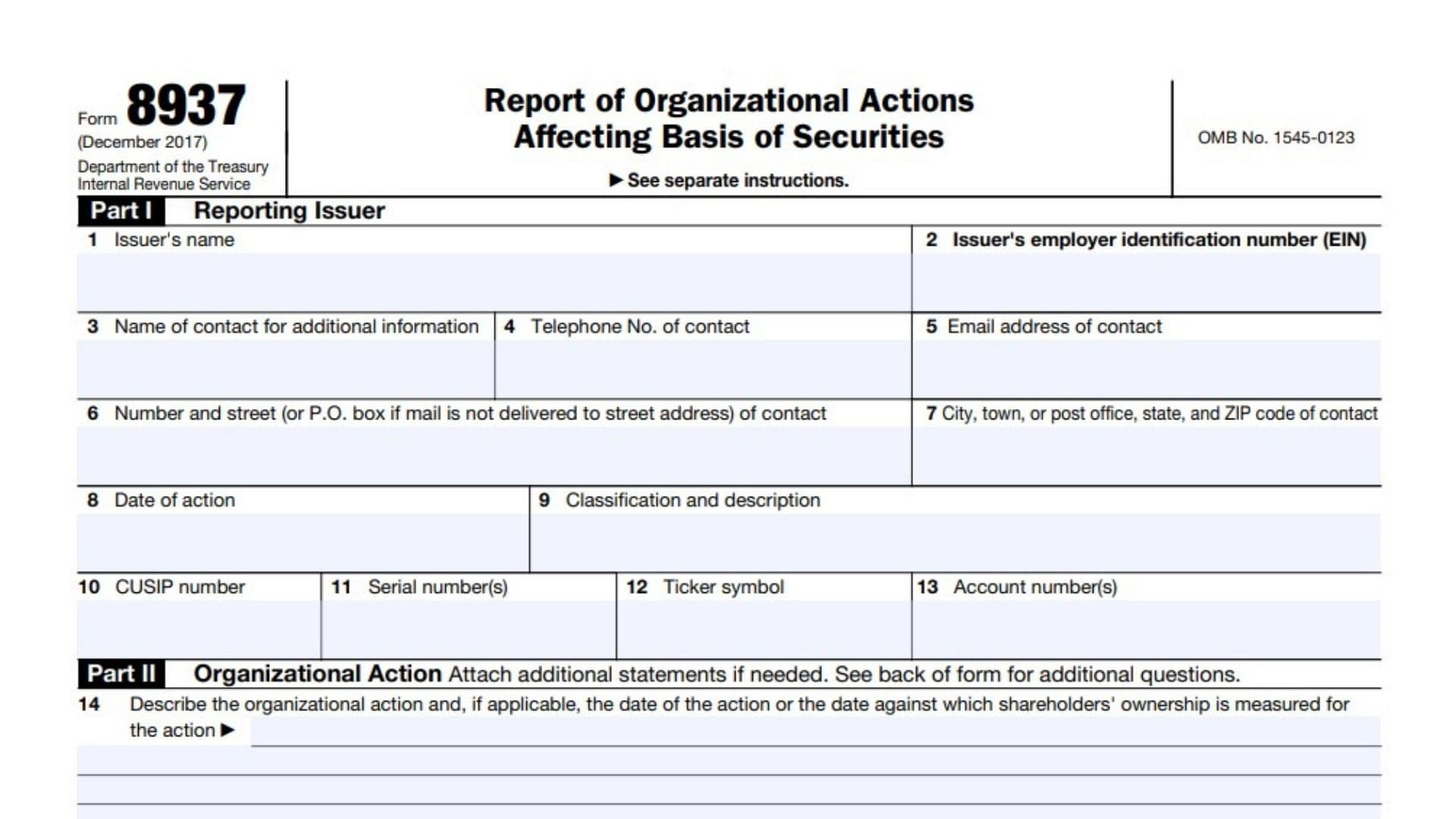

IRS Form 8937, “Report of Organizational Actions Affecting Basis of Securities,” is an official document required by the Internal Revenue Service (IRS) for corporations and other issuers of securities who undertake organizational actions that affect the tax basis of those securities. This form is crucial for transparency, as it ensures that shareholders and the IRS are informed about events—such as stock splits, mergers, spin-offs, or distributions—that change the cost basis of securities for tax purposes. Accurate completion and timely filing of Form 8937 help investors determine their correct gain or loss when selling or exchanging securities, and it is a legal requirement for issuers to publicly report these actions. The form must be filed promptly after the organizational action and must be made available to all affected security holders, either through direct mailing or by posting on a public website.

