IRS Form 8959, Additional Medicare Tax, is used by taxpayers to calculate and report the additional 0.9% Medicare tax on wages, compensation, and self-employment income that exceed certain thresholds. This additional tax applies to individuals earning over $200,000 (or $250,000 for married couples filing jointly) and must be calculated separately from the regular Medicare tax. Employers must withhold this tax from employee wages once they cross the threshold, but individuals may still need to file Form 8959 if their income from various sources pushes them over the limit. Properly filing this form ensures compliance with the Medicare tax rules and helps avoid underpayment penalties.

How to Complete Form 8959?

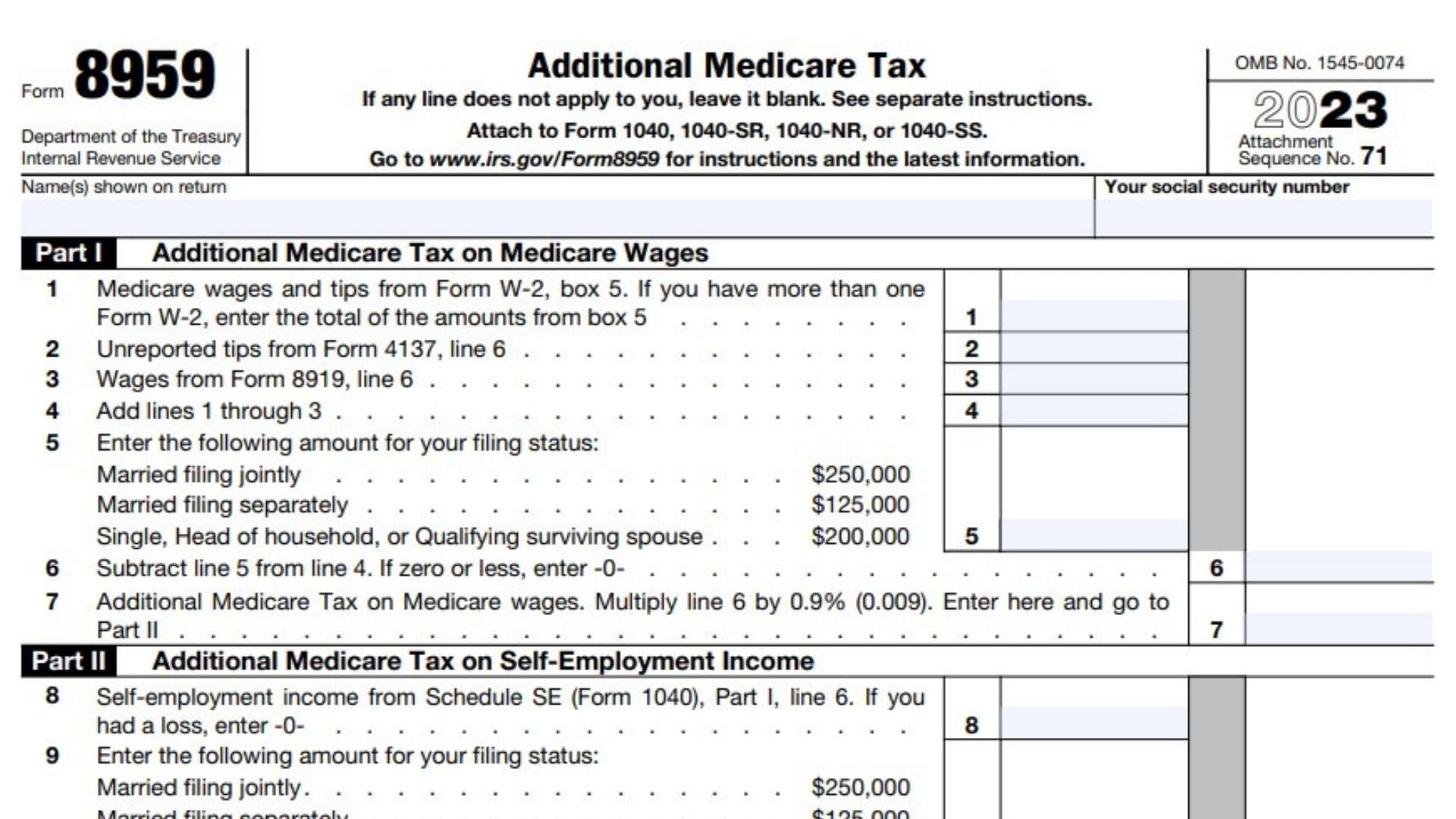

- Enter name(s) shown on your tax return

- Enter your SSN

Part I – Additional Medicare Tax on Medicare Wages

Line 1:

- Enter Medicare wages and tips from Form W-2, box 5

- If you have more than one Form W-2, enter the total amounts from box 5.

Line 2: Enter unreported tips amount from Form 4137, line 6

Line 3: Enter wages from Form 8919, line 6.

Line 4: Enter Line 1-3

Line 5: Enter your filing status:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- Single, Head of household, or Qualifying surviving spouse: $200,000

Line 6:

- Subtract line 5 from line 4

- If zero or less, enter -0-

Line 7: Multiply line 6 by 0.9% (0.009). Enter the amount here and go to Part II. (Additional Medicare Tax on Medicare wages.)

Part II – Additional Medicare Tax on Self-Employment Income

Line 8: Self-employment income from Schedule SE (Form 1040), Part I, line 6.

- If you had a loss, enter -0-.

Line 9: Enter the amount for your filing status. (Like how you did in Line 5)

Line 10: Enter Line 4 amount here.

Line 11: Subtract line 10 from line 9. If zero or less, enter -0-

Line 12: Subtract line 11 from line 8. If zero or less, enter -0-

Line 13: Multiply line 12 by 0.9% (0.009). Enter here and go to Part III (Additional Medicare Tax on self-employment income).

Part III – Additional Medicare Tax on Railroad Retirement Tax Act Compensation

Line 14: RRTA compensation and tips from Form(s) W-2, box 14

Line 15: Enter the amount for your filing status. (Like how you did in Line 9)

Line 16: Subtract line 15 from line 14. . If zero or less, enter -0-

Line 17: Additional Medicare Tax on railroad retirement compensation. Multiply line 16 by 0.9% (0.009). Enter the amount here and proceed to Part IV.

Part IV – Total Additional Medicare Tax

Line 18:

- Add lines 7, 13, and 17.

- Also include this amount on Schedule 2 (Form 1040), line 11, and go to Part V.

- Form 1040-PR or 1040-SS filers, see the IRS Instructions

Part V – Withholding Reconciliation

Line 19: Medicare tax withheld from Form W-2, box 6. Enter the total of the amounts from box 6, IF you have more than one Form W-2

Line 20: Enter the Line 1 amount.

Line 21: Multiply line 20 by 1.45% (0.0145) to figure your regular Medicare tax withholding on Medicare wages.

Line 22: Subtract line 21 from line 19. If zero or less, enter -0-. This is your Additional Medicare Tax withholding on Medicare wages.

Line 23: Additional Medicare Tax withholding on RRTA compensation from Form W-2, box 14.

Line 24: Total Additional Medicare Tax withholding