Form 8932 is a form for claiming a credit for Employer Differential Wage Payments. This credit saves up to $4,000 for an active-duty employee and up to 20% of up to $20,000 of differential pay. This is a federal tax credit designed to relieve the burden of military deployment.

If you are an owner or manager of a tavern or restaurant, check out the Form for your next tax filing. The Form can also be used to claim a tax credit for qualifying delis and restaurants, a boon for any small business shopper. Whenever you fill out Form 8932, you want to be sure that you are filling it correctly. This is because it is a very important form, and you want to make sure everything runs smoothly.

Using Form 8932 will take a little effort, but the results will be worth it. It is a good starting point for any small business owner and is easy to fill out.

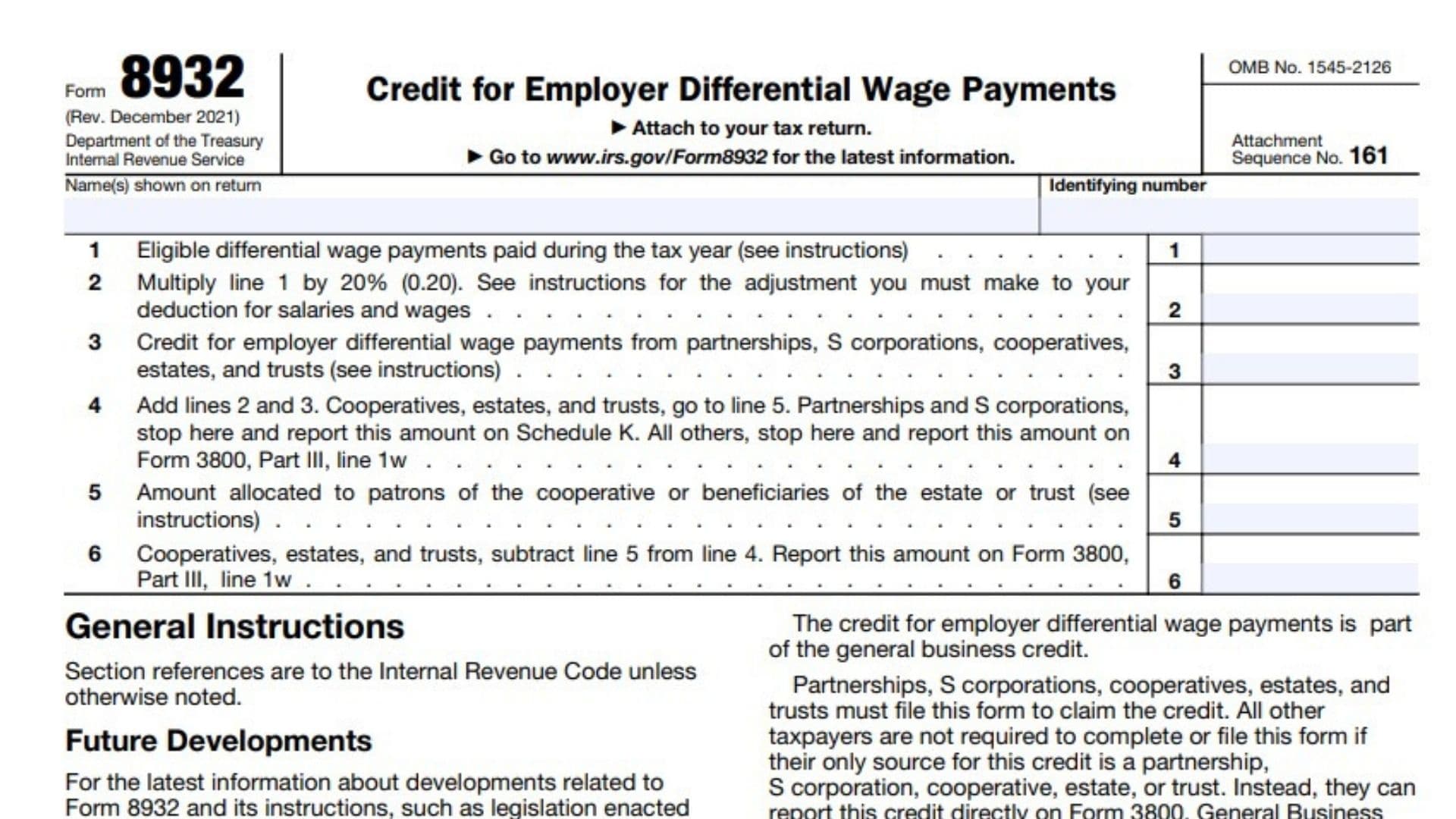

How to Complete Form 8932?

There are six lines in total in Form 8932. All lines have boxes on the right side of the Form. You need to enter the amounts asked in these boxes.

Line 1: Eligible differential wage payments paid during the tax year

Line 2: Multiply line 1 by 20% (0.20). See instructions for the adjustment you must make to your deduction for salaries and wages

Line 3: Credit for employer differential wage payments from partnerships, S corporations, cooperatives, estates, and trusts.

Line 4: Add lines 2 and 3. Cooperatives, estates, and trusts go to line 5. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and report this amount on Form 3800, Part III, line 1w.

Line 5: Enter the amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

Line 6: Cooperatives, estates, and trusts. Subtract line 5 from line 4. Report this amount on Form 3800, Part III, line 1w.