IRS Form 8971, Information Regarding Beneficiaries Acquiring Property From a Decedent, is a critical tax document for estates required to file a federal estate tax return (Form 706 or 706-NA). Introduced under the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015, this form ensures the IRS and beneficiaries receive consistent valuations for inherited property. Executors must disclose the estate tax value of each asset transferred to beneficiaries, enabling the IRS to verify basis reporting when the property is later sold. Form 8971 must be filed separately from Form 706, with Schedule A provided to each beneficiary. Failure to comply can result in penalties up to $310 per form (adjusted annually) for errors or late submissions.

How to File Form 8971?

- Who Must File: Estates required to file Form 706/706-NA (gross estate exceeding the basic exclusion amount: $13.99M in 2025).

- Deadline: 30 days after the due date or filing date of Form 706.

- Where to File: Mail to: Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence, KY 41042 Do not use the address in older instructions.

- Attachments: Submit Form 8971 with all Schedule A copies to the IRS. Provide only Schedule A (not the full form) to beneficiaries via mail, email, or in person.

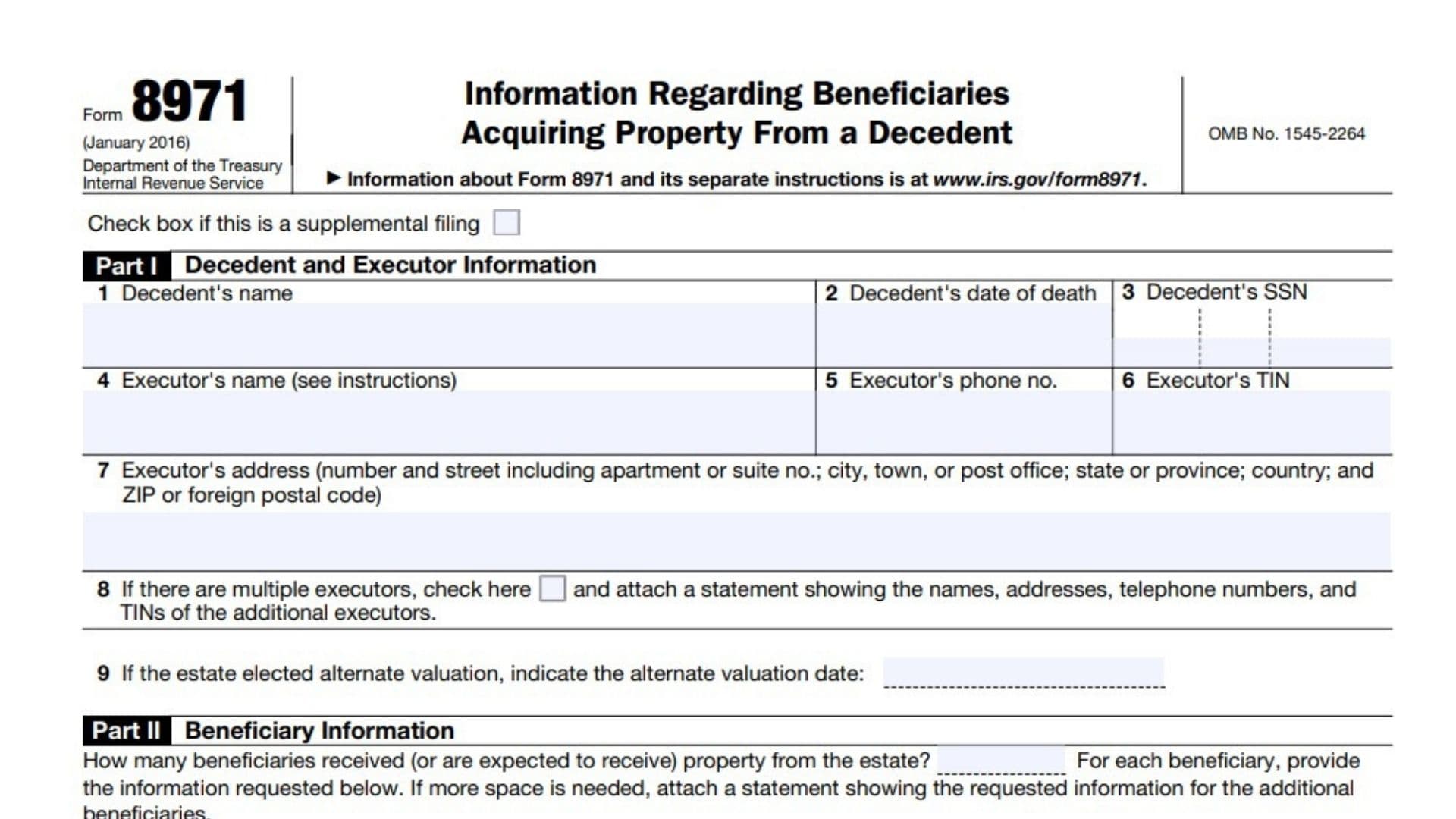

How to Complete Form 8971?

Part I: Decedent and Executor Information

- Line 1: Decedent’s full legal name.

- Line 2: Decedent’s date of death (MM/DD/YYYY).

- Line 3: Decedent’s Social Security Number (SSN). If none, file Form SS-5 to request one.

- Line 4: Executor’s name. If multiple executors, check Line 8 and attach a statement with all names, addresses, TINs, and phone numbers.

- Line 5: Executor’s phone number.

- Line 6: Executor’s Taxpayer Identification Number (TIN).

- Line 7: Executor’s full address (include country and ZIP/postal code for foreign addresses).

- Line 9: If alternate valuation was elected, enter the valuation date (MM/DD/YYYY).

