IRS Form 8915-F, titled “Qualified Disaster Retirement Plan Distributions and Repayments,” is a crucial tax document used for reporting qualified disaster distributions from retirement plans and IRAs, as well as their subsequent repayments. This form is specifically designed for taxpayers affected by qualified disasters, including the coronavirus pandemic, who have taken distributions from their retirement accounts or received qualified distributions for the purchase or construction of a main home in a disaster area. Form 8915-F is used for disasters occurring in 2021 and later, and it also replaces Form 8915-E for coronavirus-related and other 2020 disasters after the 2020 tax year. The form allows taxpayers to report these distributions, spread the taxable amount over three years if desired, and document any repayments made to their retirement accounts. It’s an essential tool for those seeking to manage the tax implications of accessing retirement funds during times of disaster-related financial stress.

How to File Form 8915-F?

To file Form 8915-F:

- Complete the form for the appropriate tax year, as indicated in item A at the top of the form.

- Attach Form 8915-F to your Form 1040, 1040-SR, or 1040-NR for the corresponding tax year.

- Submit the forms together by the regular tax filing deadline or by the extended deadline if you’ve filed for an extension.

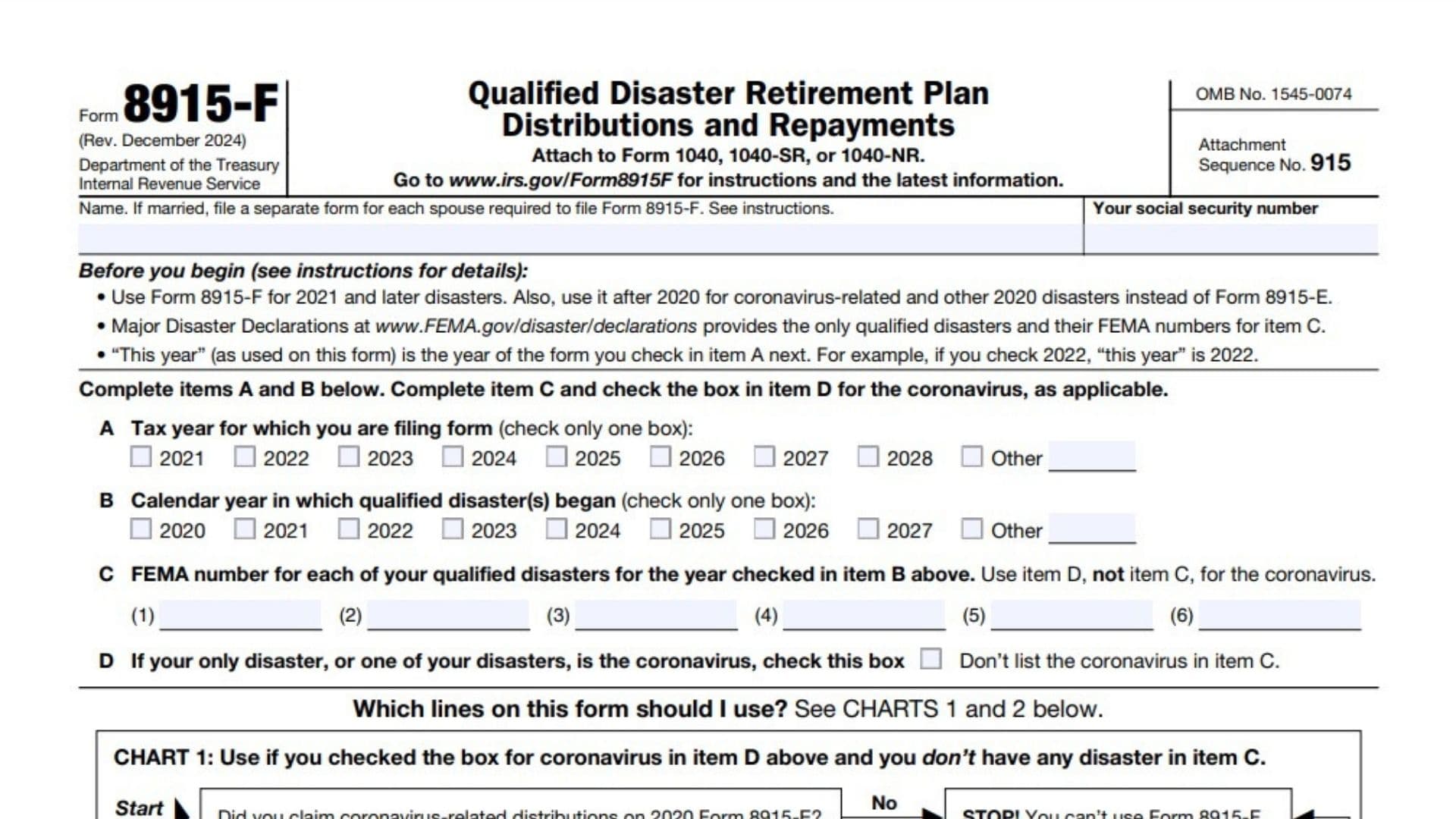

Before You Begin

- Use Form 8915-F for 2021 and later disasters, and for coronavirus-related and other 2020 disasters after 2020.

- Check www.FEMA.gov/disaster/declarations for qualified disasters and FEMA numbers.

- “This year” refers to the tax year checked in item A.

Items A through D

A. Check the box for the tax year you’re filing for.

B. Check the box for the calendar year in which the qualified disaster(s) began.

C. Enter FEMA numbers for your qualified disasters.

D. Check this box if the coronavirus is one of your disasters.

How to Complete Form 8915-F?

Part I: Total Distributions From All Retirement Plans

Part I Disaster Table: Enter FEMA number, disaster declaration date, and disaster beginning date for each disaster.

Line 1a-1e: Calculate your total available qualified disaster distribution amount.

- Follow specific instructions based on years checked in items A and B.

- Use Worksheet 1B if directed.

Line 2: Enter distributions from retirement plans (other than IRAs) made this year.

Line 3: Enter distributions from traditional, SEP, and SIMPLE IRAs made this year.

