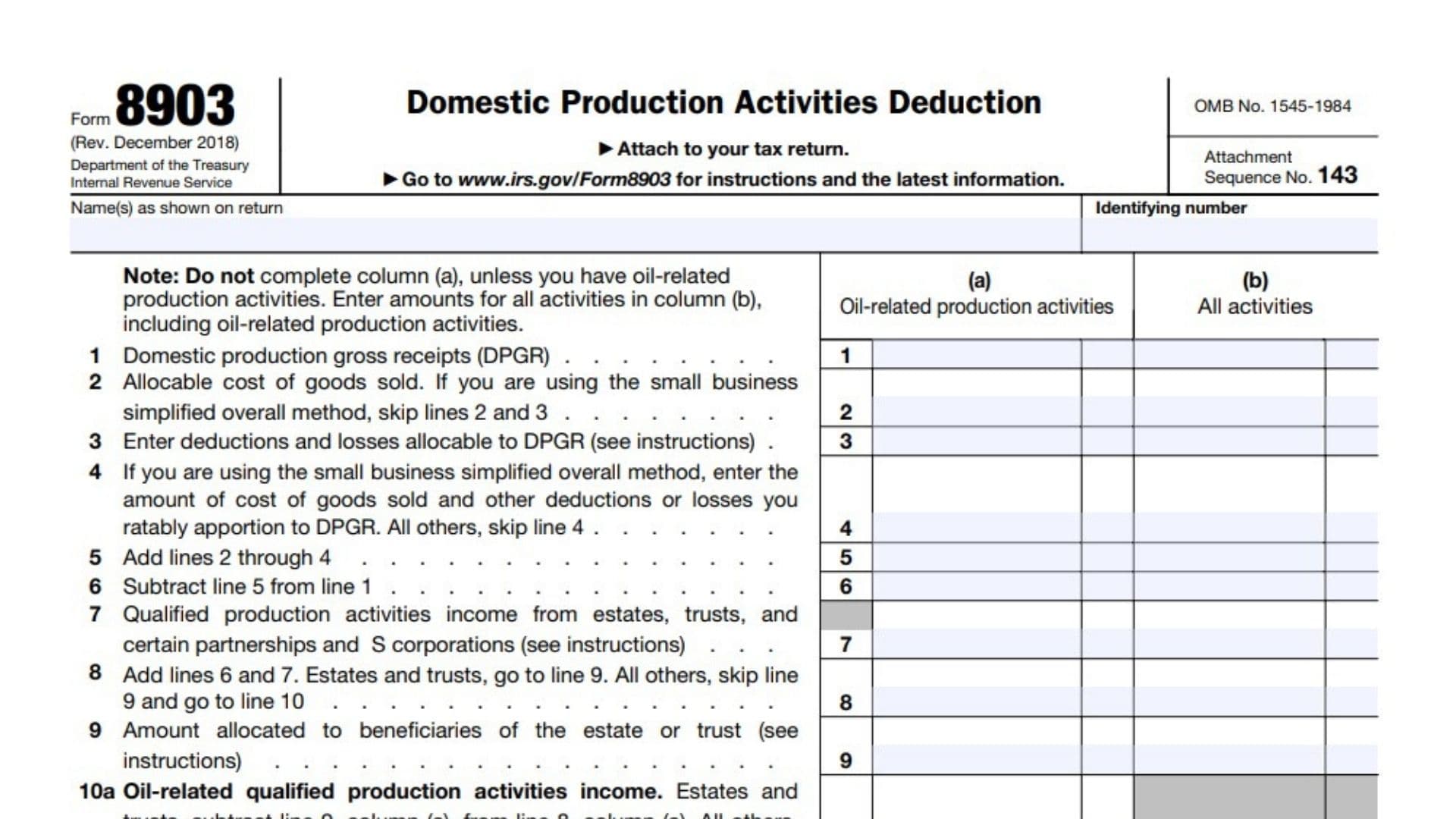

IRS Form 8903, titled “Domestic Production Activities Deduction,” was used by businesses to claim a tax deduction for certain domestic production activities under Section 199 of the Internal Revenue Code. This deduction was designed to encourage U.S.-based manufacturing, production, and certain other qualified activities by allowing eligible taxpayers to deduct a percentage of their qualified production activities income (QPAI) from their taxable income. Although the deduction was repealed for most taxpayers for tax years after 2017, some filers—such as certain cooperatives—may still need to use the form. Completing Form 8903 involves calculating domestic production gross receipts, subtracting associated costs and deductions, and applying specific limitations and wage calculations to determine the allowable deduction. The form must be attached to your tax return and filled out accurately to ensure compliance with IRS requirements.

