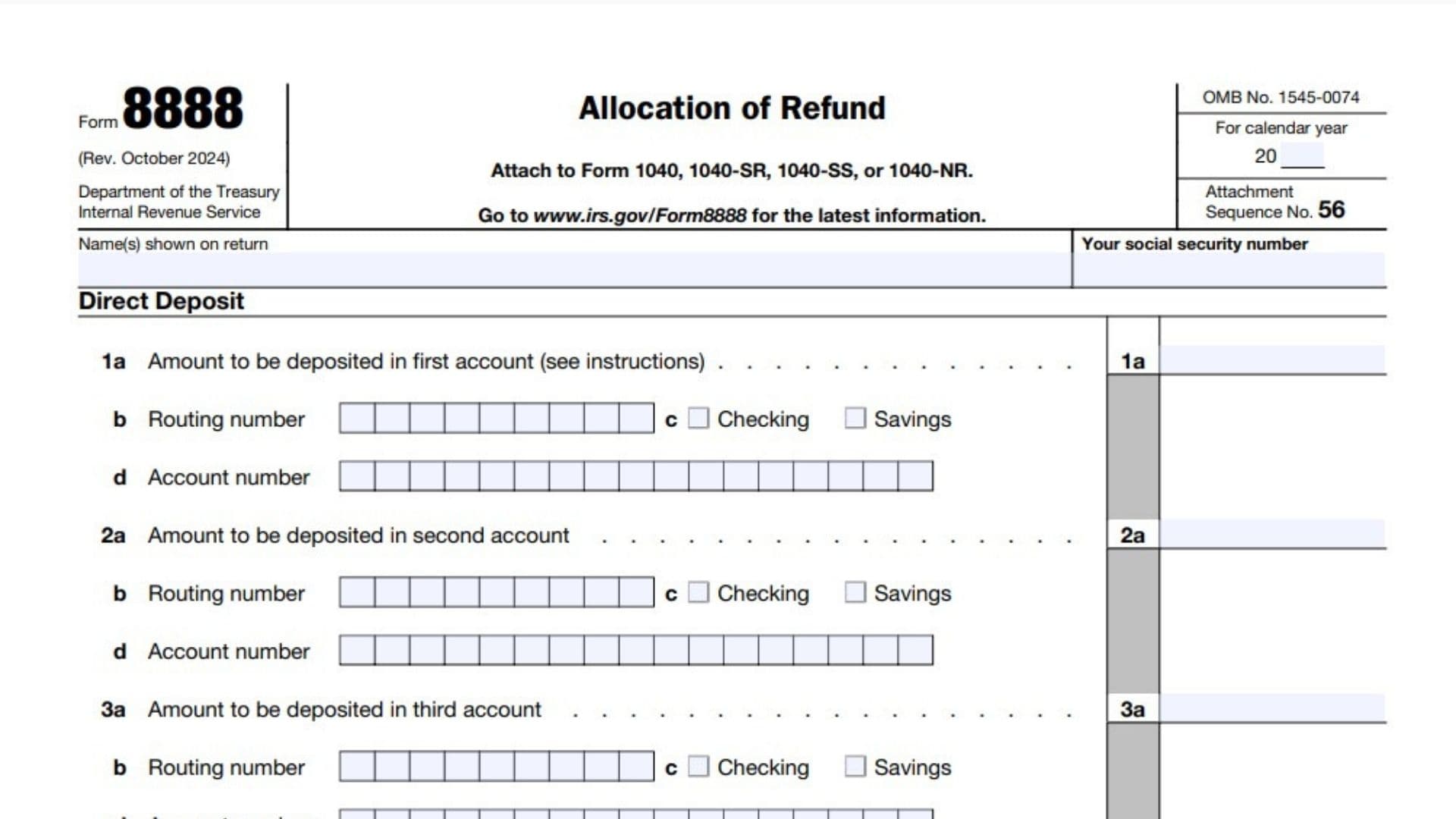

IRS Form 8888, Allocation of Refund, allows taxpayers to split their tax refund into multiple bank accounts or between direct deposit and a paper check. It is attached to your main tax return forms, such as Form 1040, 1040-SR, 1040-SS, or 1040-NR. Using this form, you can distribute your refund across checking, savings, or even investment accounts like IRAs, HSAs, or ESAs. This flexibility helps taxpayers efficiently manage their finances and prioritize their savings or expenditures. However, note that it cannot be used for depositing refunds to accounts not in your name, like your tax preparer’s account.

Why Use Form 8888?

Form 8888 offers several benefits:

- Faster Refunds: Direct deposits arrive sooner than mailed checks.

- Financial Flexibility: Split refunds across up to three accounts or receive a portion via check.

- Security: Minimizes risks of lost or stolen checks.

- Convenience: Eliminates trips to the bank for deposit.

How to File IRS Form 8888?

To file Form 8888:

- Download Form 8888: Access the latest version of Form 8888 from the IRS website or obtain it with your tax preparation software.

- Attach the Form: Submit Form 8888 with your federal tax return.

- Provide Accurate Information: Include your correct routing and account numbers to avoid rejected deposits.

How to Complete Form 8888?

Here’s a detailed, line-by-line guide to completing Form 8888:

Part I: Direct Deposit

- Line 1a, 2a, 3a (Deposit Amounts): Enter the refund amounts for each account. Each amount must be at least $1. If the IRS delays your refund, the entire amount may be deposited into the first listed account.

- Line 1b, 2b, 3b (Routing Numbers):

- Enter the 9-digit routing number for your financial institution.

- Ensure the first two digits range from 01–12 or 21–32.

- Refer to your bank for the correct number, as it may differ from your deposit slip.

- Line 1c, 2c, 3c (Account Types): Check the appropriate box (Checking or Savings). If depositing into a specialized account, consult your financial institution for guidance.

- Line 1d, 2d, 3d (Account Numbers):

- Enter the account number, up to 17 characters, including hyphens but excluding spaces or symbols.

- Leave unused boxes blank.

Part II: Paper Check

- Line 4: Enter the remaining refund amount you want to receive as a paper check. If no amount is listed, all refunds will be deposited electronically.

Part III: Total Allocation

- Line 5: Add amounts from lines 1a, 2a, 3a, and 4. Ensure this total matches the refund amount on your tax return.

Common Issues to Avoid

- Rejected Direct Deposits: Deposits may be rejected if incorrect routing/account numbers are provided or if the account owner’s name doesn’t match the tax return.

- Math Errors or Adjustments: Refund increases or decreases due to errors will affect the last listed accounts first.

- Exceeding Direct Deposit Limits: Only three deposits are allowed per account per year.

Final Notes

For changes in your refund due to offsets (e.g., unpaid taxes or debts), the adjustments will apply first to the accounts listed with the highest routing numbers. Verify account details with your financial institution and review Form 8888 thoroughly before submission to ensure accuracy.