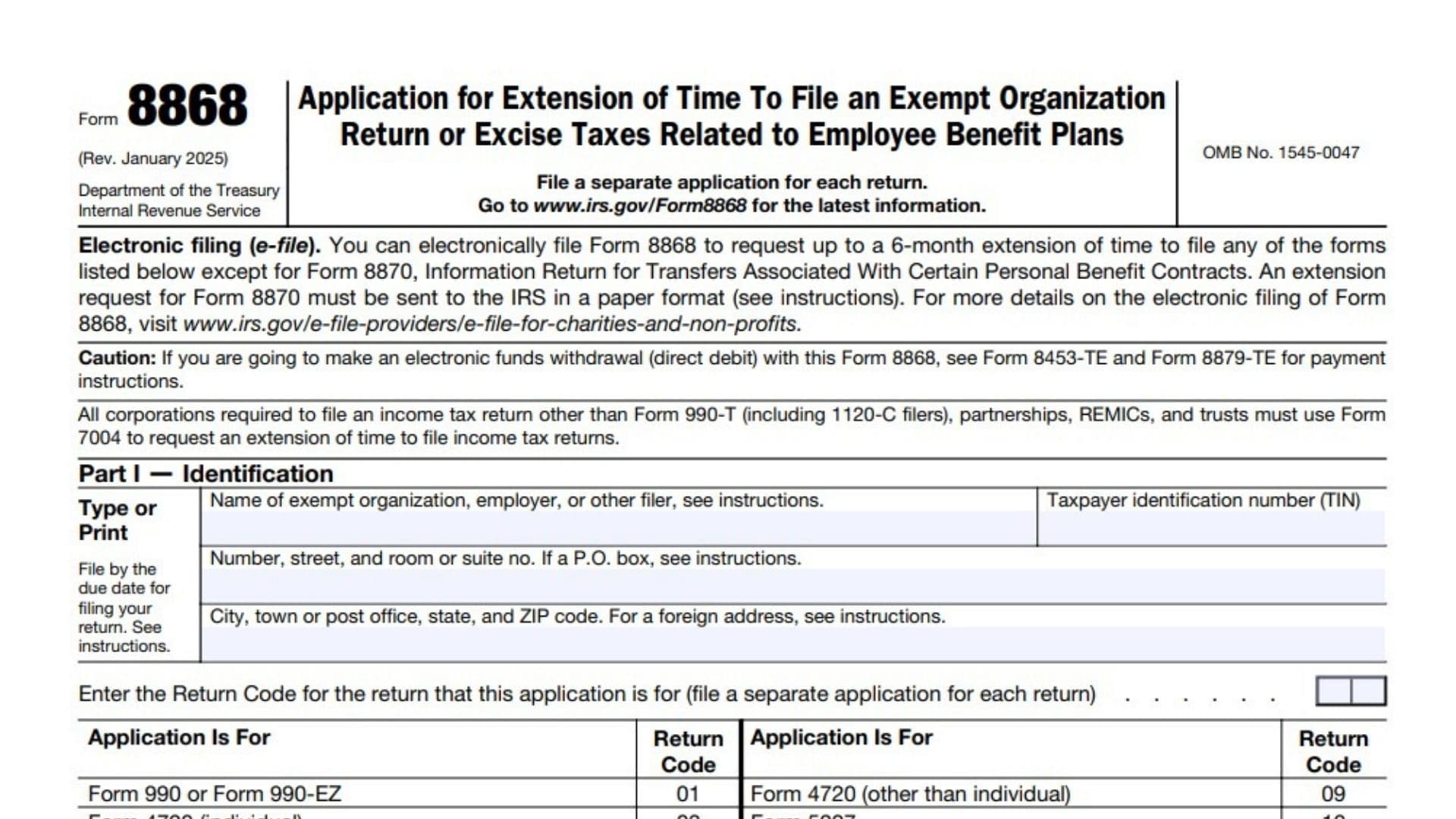

IRS Form 8868, officially titled “Application for Extension of Time To File an Exempt Organization Return or Excise Taxes Related to Employee Benefit Plans,” allows exempt organizations (like charities and certain employee benefit plans) to formally request additional time—up to 6 months—to file their required federal information or excise tax returns. This form is commonly used by nonprofits, foundations, and retirement plan administrators when unexpected delays (such as needing more time for audits, gathering financial documentation, or handling complex compliance checks) make it impossible to meet original deadlines. It’s distinct from the extension forms required by for-profit entities. Form 8868 can be filed electronically for most returns, offering a straightforward path to penalty-free extra time as long as you file by the original due date and pay any tax due. Failing to file on time may subject your organization to penalties, so understanding how to correctly complete Form 8868 is critical for compliance and peace of mind.

How to File IRS Form 8868

You can file IRS Form 8868 electronically (recommended) through IRS e-file providers, or by mailing a paper copy to the IRS. Visit the IRS website for e-filing instructions and acceptable providers. Always file on or before your original return’s due date.