Line 4: Enter distributions from Roth, Roth SEP, and Roth SIMPLE IRAs made this year.

Line 5: Allocate distributions between columns (a) and (b) following the three-step process outlined.

Line 6: Enter the total qualified disaster distributions.

Line 7: Calculate the taxable amount of your distributions.

Part II: Qualified Disaster Distributions From Retirement Plans (Other Than IRAs)

Line 8: Enter amount from line 2, column (b) if applicable.

Line 9: Enter the applicable cost of distributions.

Line 10: Calculate the taxable amount of your other-than-IRA retirement plan qualified disaster distributions.

Line 11: Decide whether to spread the taxable amount over 3 years or report it all in the current year.

Line 12: Enter income from prior years’ other-than-IRA retirement plan qualified disaster distributions.

Line 13: Calculate total income this year from other-than-IRA retirement plan qualified disaster distributions.

Line 14: Enter total repayment of other-than-IRA retirement plan qualified disaster distributions.

Line 15: Calculate amount subject to tax this year.

Part III: Qualified Disaster Distributions From IRAs

Line 16-17: Determine if you need to complete this section.

Line 18-19: Enter amounts from Form 8606 if applicable.

Line 20: Enter amount from line 3, column (b), excluding amounts reported on Form 8606.

Line 21: Calculate the taxable amount of your IRA qualified disaster distributions.

Line 22: Decide whether to spread the taxable amount over 3 years or report it all in the current year.

Line 23: Enter income from prior years’ IRA qualified disaster distributions.

Line 24: Calculate total income this year from IRA qualified disaster distributions.

Line 25: Enter total repayment of IRA qualified disaster distributions.

Line 26: Calculate amount subject to tax this year.

Part IV: Qualified Distributions for the Purchase or Construction of a Main Home

Part IV Disaster Table: Enter FEMA number, disaster declaration date, beginning date, and ending date for each disaster.

Line 27: Determine if you need to complete the rest of this section.

Line 28: Enter total qualified distributions for home purchase/construction not reported on Form 8606.

Line 29: Enter the applicable cost of distributions.

Line 30: Calculate the difference between lines 28 and 29.

Line 31: Enter total repayments made.

Line 32: Calculate the taxable amount and include in the appropriate line of Form 1040, 1040-SR, or 1040-NR.