The 8962 tax form is designed for individuals who receive advance payments of the premium tax credit (PTC) that are used to pay for their health insurance coverage in the Marketplace. This tax form is also required for individuals who registered themselves or their family members in a qualified health plan on the marketplace and received an advance payment of the PTC in 2015. If you have any changes in your income, family size, or health coverage throughout the year that may affect the amount of PTC you are entitled to, you should file this form. The 8962 form reconciles the advance payment of the PTC that was made to your insurer with the actual amount of PTC you are entitled to for the year.

How to Complete Form 8962?

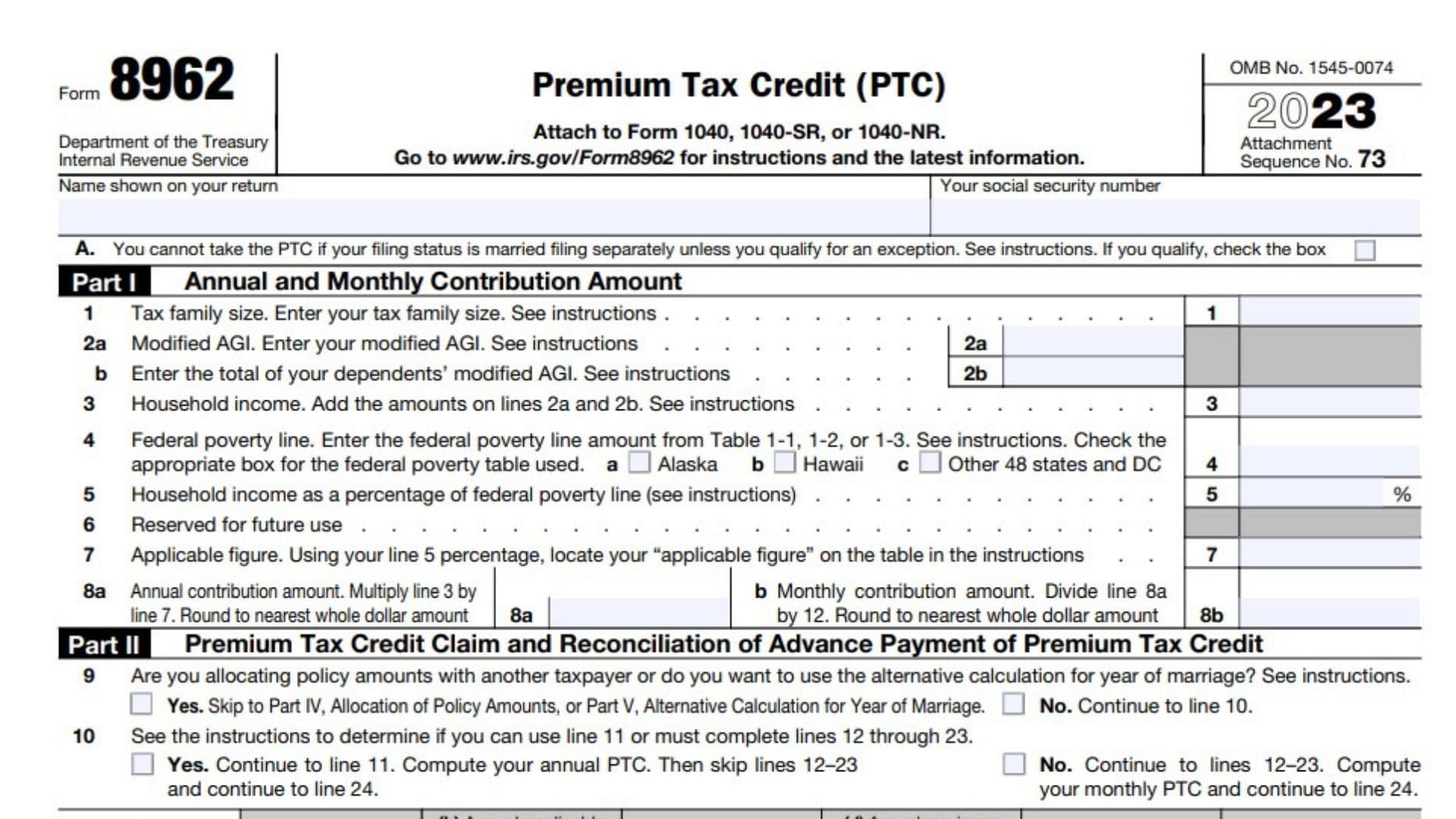

- Enter the name on your return

- Enter your SSN

Part I – Annual and Monthly Contribution Amount

Line 1: Enter your tax family size

Line 2a: Enter your modified AGI

Line 2b: Enter the total of your dependents’ modified AGI.

Line 3: Add the amounts on lines 2a and 2b to figure Household Income.

Line 4: Enter the federal poverty line amount from Table 1-1, 1-2, or 1-3. (IRS Instructions)

Line 5: Household income as a percentage of the federal poverty line.

Line 6: ……………………………………..

Line 7: Locate your “applicable figure” on the table (IRS Instructions) using your line 5 percentage.

Line 8a: Multiply line 3 by line 7. Round to the nearest whole dollar amount to figure the annual contribution amount.

Line 8b: Divide line 8a by 12. Round to the nearest whole dollar amount to figure the monthly contribution amount.

Part II – Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit

Line 9: Check the box which applies to you

Line 10: Check the box which applies to you

Line 11: Annual Calculation

Lines 12-23: Monthly Calculation

Line 24: Enter the amount from line 11(e) or add lines 12(e) through 23(e). Enter the amount ( total premium tax credit) here.

Line 25: . Enter the amount from line 11(f) or add lines 12(f) through 23(f) to figure Advance payment of PTC.

Line 26: Net premium tax credit.

- If line 24 is greater than line 25, subtract line 25 from line 24. Enter the difference here and on Schedule 3 (Form 1040), line 9

- If line 24 equals line 25, enter -0-. Stop here.

- If line 25 is greater than line 24, leave this line blank and continue to line 27

Part III – Repayment of Excess Advance Payment of the Premium Tax Credit

Line 27: If line 25 is greater than line 24, subtract line 24 from line 25. The difference is the Excess advance payment of PTC.

Line 28: Repayment limitation (IRS Instructions)

Line 29: . Enter the smaller of line 27 or line 28 here and on Schedule 2 (Form 1040) line 2 to figure your Excess advance premium tax credit repayment amount.

Part IV – Allocation of Policy Amounts

Line 30-34: Complete the following information for up to four policy amount allocations. (IRS Instructions)

Part V – Alternative Calculation for Year of Marriage

- Complete line(s) 35 and/or 36 to elect the alternative calculation for year of marriage

- For eligibility to make the election, see the instructions for line 9

- To complete line(s) 35 and/or 36 and compute the amounts for lines 12–23, see the IRS instructions for this Part V.

Line 35: Alternative entries for your SSN

Line 36: Alternative entries for your spouse’s SSN