How to Complete Form 8868

Follow these step-by-step instructions for every line and box on Form 8868 as provided in the official PDF1:

Header Section: Basic Information

- Type or Print

Fill in all information legibly using black ink if printing. - File by the due date for filing your return. See instructions.

Make sure you’re submitting this form by the due date for your specific return.

Part I — Identification

Name of exempt organization, employer, or other filer, see instructions

Write out the full legal name of the organization requesting the extension.

Taxpayer identification number (TIN)

Enter the organization’s Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

Number, street, and room or suite no. If a P.O. box, see instructions.

Input your complete mailing address, including a suite or room number if needed. If using a P.O. box, consult the detailed IRS instructions to ensure proper formatting.

City, town or post office, state, and ZIP code. For a foreign address, see instructions.

List the city, state, and ZIP code. For foreign addresses, follow IRS guidelines.

Enter the Return Code for the return that this application is for (file a separate application for each return)

Select the correct code from the list:

- Form 990 or 990-EZ — 01

- Form 4720 (individual) — 03

- Form 990-PF — 04

- Form 990-T (sec. 401(a) or 408(a) trust) — 05

- Form 990-T (trust other than above) — 06

- Form 990-T (corporation) — 07

- Form 1041-A — 08

- Form 4720 (other than individual) — 09

- Form 5227 — 10

- Form 6069 — 11

- Form 8870 — 12

- Form 5330 (individual) — 13

- Form 5330 (other than individual) — 14

- Form 990-T (governmental entities) — 15

Write the code for the return you need an extension for. File a separate Form 8868 if you are requesting extensions for multiple returns.

– After you enter your Return Code, complete either Part II or Part III. Part III, including signature, is applicable only for an extension of time to file Form 5330.

– If this application is for an extension of time to file Form 5330, you must enter the following information.

- Plan Name:

Enter the full legal name of the benefit plan. - Plan Number:

Write the assigned number for the plan. - Plan Year Ending (MM/DD/YYYY):

Enter the month, day, and year when the plan year ends.

Part II — Automatic Extension of Time To File for Exempt Organizations

The books are in the care of

Enter the name of the person responsible for maintaining the organization’s books and records.

Telephone No.

List the phone number for the contact person above.

Fax No.

If applicable, include the contact’s fax number.

– If the organization does not have an office or place of business in the United States, check this box.

Check if your organization is foreign-based.

– If this is for a Group Return, enter the organization’s four-digit Group Exemption Number (GEN)

If filing for a group, provide the four-digit GEN.

- If this is for the whole group, check this box.

- Check if your extension application covers the entire group.

- If it is for part of the group, check this box and attach a list with the names and TINs of all members the extension is for.

- Check if only part of the group is included, and attach required documentation listing names and TINs.

Line 1

I request an automatic 6-month extension of time until ____, 20, to file the exempt organization return for the organization named above. The extension is for the organization’s return for:

- calendar year 20____

Fill in the tax year. - or tax year beginning ____, 20, and ending ____, 20.

If not a calendar year, specify the fiscal tax year’s start and end dates.

Line 2

If the tax year entered in line 1 is for less than 12 months, check reason:

- Initial return (organization’s first return)

- Final return (organization’s last return)

- Change in accounting period (switching fiscal years)

Check the box that best fits your situation.

Line 3a

If this application is for Forms 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any nonrefundable credits. See instructions.

- Enter the calculated tentative tax amount, minus any nonrefundable credits for the period in question.

Line 3b

If this application is for Forms 990-PF, 990-T, 4720, or 6069, enter any refundable credits and estimated tax payments made. Include any prior year overpayment allowed as a credit.

- Enter all refundable credits, estimated payments, and any prior year overpayments you’re applying.

Line 3c

Balance due. Subtract line 3b from line 3a. Include your payment with this form, if required, by using EFTPS (Electronic Federal Tax Payment System). See instructions.

- Subtract the amount entered on line 3b from that on 3a.

- If a balance is due, make payment via EFTPS.

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form 8868 (Rev. 1-2025)

Page 2: Part III — Extension of Time To File Form 5330

Part III is ONLY for applications for extension of time to file Form 5330.

Line 1

I request an extension of time until ____, 20, to file Form 5330.

- Enter the requested extended due date for Form 5330.

You may be approved for up to a 6-month extension to file Form 5330, after the normal due date of Form 5330.

Line 1a

Enter the Code section(s) imposing the tax.

- Specify the exact Internal Revenue Code section(s) resulting in the tax reported on Form 5330.

Line 1b

Enter the payment amount attached.

- Write the total payment amount included with this extension request, if any.

Line 1c

For excise taxes under section 4980 or 4980F of the Code, enter the reversion/amendment date (MM/DD/YYYY).

- Enter any applicable plan amendment or reversion date.

Line 2

State in detail why you need the extension.

- Clearly explain the reasons for requesting more time, including any relevant details.

Signature Section

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made on this form are true, correct, and complete, and that I am authorized to prepare this application.

- Sign and date the form.

- Only authorized individuals may sign.