IRS Form 8918, titled “Material Advisor Disclosure Statement,” is used by material advisors to disclose reportable transactions to the Internal Revenue Service (IRS). A material advisor is any individual or entity that provides aid, assistance, or advice on a reportable transaction and receives gross income exceeding a specific threshold for their services. Reportable transactions are transactions that the IRS has identified as having the potential for tax avoidance or evasion. Filing Form 8918 is mandatory for material advisors to ensure compliance with tax regulations and avoid penalties. The form requires detailed information about the reportable transaction, including its nature, expected tax benefits, and the roles of involved entities or individuals. By filing this form, the IRS can monitor potentially abusive tax strategies and ensure transparency in tax reporting.

How to File Form 8918?

To file Form 8918, follow these steps:

- Download the Form: Access IRS Form 8918 from the official IRS website or use the direct PDF link provided by the IRS. Ensure you download it to your computer.

- Open in Adobe Acrobat Reader: The form must be completed using Adobe Reader DC or Adobe Acrobat DC. Handwritten forms or those filled out in a browser may face processing delays.

- Complete the Form: Fill out all required fields accurately (instructions provided below).

- Submit the Form: Print and mail the completed form to the address specified in the form’s instructions. Retain a copy for your records.

How to Complete Form 8918?

Below is a step-by-step guide to completing each section of IRS Form 8918:

Part I: Material Advisor Information

- Line 1: Enter your full name (individual or entity).

- Line 2: Provide your employer identification number (EIN) or social security number (SSN).

- Line 3: Enter your complete address, including street address, city, state, and ZIP code.

- Line 4: Indicate your telephone number.

- Line 5: Specify your email address (optional but recommended for correspondence).

Part II: Reportable Transaction Information

- Line 6: Provide a detailed description of the reportable transaction for which you are filing this disclosure statement.

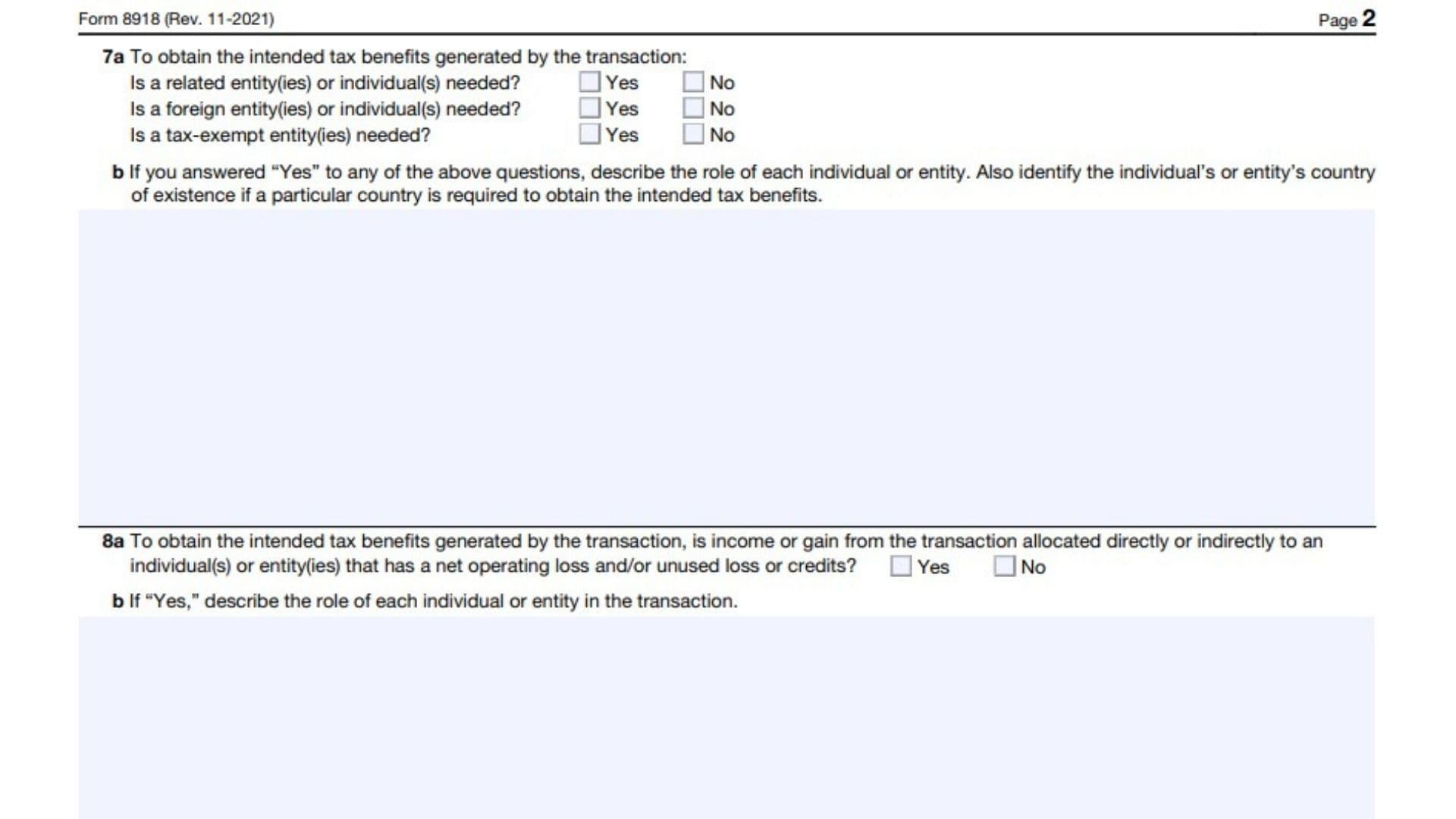

- Line 7a: Answer whether related entities or individuals are required to achieve the intended tax benefits of the transaction (Yes/No). If “Yes,” describe their roles and identify their countries of existence.

- Line 8a: Indicate if income or gain from the transaction is allocated to individuals/entities with net operating losses or unused credits (Yes/No). If “Yes,” describe their roles in detail.

Part III: Financial Instruments and Tax Benefits

- Line 9: Identify all financial instruments used in this transaction (e.g., stocks, bonds). Refer to instructions for examples.

- Line 10: Check all applicable types of tax benefits generated by this transaction (e.g., deductions, capital loss, deferral).

- Line 11: Specify when these tax benefits are claimed (e.g., first year of participation or another year).

Part IV: Internal Revenue Code Sections

- Line 12: List all Internal Revenue Code sections relevant to claiming tax benefits from this transaction.

Part V: Description of Reportable Transaction

- Line 13: Provide a comprehensive description of the reportable transaction, including:

- Nature of expected tax treatment.

- Expected tax benefits across all years.

- Roles of individuals/entities mentioned in Lines 7a and 8a.

- Roles of financial instruments listed in Line 9.

- Application of Internal Revenue Code sections from Line 12.

Part VI: Declaration

- Sign and date the form under penalty of perjury, declaring that all information provided is true and accurate to the best of your knowledge.