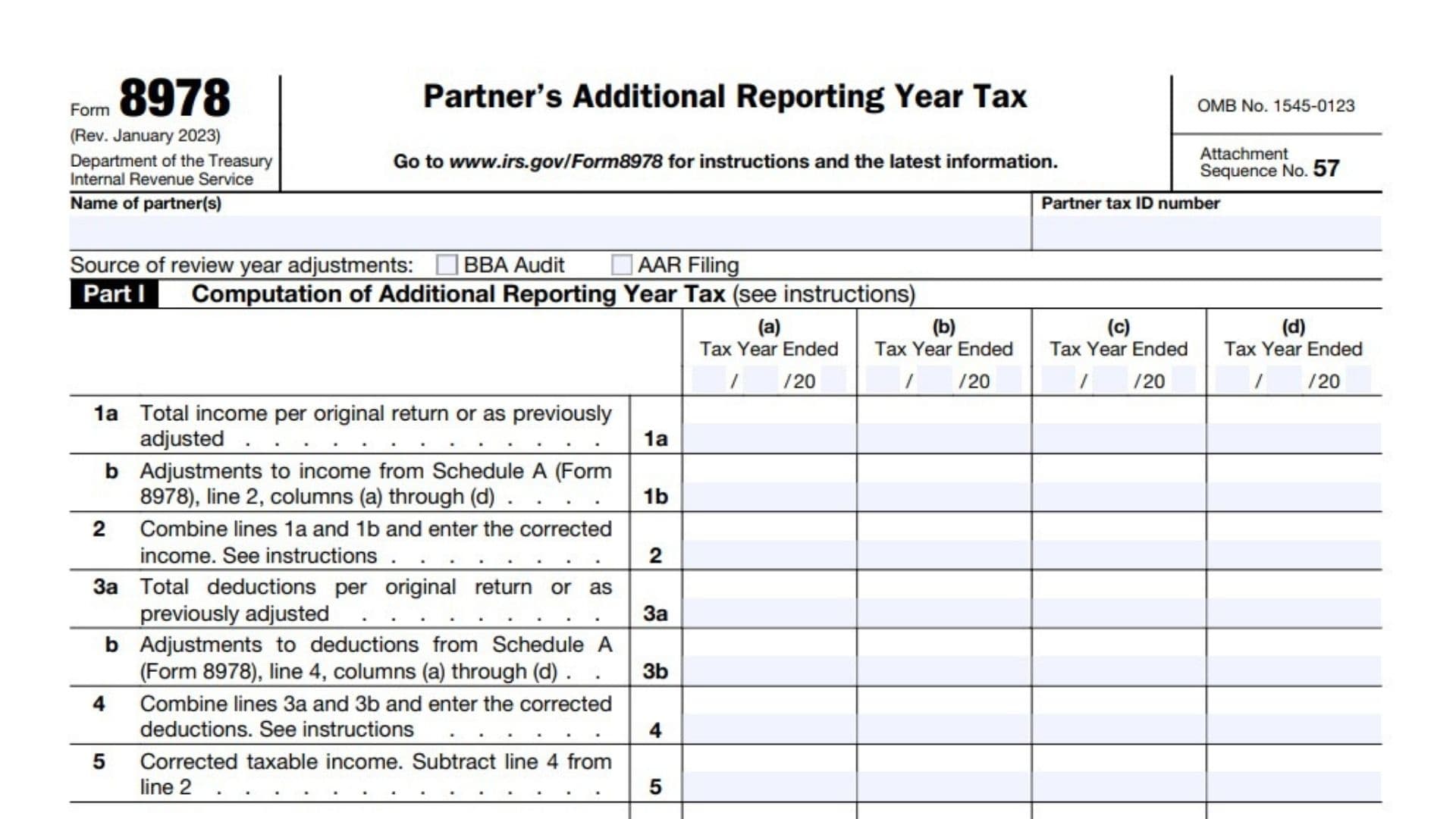

This article provides line-by-line instructions for completing IRS Form 8978, Partner’s Additional Reporting Year Tax. This form is used to calculate the tax adjustments for a partner’s share of partnership items from a prior year, often due to an audit adjustment, administrative adjustment request (AAR), or other changes. The form takes into account changes to income, deductions, and credits for up to four prior tax years, ultimately determining the net increase or decrease in the partner’s current year tax liability due to these prior-year adjustments.

How to File Form 8978?

Form 8978 is an attachment to your individual income tax return (Form 1040). Do not file this form separately. Include it with your return for the year in which you are reporting the adjustments to your prior-year partnership income.

How to Complete Form 8978?

Part I – Computation of Additional Reporting Year Tax:

(a) – (d) Tax Year Ended: Enter the ending date (MM/YY) of each affected tax year for which you are making adjustments. Use columns (a) through (d) for up to four years.

Line 1a. Total income per original return or as previously adjusted: For each tax year, enter the total income reported on your original tax return or as previously adjusted in prior Form 8978 filings.

Line 1b. Adjustments to income from Schedule A (Form 8978): Enter the net adjustment to income from Schedule A, columns (a) through (d) for each respective tax year.

Line 2. Corrected Income: Add lines 1a and 1b for each tax year.

Line 3a. Total deductions per original return or as previously adjusted: Enter the total deductions claimed on your original tax return or as previously adjusted.

Line 3b. Adjustments to deductions from Schedule A (Form 8978): Enter the net adjustment to deductions from Schedule A.

Line 4. Corrected Deductions: Add lines 3a and 3b for each tax year.

Line 5. Corrected Taxable Income: Subtract line 4 from line 2 for each year.

Line 6. Income Tax on Line 5: Calculate the income tax on the corrected taxable income (Line 5) using the applicable tax rates for that tax year. Refer to the IRS instructions for guidance on this calculation.

Line 7. Alternative Minimum Tax on Line 5: Calculate the alternative minimum tax (AMT), if applicable, on the corrected taxable income. Consult the IRS instructions for AMT calculations.

Line 8. Total Corrected Income Tax: Add lines 6 and 7.

Line 9a. Total credits per original return or as previously adjusted: Enter the total credits claimed on your original return or as previously adjusted.

Line 9b. Adjustments to credits from Schedule A (Form 8978): Enter the net adjustment to credits from Schedule A.

Line 10. Corrected Credits: Add lines 9a and 9b.

Line 11. Total Corrected Income Tax Liability: Subtract line 10 from line 8.

Line 12. Total income tax shown on original return or as previously adjusted: Enter the total income tax shown on your original return or as previously adjusted.

Line 13. Increase/Decrease to Tax: Subtract line 12 from line 11 for each tax year.

Line 14. Total increase/decrease to reporting year tax: Add the amounts from line 13, columns (a) through (d). Enter this total here and on the appropriate line of your tax return.

Part II – Penalties:

Line 15. Penalties: Enter any penalties related to the adjustments for each tax year. Refer to the instructions for specific penalty calculations.

Line 16. Total penalties: Add line 15, columns (a) through (d).

Part III – Interest:

Line 17. Interest: Enter the interest due on the underpayment for each tax year. Refer to the instructions for interest calculations.

Line 18. Total interest: Add line 17, columns (a) through (d).

This information is for general guidance only. Consult a tax professional for personalized advice.