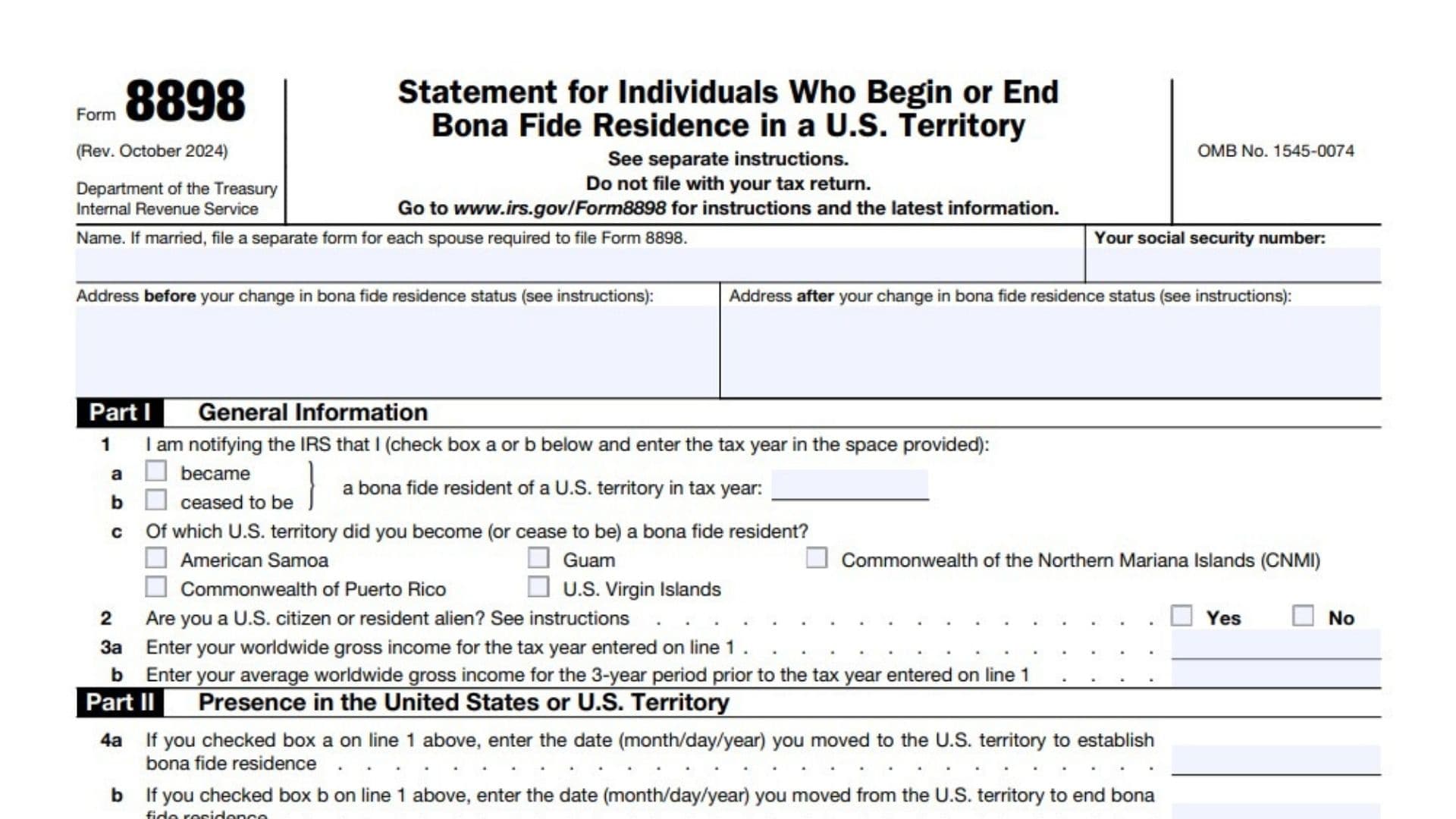

Form 8898 is a statement for individuals who begin or end bona fide residence in a U.S. territory. This form is required for U.S. citizens or resident aliens who establish or terminate bona fide residence in a U.S. territory during the tax year. It is not filed with the tax return but submitted separately to the IRS. The form provides essential information for determining tax implications related to residency changes, including the individual’s presence in the U.S. or the U.S. territory, connections to the U.S. or other foreign countries, and the sources of their income. This form helps the IRS assess the individual’s tax status, residency, and whether they qualify for certain tax benefits related to U.S. territories.

