line 44, column (h)).

- Line 4: Report floor plan financing interest expense as per instructions.

- Line 5: Sum lines 1 through 4 to get the total business interest expense.

Section II—Adjusted Taxable Income:

- Line 6: Enter tentative taxable income as instructed.

- Lines 7-15: Add adjustments (like losses not allocable to business, operating losses, qualified business income deductions, and excess items from partnerships and S corporations).

- Line 16: Add lines 7 through 15 for total adjustments.

- Lines 17-21: Subtract income or gain items not allocable to business, business interest income, and pass-through income. Total these on line 21.

- Line 22: Combine lines 6, 16, and 21 to calculate adjusted taxable income.

Section III—Business Interest Income

- Line 23: Enter current year business interest income.

- Line 24: Report excess business interest income from partnerships and S corporations.

- Line 25: Total lines 23 and 24 for overall business interest income.

- Section IV—163(j) Limitation Calculations:

- Line 26: Multiply line 22 by the applicable percentage to calculate the business interest expense limitation.

- Line 27: Input business interest income from line 25.

- Line 28: Enter floor plan financing interest from line 4.

- Line 29: Sum lines 26, 27, and 28.

- Line 30: Report allowable business interest expense deduction following the instructions.

- Line 31: Calculate disallowed business interest expense by subtracting line 29 from line 5.

Part II – Partnership Pass-Through Items:

- Only complete this section if you are a partnership subject to section 163(j).

- Line 32: Enter any excess business interest expense from line 31.

- (If you entered an amount on line 32, skip lines 33 through 37)

- Lines 33-37: Compute excess taxable income and excess business interest income following calculations on each line as directed.

Part III – S Corporation Pass-Through Items:

- Only S corporations subject to section 163(j) complete this part.

- Line 38-42: Follow each line’s instructions to report excess taxable income and excess business interest income specific to S corporations.

Schedule A – Summary of Partner’s Section 163(j) Excess Items:

- Lines 43-44: Complete this schedule if the taxpayer owns an interest in a partnership subject to Section 163(j). List each partnership, EIN, and excess items like taxable income and business interest expense.

- Lines 45-46: Complete this schedule if the taxpayer is an S corporation shareholder with excess items as described.