How to File Form 8903

To file Form 8903, complete all applicable lines using your business’s financial information for the tax year. Attach the form to your federal tax return and submit it to the IRS by your tax filing deadline. If you are a cooperative or part of an affiliated group, additional allocations may be required. Always use the most recent version of the form and consult the official instructions for special rules or exceptions.

How to Complete Form 8903

Header Information

- Name(s) as shown on return: Enter the name of the individual, corporation, partnership, or entity filing the form.

- Identifying number: Enter the taxpayer identification number (TIN) or employer identification number (EIN) as shown on your return.

Columns

- Column (a): Oil-related production activities – Complete only if you have oil-related activities.

- Column (b): All activities – Enter amounts for all qualifying activities here, including oil-related.

Lines 1–25

Line 1: Domestic production gross receipts (DPGR)

Enter the total receipts from qualified domestic production activities.

Line 2: Allocable cost of goods sold

Enter the cost of goods sold allocable to DPGR. If using the small business simplified overall method, skip lines 2 and 3.

Line 3: Enter deductions and losses allocable to DPGR

List deductions and losses directly related to DPGR as per IRS instructions.

Line 4: Small business simplified overall method allocation

If applicable, enter the amount of cost of goods sold and other deductions or losses ratably apportioned to DPGR. All others skip this line.

Line 5: Add lines 2 through 4

Add the amounts from lines 2, 3, and 4 for each column.

Line 6: Subtract line 5 from line 1

This is your qualified production activities income (QPAI) before considering income from other sources.

Line 7: Qualified production activities income from estates, trusts, and certain partnerships and S corporations

Enter any QPAI received from these entities.

Line 8: Add lines 6 and 7

This is your total QPAI before allocation to beneficiaries (if applicable).

Line 9: Amount allocated to beneficiaries of the estate or trust

Enter the portion of QPAI allocated to beneficiaries, if applicable.

Line 10a: Oil-related qualified production activities income

For estates and trusts, subtract line 9, column (a), from line 8, column (a). All others, enter amount from line 8, column (a). Enter zero if negative.

Line 10b: Qualified production activities income

For estates and trusts, subtract line 9, column (b), from line 8, column (b). All others, enter amount from line 8, column (b). Enter zero if negative; if zero or less, skip lines 11–21 and enter zero on line 22.

Line 11: Income limitation

- Individuals, estates, and trusts: Enter adjusted gross income (AGI) without the domestic production activities deduction.

- All others: Enter taxable income without the deduction (see instructions for tax-exempt organizations).

Line 12: Enter the smaller of line 10b or line 11

If zero or less, skip lines 13–21 and enter zero on line 22.

Line 13: Enter 9% of line 12

Multiply line 12 by 9% (0.09).

Line 14a: Enter the smaller of line 10a or line 12

This step applies only if you have oil-related production activities.

Line 14b: Reduction for oil-related qualified production activities income

Multiply line 14a by 3% (0.03).

Line 15: Subtract line 14b from line 13

This is your preliminary deduction amount.

Line 16: Form W-2 wages

Enter total W-2 wages paid that are allocable to DPGR (see instructions for details).

Line 17: Form W-2 wages from estates, trusts, and certain partnerships and S corporations

Enter any additional W-2 wages received from these entities.

Line 18: Add lines 16 and 17

This is your total W-2 wages available for the wage limitation.

Line 19: Amount allocated to beneficiaries of the estate or trust

Enter any portion of W-2 wages allocated to beneficiaries.

Line 20: Estates and trusts, subtract line 19 from line 18. All others, enter amount from line 18

This is the total W-2 wages available for the wage limitation calculation.

Line 21: Form W-2 wage limitation

Enter 50% of line 20 (multiply by 0.5).

Line 22: Enter the smaller of line 15 or line 21

This is your allowable domestic production activities deduction before adjustments.

Line 23: Domestic production activities deduction from cooperatives

Enter any deduction passed through from cooperatives (from Form 1099-PATR, box 6).

Line 24: Expanded affiliated group allocation

Enter any allocation as required for members of an expanded affiliated group.

Line 25: Domestic production activities deduction

Add lines 22, 23, and 24. Enter the total here and on the applicable line of your tax return.