IRS Form 8975, known as the Country-by-Country Report, is a tax document required by the Internal Revenue Service (IRS) for U.S. multinational enterprise (MNE) groups with annual revenues of $850 million or more. The form is designed to promote transparency in global tax reporting by requiring the ultimate parent entity of a U.S. MNE group to disclose detailed financial and operational data for each country in which it operates. This includes revenues, profits, taxes paid, accumulated earnings, number of employees, and tangible assets, among other data points. The information collected helps tax authorities assess transfer pricing risks, identify potential base erosion and profit shifting (BEPS), and ensure that multinational companies are paying their fair share of taxes in each jurisdiction. The form must be filed annually along with the parent entity’s income tax return and includes one or more Schedules A, each corresponding to a tax jurisdiction where the group has operations.

How to File Form 8975

- Form 8975 must be filed electronically with the IRS, attached to the ultimate parent entity’s income tax return (such as Forms 1120, 1065, 1120-S, 990-T, or 1041).

- The filing deadline matches the due date (including extensions) of the parent entity’s tax return.

- Each tax jurisdiction in which the group operates requires a separate Schedule A (Form 8975).

- If the report is amended, a new Form 8975 and all Schedules A must be submitted, including those not amended.

Who Must File?

- Only ultimate parent entities of U.S. multinational enterprise groups with annual revenues of $850 million or more are required to file Form 8975.

- Entities below this threshold or without international operations generally do not need to file.