How to File IRS Form 8937

To file Form 8937, issuers must complete the form in its entirety and submit it to the IRS at the address provided on the form. Additionally, issuers must make the completed form available to all holders of the affected securities. This can be done by mailing the form directly to holders or by posting it in a readily accessible format on a public website. The form should be filed as soon as possible after the organizational action occurs. If you are a paid preparer, you must also complete the relevant section for preparer information and signatures.

How to Complete Form 8937

Part I: Reporting Issuer

Line 1: Issuer’s Name

Enter the full legal name of the entity issuing the securities affected by the organizational action.

Line 2: Issuer’s Employer Identification Number (EIN)

Provide the issuer’s nine-digit EIN as assigned by the IRS.

Line 3: Name of Contact for Additional Information

List the name of the individual who can answer questions about the form or the organizational action.

Line 4: Telephone Number of Contact

Provide the direct phone number for the contact person listed in Line 3.

Line 5: Email Address of Contact

Enter the email address for the contact person to facilitate communication.

Line 6: Number and Street (or P.O. Box if mail is not delivered to street address) of Contact

Write the street address or P.O. Box for the contact person.

Line 7: City, Town, or Post Office, State, and ZIP Code of Contact

Enter the city, state, and ZIP code for the address provided in Line 6.

Line 8: Date of Action

Specify the exact date when the organizational action affecting the basis took place.

Line 9: Classification and Description

Describe the type of security (e.g., common stock, preferred stock) and provide a brief description of the affected securities.

Line 10: CUSIP Number

Enter the CUSIP number for the affected securities, if available.

Line 11: Serial Number(s)

If applicable, list the serial numbers of the affected securities.

Line 12: Ticker Symbol

Provide the ticker symbol under which the security is traded.

Line 13: Account Number(s)

List any relevant account numbers associated with the affected securities.

Part II: Organizational Action

Line 14: Description of Organizational Action

Describe the organizational action in detail and, if applicable, specify the date of the action or the date against which shareholders’ ownership is measured. This could include mergers, stock splits, spin-offs, or distributions.

Line 15: Quantitative Effect on Basis

Explain the quantitative effect of the organizational action on the basis of the security in the hands of a U.S. taxpayer. Specify the adjustment per share or as a percentage of the old basis.

Line 16: Calculation of Change in Basis

Describe how the change in basis was calculated, including any supporting data such as market values of securities and relevant valuation dates.

Line 17: Applicable Internal Revenue Code Section(s)

List the specific Internal Revenue Code section(s) and subsection(s) that determine the tax treatment of the organizational action.

Line 18: Recognition of Loss

State whether any resulting loss can be recognized due to the organizational action.

Line 19: Additional Information

Provide any other information necessary for implementing the adjustment, such as the reportable tax year or other relevant details.

Signature Section

Signature

The authorized person must sign the form, certifying under penalties of perjury that the information provided is true, correct, and complete.

Date

Enter the date the form is signed.

Print Your Name

Print the name of the person signing the form.

Title

Provide the title or position of the person signing the form.

Paid Preparer Use Only (If Applicable)

Print/Type Preparer’s Name

If a paid preparer completes the form, print or type the preparer’s name.

Preparer’s Signature

The preparer must sign the form.

Date

Enter the date the preparer signed the form.

Check if Self-Employed

Mark this box if the preparer is self-employed.

PTIN

Enter the preparer’s Preparer Tax Identification Number.

Firm’s Name

If applicable, provide the name of the preparer’s firm.

Firm’s Address

Enter the address of the preparer’s firm.

Firm’s EIN

Provide the firm’s Employer Identification Number.

Phone Number

List the phone number for the preparer or firm.

Submission Address

Send the completed Form 8937 (including any accompanying statements) to:

Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-00541.