How to Complete Form 8898?

Part I: General Information

- Line 1: Check the box indicating whether you became or ceased to be a bona fide resident of a U.S. territory in the tax year. Enter the specific year of the change.

- Line 2: Indicate whether you are a U.S. citizen or resident alien by checking “Yes” or “No.”

- Line 3:

- Line 3a: Enter your worldwide gross income for the tax year listed in Line 1.

- Line 3b: Enter your average worldwide gross income for the 3-year period prior to the tax year entered on Line 1.

Part II: Presence in the United States or U.S. Territory

- Line 4: If you moved to the U.S. territory to establish bona fide residence, enter the date of the move.

- Line 4b: If you moved from the U.S. territory to end bona fide residence, enter the date of the move.

- Line 5: Enter the number of days you were present in the United States during the tax year.

- Line 6:

- Line 6a: Enter the number of days you were present in the U.S. territory during the tax year.

- Line 6b: Enter the number of days you were present in the U.S. territory in the tax year immediately preceding the one on Line 1.

- Line 6c: Enter the number of days you were present in the U.S. territory in the second tax year immediately preceding the one on Line 1.

- Line 7: Indicate if you had a significant connection to the United States during the tax year.

- Line 8: Indicate if you had earned income from U.S. sources during the tax year and whether it exceeded $3,000.

Part III: Closer Connection to the United States, Foreign Country, or U.S. Territory

- Line 9: Indicate if you had a tax home outside the U.S. territory at any time during the tax year.

- If “Yes,” specify the location.

- Line 10: Indicate if you had a closer connection to the U.S. or a foreign country than to the U.S. territory at any time during the tax year.

- If “Yes,” specify where.

- Line 11: Indicate if you are using the year-of-the-move exception.

- Line 12: State where your principal permanent home was located during the tax year.

- Line 13: If you had multiple permanent homes, list the locations of each.

- Line 14: Indicate where your immediate family was located during the tax year.

- Line 15: Indicate where your automobile(s) were located during the tax year.

- Line 16: State where your automobile(s) were registered during the tax year.

- Line 17: Indicate where your personal belongings, furniture, etc., were located during the tax year.

- Line 18: Indicate where the bank(s) with which you conducted routine personal banking activities were located.

- Line 19: Indicate if you conducted business activities in a location other than your tax home.

- Line 20: State where your driver’s license was issued.

- Line 20b: If you hold a second driver’s license, indicate where it was issued.

- Line 21: Indicate if you were registered to vote during the tax year, and if so, where.

- Line 22: Indicate if you claimed a homestead exemption for the tax year, and if so, where.

- Line 23: Indicate what address you listed as your residence when completing official documents.

- Line 24: Indicate where you kept your personal, financial, and legal documents during the tax year.

- Line 25: Indicate where you derived the majority of your income during the tax year (e.g., U.S., U.S. territory, or other country).

- Line 26: Indicate if you had any income from U.S. sources during the tax year, and specify the type.

- Line 27: Indicate if you had any income from U.S. territory sources during the tax year, and specify the type.

- Line 28: Indicate where your investments were located during the tax year.

Part IV: Source of Income

- Line 29: Indicate if you had an office in the U.S. territory from which you conducted a trade or business, and provide details.

- Line 30: Indicate if you received compensation for personal services, and if so, where the services were performed.

- Line 31: Indicate if you manufactured an article in the U.S. territory for sale to customers.

- Line 32: Indicate if you sold or exchanged appreciated property after becoming a resident of the U.S. territory.

- Line 33: Indicate if your business involved receiving rents, dividends, interest, or the sale of personal property outside the U.S. territory.

Signature Section

- Sign and date: Sign the form under penalties of perjury, declaring that all information is true, correct, and complete.