Form 8960 is used to calculate the Net Investment Income Tax (NIIT) for individuals, estates, and trusts. This form is required for taxpayers with certain types of investment income and modified adjusted gross income above specified thresholds. The NIIT is a 3.8% tax on the lesser of net investment income or the excess of modified adjusted gross income over the statutory threshold amount.To file Form 8960, follow these steps:

- Determine if you need to file Form 8960. You generally need to file this form if you have net investment income and your modified adjusted gross income exceeds certain thresholds.

- Gather all necessary information related to your investment income, including interest, dividends, capital gains, rental income, and other investment-related income.

- Complete Form 8960 line by line, following the instructions provided on the form and in the IRS instructions document.

- Calculate your Net Investment Income Tax (NIIT) using the form.

- Attach the completed Form 8960 to your Form 1040, 1040-SR, or Form 1041 (for estates and trusts).

- Include the calculated NIIT amount on the appropriate line of your main tax return:

- For individuals: Include the amount from line 17 of Form 8960 on Schedule 2 (Form 1040), line 11.

- For estates and trusts: Include the amount from line 21 of Form 8960 on Form 1041, line 24.

- File your complete tax return, including Form 8960, by the appropriate deadline.

Remember to keep a copy of Form 8960 and all supporting documents for your records. If you’re unsure about any part of the process, consider consulting with a tax professional

How to Complete Form 8960?

Here is the Line-by-line instructions for Form 8960:

