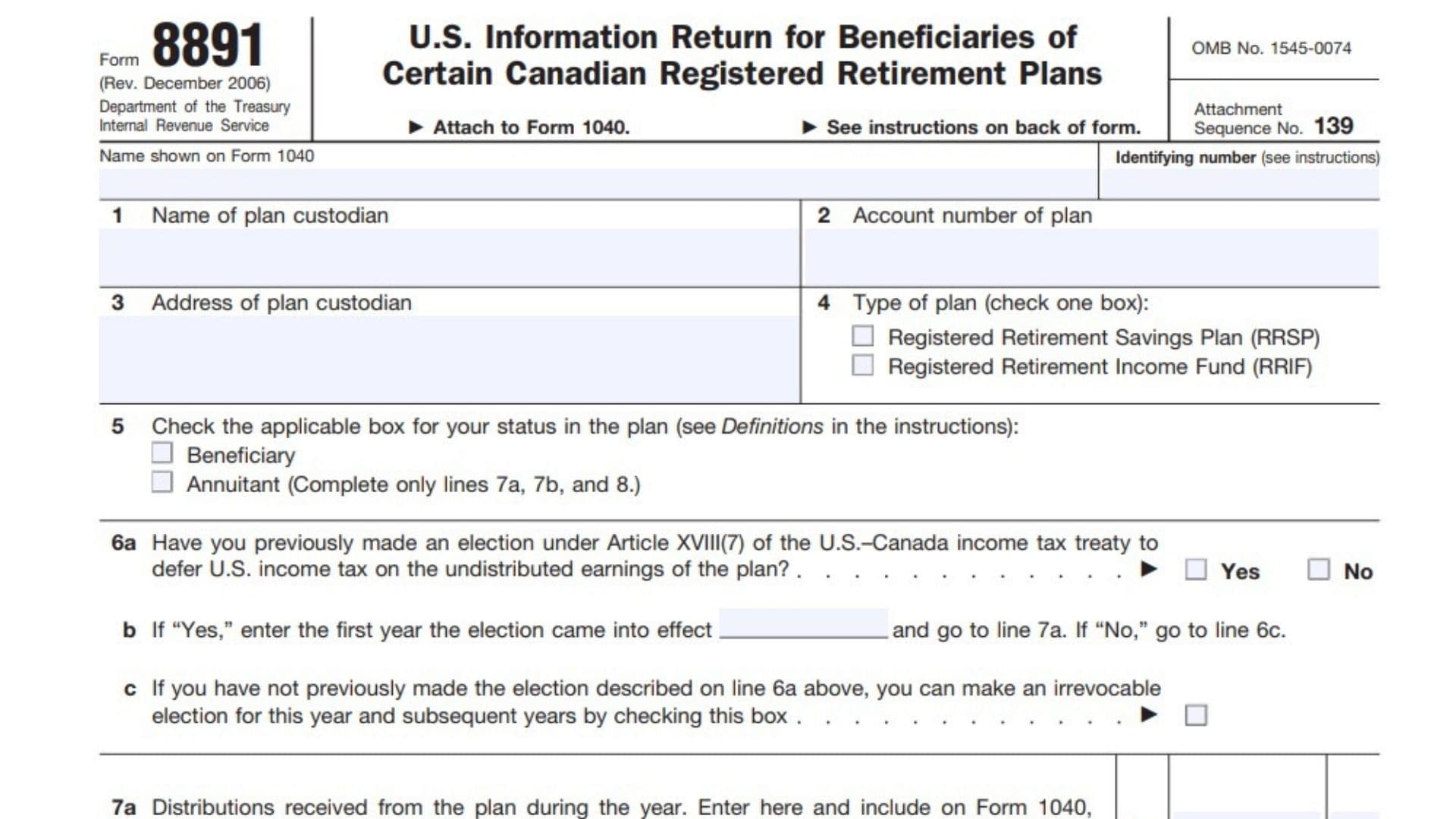

IRS Form 8891, U.S. Information Return for Beneficiaries of Certain Canadian Registered Retirement Plans, is a disclosure and tax reporting form for U.S. citizens or residents who hold interests in Canadian RRSPs or RRIFs, used to report contributions, undistributed income, and distributions, and to make a treaty deferral election under Article XVIII(7) so that accrued but undistributed plan income is deferred for U.S. tax purposes. Form 8891 must be attached to Form 1040, and a separate Form 8891 is required for each RRSP or RRIF; beneficiaries use it to report plan activity and may elect deferral, while annuitants use it in any year a distribution is received, with entries made in U.S. dollars and supported by records such as Canadian slips (T4RSP, T4RIF, NR4). Filing Form 8891 generally replaces Form 3520 and avoids related penalties for these plans per Notice 2003‑75; the deferral election may also be made on the form following Rev. Proc. 2002‑23, and taxable distributions are computed under IRC section 72 and Pub. 939 rules for pensions and annuities.

Note: Form 8891 was later discontinued by Rev. Proc. 2014‑55 and is not required for tax years beginning on or after Jan. 1, 2014; this guide covers the official 2006 version the PDF reflects.

How To File It

- Attach a completed Form 8891 for each RRSP or RRIF to Form 1040 for the applicable year, using U.S. dollars for all amounts.

- File if a U.S. citizen or resident is a beneficiary (reporting contributions, undistributed earnings, distributions) or is an annuitant who received a distribution during the year.

