The Affordable Care Act (ACA) requires individuals to have minimum essential health coverage or make a shared responsibility payment when filing their federal income tax return. However, certain individuals may qualify for exemptions from this requirement. Form 8965, Health Coverage Exemptions, allows taxpayers to claim these exemptions. Understanding the requirements, eligibility, and steps to complete Form 8965 is crucial for taxpayers to avoid unnecessary penalties and ensure compliance with the ACA. Taxpayers must file Form 8965 if they or any member of their household did not have minimum essential health coverage for any month during the tax year and they qualify for an exemption. Common exemptions include:

- Income Below Filing Threshold: If the taxpayer’s gross income is below the minimum threshold for filing a tax return.

- Short Coverage Gap: If the taxpayer had a gap in coverage that was less than three consecutive months.

- Hardship: If the taxpayer experienced a hardship that prevented them from obtaining coverage, such as homelessness, eviction, or domestic violence.

- Unaffordable Coverage: If the cost of coverage was more than a certain percentage of the taxpayer’s household income.

- Exempt Noncitizens: If the taxpayer is not a U.S. citizen, U.S. national, or lawfully present resident.

How to File Form 8965?

Form 8965 should be filed with the taxpayer’s annual federal income tax return. It can be filed electronically using tax preparation software or manually by attaching it to a paper return. Taxpayers should ensure they have all necessary documentation, such as exemption certificates or proof of hardship, before filing.

How to Complete Form 8965?

Completing Form 8965 involves several detailed steps to accurately report health coverage exemptions. Here are the steps to complete the form:

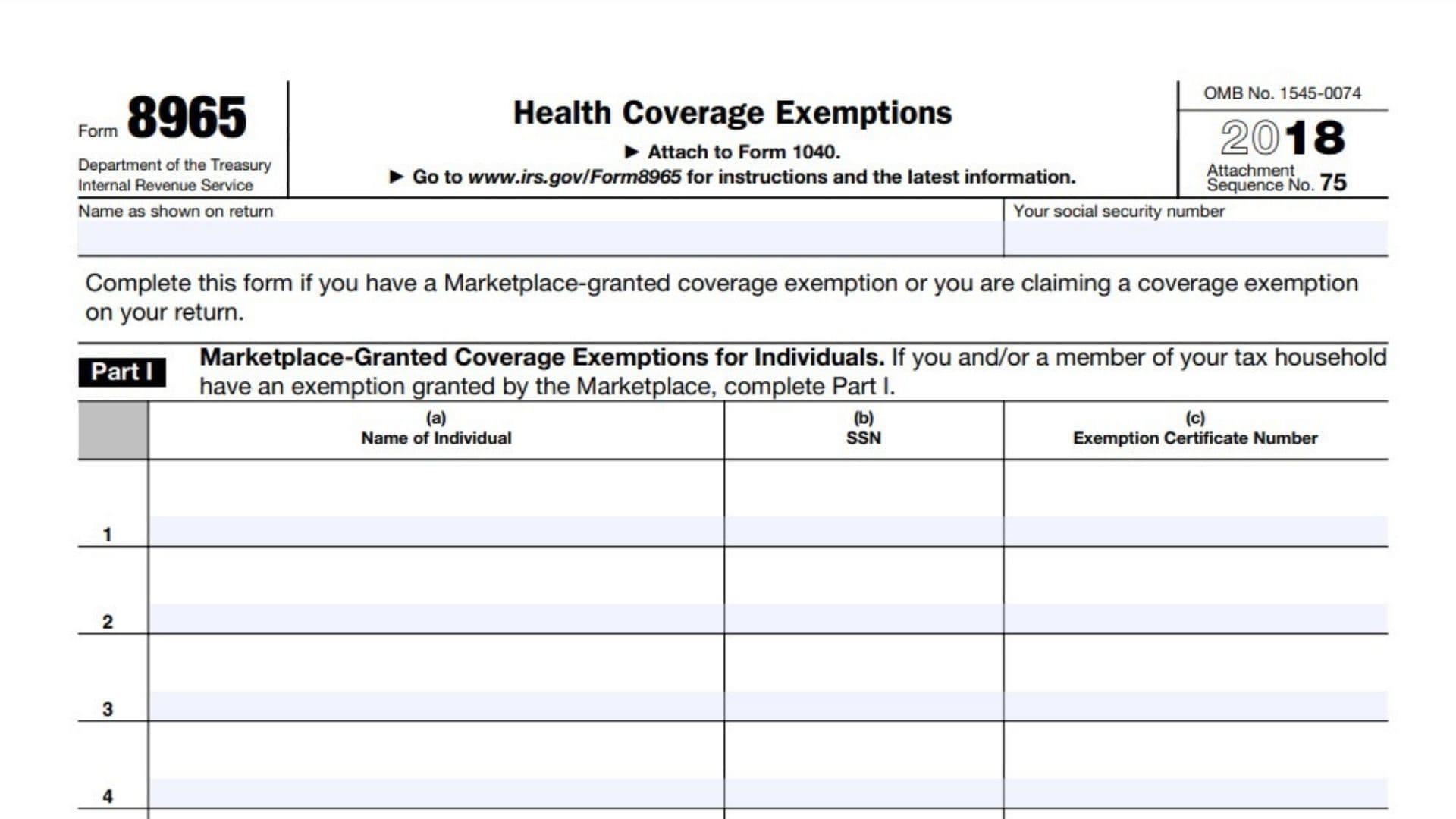

- Enter the taxpayer’s name and Social Security number at the top of the form.

- List all members of the household, including their names, Exemption Certificate Numbers and Social Security numbers.

- In Part I, indicate if the taxpayer’s gross income or household income is below the filing threshold.

- If you are claiming a coverage exemption because your household income or gross income is below the filing threshold, check here.

- In Part III, claim exemptions directly on the tax return for any months a household member did not have coverage and qualifies for an exemption.

- Provide any additional information or documentation required to support the exemption claim.

Claiming health coverage exemptions using Form 8965 can provide significant financial relief by avoiding the shared responsibility payment. Key benefits include:

- Penalty Avoidance: By claiming exemptions, taxpayers can avoid the shared responsibility payment, which can be substantial.

- Compliance with ACA Requirements: Ensures that taxpayers comply with ACA mandates without facing penalties.

- Financial Relief: Provides relief for individuals and families who cannot afford health coverage or face other qualifying hardships.

Common Problems with Form 8965

Taxpayers may face several challenges when completing Form 8965, including:

- Determining eligibility for various exemptions can be complex. Taxpayers should refer to IRS guidelines and consult with tax professionals if needed.

- Proper documentation, such as exemption certificates or proof of hardship, is essential. Taxpayers should maintain detailed records to support their exemption claims.

- Ensuring accurate reporting of exemptions requires careful attention to detail. Using tax preparation software can help streamline this process.