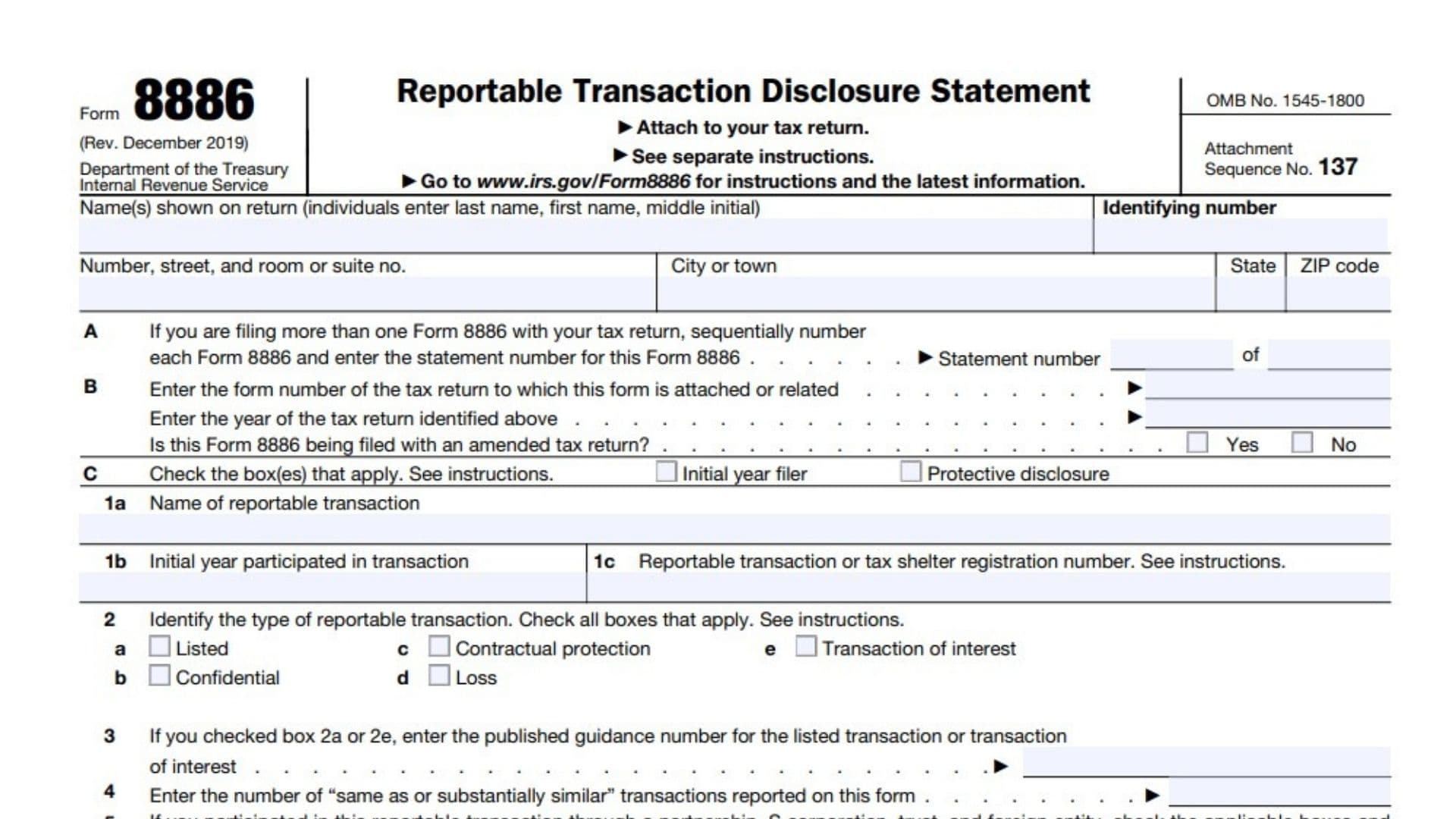

IRS Form 8886, also known as the Reportable Transaction Disclosure Statement, is a form used by taxpayers to disclose certain types of reportable transactions to the Internal Revenue Service (IRS). Reportable transactions generally involve transactions that may have significant tax consequences or are potentially abusive tax shelters. The purpose of this form is to provide transparency to the IRS and avoid penalties for failing to disclose such transactions. Taxpayers must file this form to report any participation in reportable transactions, including those involving tax shelters, as part of their annual tax return.

The form requires the filer to disclose detailed information about the reportable transaction, including the nature of the transaction, the parties involved, and the expected tax benefits. Form 8886 helps the IRS track complex tax strategies that could lead to improper tax avoidance. For instance, individuals or entities that have participated in transactions with specific tax benefits (such as deductions, exclusions from income, or nonrecognition of gains) are required to disclose them on this form.

How to File IRS Form 8886?

To file IRS Form 8886, you must attach it to your regular tax return. This form is an essential part of your tax filing process if you have engaged in a reportable transaction. The IRS provides instructions on the filing process, and the form can be accessed via the IRS website (www.irs.gov). Make sure to file it along with the rest of your tax documents for the year in which the transaction occurred.

How to Complete Form 8886?

- Name and Address:

- Line A: Enter your name(s) and address. If you are filing for a business, use the business name.

- Line B: Enter the form number of the tax return you are attaching the form to.

- Line C: Indicate whether you are filing with an amended return or an initial return.

- Reportable Transaction Information:

- Line 1a: Enter the name of the reportable transaction.

- Line 1b: Provide the year in which you first participated in the transaction.

- Line 1c: If the IRS has issued a reportable transaction or tax shelter registration number, enter it here.

- Line 2: Check the box that corresponds to the type of reportable transaction you participated in (e.g., listed, confidential, loss, etc.).

- Guidance Information:

- Line 3: If the transaction is a listed transaction or a transaction of interest, provide the published guidance number.

- Transaction Details:

- Line 4: Enter the number of transactions that are substantially similar to the one you are reporting.

- Line 5: If the transaction involves a partnership, S corporation, trust, or foreign entity, check the corresponding box and provide the entity details.

- Fees Paid Information:

- Line 6: List the individuals or entities who were paid fees for promoting, soliciting, or advising on the transaction. Include their names, identifying numbers, and fees paid.

- Tax Benefits:

- Line 7a: Identify the type of tax benefit the transaction generates (e.g., deductions, tax credits, nonrecognition of gain).

- Line 7b: Enter the total dollar amount of your tax benefits from this transaction.

- Line 7c: Provide the number of years the transaction will generate tax benefits.

- Line 7d: Enter the total amount of your investment in the transaction.

- Line 7e: Provide a detailed description of the expected tax benefits and treatment for all affected years.

- Involvement of Related Entities:

- Line 8: Identify any related, foreign, or tax-exempt individuals/entities involved in the transaction. Include their names, addresses, and descriptions of their involvement.