- Maintain records: T4RSP, T4RIF, NR4, and plan statements; Form 8891 generally substitutes for Form 3520/3520‑A reporting for these plans under Notice 2003‑75.

Who Must File

- Beneficiaries of RRSPs/RRIFs: file annually to report contributions, undistributed income, distributions; may elect treaty deferral on undistributed income.

- Annuitants: file for any year with distributions; complete only the specified lines for annuitants.

How to Complete Form 8891

Complete one form per RRSP/RRIF; enter amounts in U.S. dollars.

- Name Shown on Form 1040: Enter the filer’s name; if filing jointly, enter only the name of the person for this specific plan.

- Identifying Number: Enter U.S. SSN or ITIN; do not enter a Canadian number.

- Name of Plan Custodian: Enter the RRSP/RRIF custodian’s legal name as shown on plan statements.

- Account Number of Plan: Enter the plan or contract/account number for identification.

- Address of Plan Custodian: Enter complete mailing address (street, city, province, postal code, country).

- Type of Plan: Check RRSP or RRIF as applicable. Select only one.

- Status in the Plan: Check Beneficiary or Annuitant. Beneficiary is generally the person subject to current U.S. taxation absent treaty deferral; an annuitant is the person designated by the plan who is not also a beneficiary.

6a. Prior Treaty Deferral Election: Answer Yes if an Article XVIII(7) deferral election was previously made; if Yes, enter the first year the election became effective and proceed to line 7a; if No, go to line 6c.

6b. (Sub‑entry of 6a on the form face): Enter the first year the election came into effect if 6a is Yes; otherwise leave blank.

6c. Make Current-Year Deferral Election: If no prior election, check this box to make an irrevocable deferral election for this and subsequent years under Article XVIII(7), then proceed per beneficiary/annuitant rules.

7a. Distributions Received During the Year: Enter gross distributions received; also include the same amount on Form 1040, line 16a (per 2006 return line references).

7b. Taxable Distributions During the Year: Enter the taxable amount determined under IRC section 72 and Pub. 939; also include on Form 1040, line 16b (per 2006 references).

8. Plan Balance at Year-End: Enter the fair market value at year end; if you checked Annuitant on line 5, or Yes on 6a, or elected deferral on 6c, stop after line 8 and do not complete lines 9–10.

- Contributions to the Plan During the Year: Enter total contributions (employee/individual) made during the year.

- Undistributed Earnings of the Plan During the Year: Report the following income categories that accrued but were not distributed (only if required to complete beyond line 8):

- 10a. Interest Income: Enter interest; also include on Form 1040, line 8a (per 2006 reference).

- 10b. Total Ordinary Dividends: Enter total ordinary dividends; also include on Form 1040, line 9a (per 2006 reference).

- 10c. Qualified Dividends: Enter qualified dividends amount; also include on Form 1040, line 9b (per 2006 reference).

- 10d. Capital Gains: Report capital gains; follow Form 1040 Schedule D/line 13 instructions for the year as applicable.

- 10e. Other Income: Enter other types of income; list type and amount; also include on Form 1040, line 21 (per 2006 reference).

Guidance Notes:

- Beneficiaries who have made (line 6a) or are making (line 6c) the deferral election generally complete only lines 1–8; undistributed income in line 10 is deferred by election and not currently taxable.

- Annuitants complete only lines 1–5, 7a, 7b, and 8 in a year with distributions.

- Taxable distributions (line 7b) are figured under section 72 and Pub. 939; consult those for basis/exclusion ratio determinations.

Special Administrative Rules

- Record Retention: Keep T4RSP, T4RIF, NR4, and custodian statements supporting amounts reported.

- Other Reporting: Taxpayers required to file Form 8891 are not required to file Form 3520 for these plans and are not subject to section 6677 penalties on such RRSPs/RRIFs pursuant to section 6048(d)(4) and Notice 2003‑75.

- Election Procedures: Article XVIII(7) deferral may be made on Form 8891 consistent with Rev. Proc. 2002‑23 procedures; if previously made under Rev. Proc. 89‑45, check “No” on 6a but prior valid elections continue for rollover plans.

- Currency: All amounts must be in U.S. dollars.

Frequently Asked Questions

- Do spouses file one form or two?

Each spouse files a separate Form 8891 for their own plan; one form per plan per filer. - If the deferral box (6c) is checked, are undistributed earnings taxable?

No; under the treaty election, accrued but undistributed income is deferred; report only distributions when received per section 72. - Is Form 3520 still required if Form 8891 is filed?

Generally no for these plans; Form 8891 satisfies the RRSP/RRIF reporting under Notice 2003‑75, avoiding section 6677 penalties. - Is Form 8891 still required today?

Rev. Proc. 2014‑55 eliminated Form 8891 for years beginning on or after Jan. 1, 2014, and deems eligible individuals to have made the deferral election; this guide applies to the historical 2006 form.

Quick Filing Checklist

- One Form 8891 per RRSP/RRIF attached to Form 1040.

- Confirm status (Beneficiary vs. Annuitant) and treaty deferral election (6a/6c).

- Report distributions (7a/7b) and year‑end balance (8); complete lines 9–10 only if required.

- Keep Canadian slips and statements; amounts in U.S. dollars.

Sources: IRS Form 8891 (Rev. 12‑2006) and IRS prior‑year references; Notice 2003‑75; Rev. Proc. 2002‑23; Rev. Proc. 2014‑55 (discontinuation and deemed election).