How to Complete IRS Form 8975

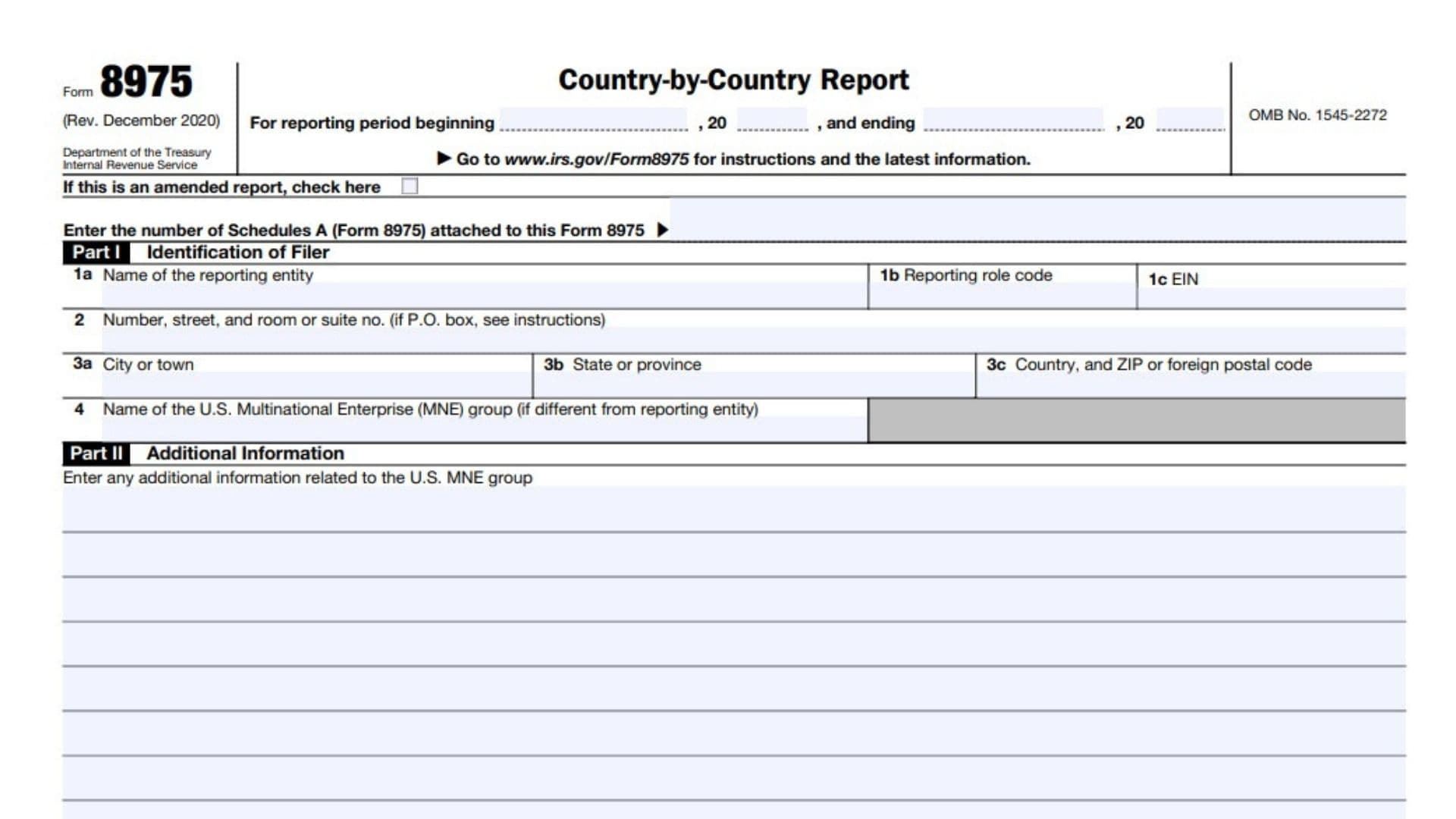

Heading Section

- For reporting period beginning ___, and ending ___, 20___

- Enter the start and end dates of the reporting period, typically matching the tax year of the ultimate parent entity.

- If this is an amended report, check here

- Check this box if you are submitting an amended version of Form 8975.

- Enter the number of Schedules A (Form 8975) attached to this Form 8975

- Write the total number of Schedules A included, one for each tax jurisdiction (including “stateless” entities if applicable).

Part I — Identification of Filer

- 1a. Name of the reporting entity

- Enter the complete legal name of the ultimate parent entity filing the report.

- 1b. Reporting role code

- Enter the reporting role code. For ultimate parent entities, this is typically “ULT”.

- 1c. EIN

- Enter the Employer Identification Number (EIN) of the reporting entity.

- 2. Number, street, and room or suite no. (if P.O. box, see instructions)

- Provide the full street address of the reporting entity. If using a P.O. box, follow IRS instructions.

- 3a. City or town

- Enter the city or town where the reporting entity is located.

- 3b. State or province

- Enter the state or province of the reporting entity.

- 3c. Country, and ZIP or foreign postal code

- Enter the country and ZIP or foreign postal code for the reporting entity’s address.

- 4. Name of the U.S. Multinational Enterprise (MNE) group (if different from reporting entity)

- If the MNE group’s common name differs from the reporting entity’s name, enter it here.

Part II — Additional Information

- Enter any additional information related to the U.S. MNE group

- Use this space to provide any relevant details about the group, such as explanations of differences in entity names, reporting anomalies, or clarifications regarding the data reported. If the space is insufficient, attach additional pages as needed.

Completing Schedule A (Form 8975) — Required for Each Tax Jurisdiction

Each Schedule A must be completed for every tax jurisdiction where the MNE group has constituent entities, including “stateless” entities.

Heading Section

- For reporting period beginning ___, and ending ___, 20___

- Enter the same reporting period as on Form 8975.

- Name of the reporting entity

- Enter the legal name of the reporting entity as on Form 8975.

- EIN

- Enter the EIN of the reporting entity.

Part I — Tax Jurisdiction Information

- Tax jurisdiction

- Enter the name of the country or jurisdiction for which this Schedule A is being completed.

- 1. Revenues

- (a) Unrelated party: Enter aggregate revenues from transactions with entities outside the group.

- (b) Related party: Enter aggregate revenues from transactions with other group entities.

- (c) Total: Sum of (a) and (b).

- 2. Profit (loss) before income tax

- Enter the aggregate profit or loss before income tax for constituent entities in this jurisdiction.

- 3. Income tax paid (on cash basis)

- Enter total income taxes paid on a cash basis during the reporting period for these entities.

- 4. Income tax accrued—current year

- Enter the total accrued current income tax expense for the year, excluding deferred taxes.

- 5. Stated capital

- Enter the aggregate stated capital of the constituent entities in this jurisdiction.

- 6. Accumulated earnings

- Enter the aggregate accumulated earnings of the constituent entities.

- 7. Number of employees

- Enter the total number of employees on a full-time equivalent basis.

- 8. Tangible assets other than cash and cash equivalents

- Enter the aggregate value of tangible assets (excluding cash, cash equivalents, and financial assets).

Part II — Constituent Entity Information

- 1. Constituent entities resident in the tax jurisdiction

- List the legal names of all constituent entities resident in the jurisdiction.

- 2. Entity role

- Indicate the role of each entity (e.g., parent, subsidiary, branch).

- 3. TIN

- Enter the Taxpayer Identification Number for each entity.

- 4. Tax jurisdiction of organization or incorporation if different from tax jurisdiction of residence

- If applicable, enter the jurisdiction where the entity is organized or incorporated.

- 5. Main business activities

- (a) Activity code: Enter the code for the main business activity (see IRS instructions for codes).

- (b) If “Other,” describe the business activity in detail.