Part II: Beneficiary Information

- Column A: Full name of each beneficiary (individual, trust, or estate).

- Column B: Beneficiary’s TIN (Social Security Number, EIN, or ITIN). Do not write “none” or “unknown”-this renders the form invalid.

- Column C: Beneficiary’s address (use foreign format if applicable).

- Column D: Date Schedule A was provided to the beneficiary (MM/DD/YYYY). Retain proof of delivery (e.g., certified mail receipt).

Schedule A: Property Details for Beneficiaries

Part 1: General Information

- Line 1: Decedent’s name (matches Form 8971).

- Line 2: Decedent’s SSN.

- Line 3: Beneficiary’s name.

- Line 4: Beneficiary’s TIN.

- Line 5: Executor’s name.

- Line 6: Executor’s phone number.

- Line 7: Executor’s address.

Part 2: Property Acquired

- Column A: Item number (e.g., 1, 2, 3).

- Column B: Property description and Form 706 schedule/item number (e.g., “Form 706, Schedule A, Item 5: 123 Main St.”).

- Column C: Indicate if the asset increased estate tax liability (Y/N).

- Column D: Valuation date (date of death or alternate date).

- Column E: Estate tax value in USD.

Continuation Sheet: Use Page A-2 if additional space is needed.

Key Tips

- Consistency: Ensure values match Form 706 and Schedule A.

- TIN Verification: Confirm beneficiary TINs to avoid penalties.

- Alternate Valuation: Only complete Line 9 if elected on Form 706.

- Supplemental Filings: Check the “supplemental filing” box and refile within 30 days of value adjustments.

Penalties for Non-Compliance

- Late Filing: $310 per form (adjusted annually).

- Incorrect TINs: $310 per missing/invalid TIN.

- Intentional Disregard: $500 per failure or 10% of the unreported value.

FAQs

Q: Can I e-file Form 8971?

A: No-mail it to the IRS address above.

Q: What if a beneficiary’s TIN is unknown?

A: Request it immediately. Do not proceed without it.

Q: How long must executors retain records?

A: Keep proof of Schedule A delivery for 3 years after the filing date.