IRS Form 8966, known as the FATCA Report, is used by certain foreign financial institutions (FFIs), U.S. financial institutions, and other entities to report information about financial accounts held by U.S. persons or by foreign entities in which U.S. persons hold a substantial ownership interest. The form is a key part of the Foreign Account Tax Compliance Act (FATCA) regime, designed to combat offshore tax evasion by requiring disclosure of foreign financial assets. Entities required to file Form 8966 must report details about account holders, owners, and financial activity, ensuring transparency and compliance with U.S. tax laws. The form can be filed electronically or on paper, and accurate completion is essential to avoid penalties and maintain good standing with the IRS.

How to File Form 8966?

Form 8966 can be filed electronically via the IRS FIRE system or on paper (if permitted). Before filing, gather all relevant information about the filer, account holders, owners, and financial details. Ensure you have your Global Intermediary Identification Number (GIIN), Taxpayer Identification Numbers (TINs), and supporting documentation ready. Always check the latest IRS instructions for updates or changes.

How to Complete Form 8966?

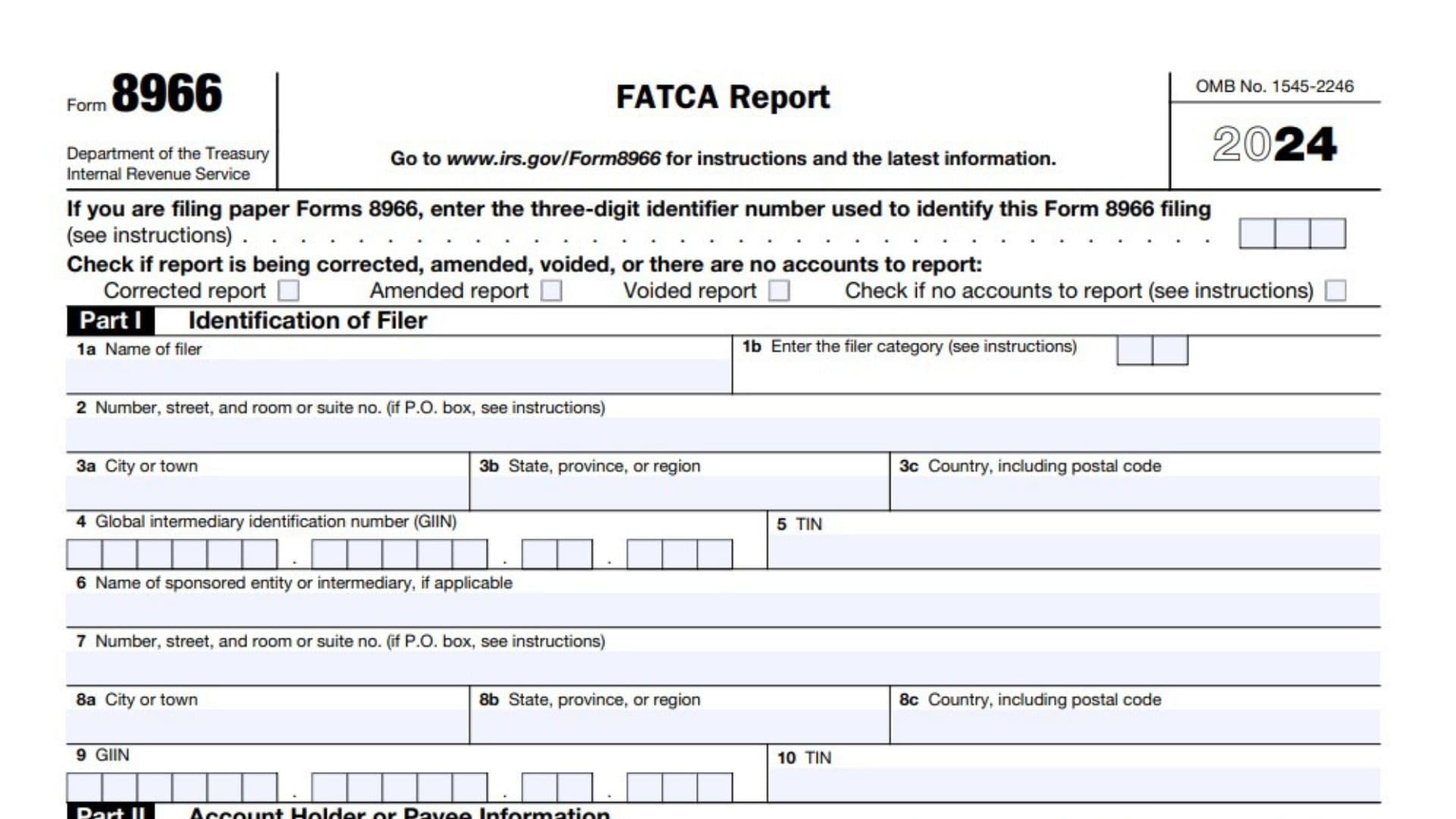

Header Section

- If you are filing paper Forms 8966, enter the three-digit identifier number used to identify this Form 8966 filing.