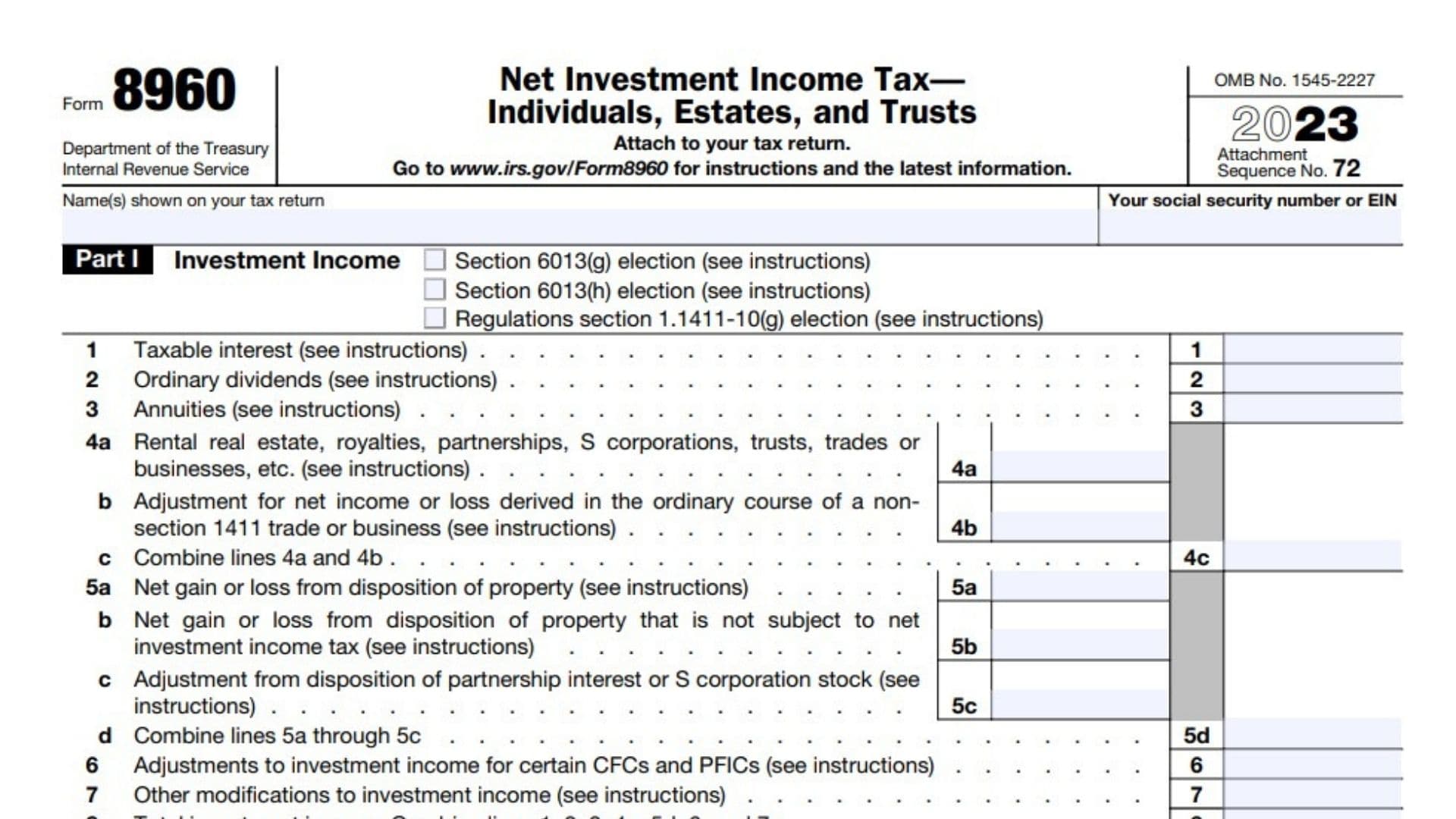

Part I: Investment Income

Check boxes: Indicate if you’re making a Section 6013(g), Section 6013(h), or Regulations section 1.1411-10(g) election.

- Line 1: Enter your taxable interest income.

- Line 2: Enter your ordinary dividend income.

- Line 3: Enter income from annuities.

- Line 4a: Enter income from rental real estate, royalties, partnerships, S corporations, trusts, and trades or businesses.

- Line 4b: Enter any adjustments for net income or loss derived in the ordinary course of a non-section 1411 trade or business.

- Line 4c: Combine lines 4a and 4b.

- Line 5a: Enter net gain or loss from disposition of property.

- Line 5b: Enter net gain or loss from disposition of property not subject to net investment income tax.

- Line 5c: Enter any adjustment from disposition of partnership interest or S corporation stock.

- Line 5d: Combine lines 5a through 5c.

- Line 6: Enter adjustments to investment income for certain CFCs and PFICs.

- Line 7: Enter other modifications to investment income.

- Line 8: Calculate total investment income by combining lines 1, 2, 3, 4c, 5d, 6, and 7.

Part II: Investment Expenses Allocable to Investment Income and Modifications

- Line 9a: Enter investment interest expenses.

- Line 9b: Enter state, local, and foreign income tax related to investment income.

- Line 9c: Enter miscellaneous investment expenses.

- Line 9d: Add lines 9a, 9b, and 9c.

- Line 10: Enter any additional modifications.

- Line 11: Calculate total deductions and modifications by adding lines 9d and 10.

Part III: Tax Computation

- Line 12: Calculate net investment income by subtracting line 11 from line 8.

For Individuals:

- Line 13: Enter your modified adjusted gross income.

- Line 14: Enter the threshold based on your filing status.

- Line 15: Subtract line 14 from line 13.

- Line 16: Enter the smaller of line 12 or line 15.

- Line 17: Calculate the net investment income tax by multiplying line 16 by 3.8% (0.038).For Estates and Trusts:

Line 18a: Enter net investment income from line 12. - Line 18b: Enter deductions for distributions of net investment income and charitable deductions.Line 18c: Calculate undistributed net investment income by subtracting line 18b from line 18a.

- Line 19a: Enter adjusted gross income.

- Line 19b: Enter the highest tax bracket for estates and trusts for the year.

- Line 19c: Subtract line 19b from line 19a.

- Line 20: Enter the smaller of line 18c or line 19c.

- Line 21: Calculate the net investment income tax for estates and trusts by multiplying line 20 by 3.8% (0.038).