- Enter the unique three-digit identifier for this filing batch.

- Check if report is being corrected, amended, voided, or there are no accounts to report:

- Mark the appropriate box if this report is a correction, amendment, void, or if there are no accounts to report.

Part I: Identification of Filer

- 1a Name of filer:

Enter the full legal name of the reporting entity. - 1b Enter the filer category (see instructions):

Specify the filer category (e.g., FFI, U.S. FI, Direct Reporting NFFE). - 2 Number, street, and room or suite no. (if P.O. box, see instructions):

Provide the complete address, including suite or room number. If using a P.O. box, follow IRS instructions. - 3a City or town:

Enter the city or town of the filer’s address. - 3b State, province, or region:

Enter the state, province, or region. - 3c Country, including postal code:

List the country and postal code. - 4 Global intermediary identification number (GIIN):

Enter your GIIN assigned by the IRS. - 5 TIN:

Provide the Taxpayer Identification Number for the filer, if applicable. - 6 Name of sponsored entity or intermediary, if applicable:

If filing on behalf of a sponsored entity or intermediary, enter their name. - 7 Number, street, and room or suite no. (if P.O. box, see instructions):

Enter the address of the sponsored entity or intermediary. - 8a City or town:

Enter the city or town for the sponsored entity or intermediary. - 8b State, province, or region:

Enter the state, province, or region for the sponsored entity or intermediary. - 8c Country, including postal code:

Enter the country and postal code. - 9 GIIN:

Enter the GIIN for the sponsored entity or intermediary, if applicable. - 10 TIN:

Enter the TIN for the sponsored entity or intermediary, if applicable.

Part II: Account Holder or Payee Information

- 1a Name of account holder or payee:

Enter the full name of the account holder or payee. - 1b Indicate whether account holder or payee is an individual or entity:

Check the appropriate box: Individual or Entity. - 2 Number, street, and room or suite no. (if P.O. box, see instructions):

Enter the address of the account holder or payee. - 3a City or town:

Enter the city or town. - 3b State, province, or region:

Enter the state, province, or region. - 3c Country, including postal code:

Enter the country and postal code. - 4 TIN:

Enter the TIN for the account holder or payee, if applicable. - 5 If account holder or payee is an entity, check applicable box to specify the entity type:

- Owner-Documented FFI with specified U.S. Owner(s)

- Non-Participating FFI

- Passive NFFE with substantial U.S. Owner(s)

- Specified U.S. Person

Check the box that best describes the entity type.

Part III: Owner Information

(File a separate report for each U.S. Owner that is a specified U.S. Person.)

- 1 Name of owner:

Enter the full name of the U.S. owner. - 2 Number, street, and room or suite no. (if P.O. box, see instructions):

Enter the address of the owner. - 3a City or town:

Enter the city or town. - 3b State, province, or region:

Enter the state, province, or region. - 3c Country, including postal code:

Enter the country and postal code. - 4 TIN of owner:

Enter the Taxpayer Identification Number of the owner.

Part IV: Financial Information

- 1 Account number:

Enter the account number being reported. - 2 Currency code (see instructions):

Enter the three-letter currency code (e.g., USD, EUR). - 3a Account balance:

Enter the account balance as of the reporting date. - 3b Check if account closed during the year (see instructions):

Mark this box if the account was closed during the reporting year. - 4a Interest:

Enter the amount of interest paid or credited to the account. - 4b Dividends:

Enter the amount of dividends paid or credited. - 4c Gross proceeds/Redemptions:

Enter the gross proceeds or redemptions from the account. - 4d Other:

Report any other relevant financial information.

Part V: Pooled Reporting Type

- 1 Check applicable pooled reporting type (check only one):

- Recalcitrant account holders with U.S. Indicia

- Dormant accounts

- Recalcitrant account holders that are U.S. Persons

- Recalcitrant account holders without U.S. Indicia

- Non-Participating FFI

- Recalcitrant account holders that are passive NFFEs

Select only one type that applies.

- 2 Number of accounts:

Enter the total number of accounts in this pooled reporting type. - 3 Aggregate payment amount:

Enter the total payment amount for all accounts in this category. - 4 Aggregate account balance:

Enter the combined account balance for all reported accounts. - 5 Currency code:

Enter the three-letter currency code for the amounts reported.

FAQs

Q: Who must file IRS Form 8966?

A: Foreign financial institutions, certain U.S. financial institutions, and other entities with FATCA reporting obligations must file Form 8966.

Q: Can Form 8966 be filed electronically?

A: Yes, Form 8966 is typically filed electronically via the IRS FIRE system, though paper filing is allowed in limited cases.

Q: What is a GIIN on Form 8966?

A: GIIN stands for Global Intermediary Identification Number, a unique identifier assigned to financial institutions for FATCA reporting.