Using Form 8864 ensures that you are calculating the right amount of tax. This tax credit can also be used as an incentive to encourage the production of renewable diesel fuels. You must prove you are a qualified biodiesel or renewable diesel fuel producer. In addition to the Biodiesel and Renewable Diesel Fuels Credit, there is also a Small Agri-Biodiesel Producer Credit. This credit is given to pass-through entities, including partnerships, S corporations, and cooperatives.

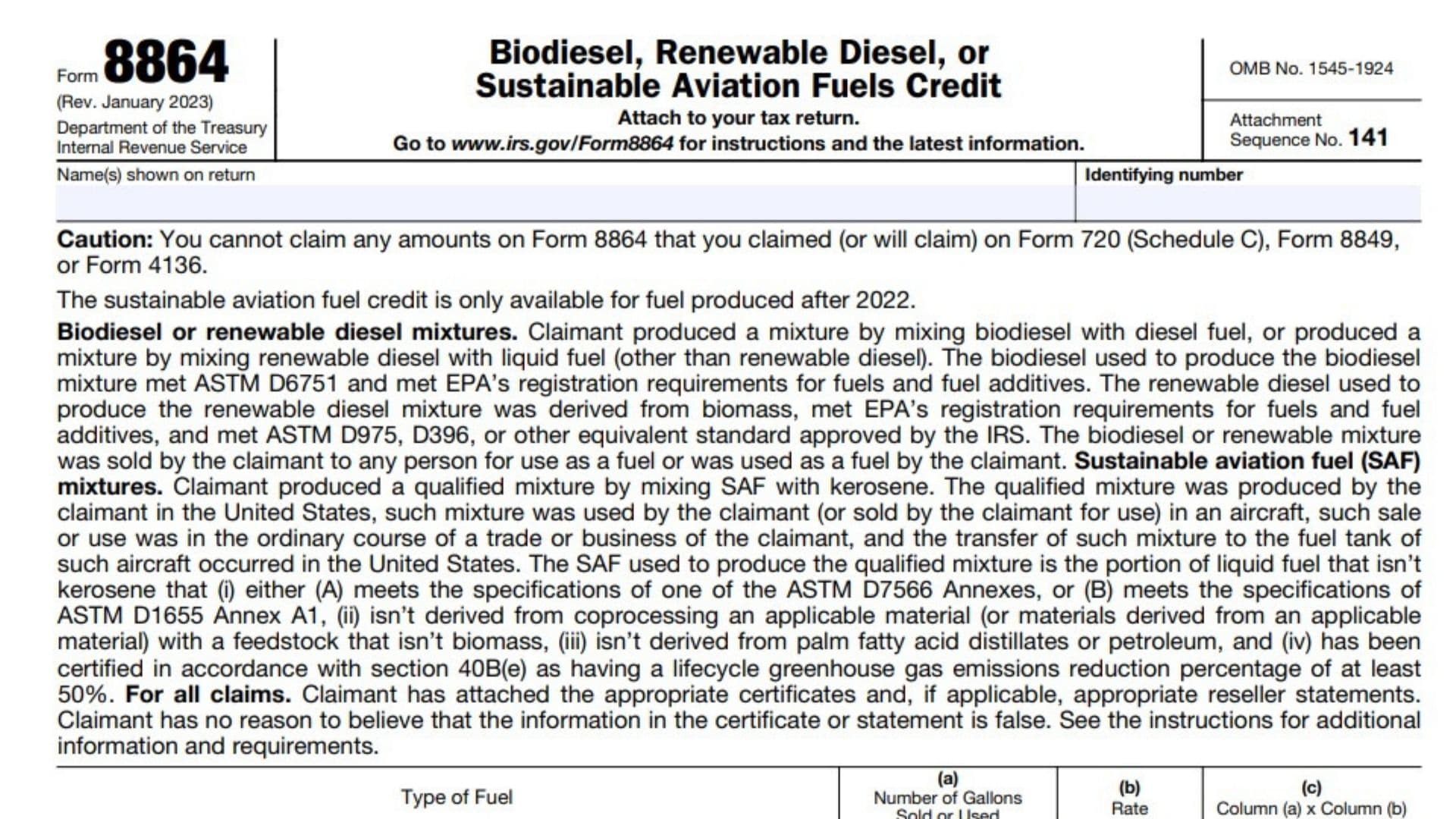

To calculate your credit, you must fill out Form 8864 and attach a certificate or statement of the amount of the fuel. You must also ensure that the fuel you use is registered with the EPA. You must also attach a statement stating that you are using renewable diesel. You cannot claim any amounts on Form 8864 that you claimed (or will claim) on Form 720 (Schedule C), Form 8849, or Form 4136.

Notes

- Use lines 1-8 to figure any biodiesel and renewable diesel fuels credit from your own trade or business.

- Skip lines 1-8 if you are claiming only a credit that was allocated to you from a pass-through entity

How to Complete Form 8864?

Line 1: Enter Biodiesel (other than agri-biodiesel)

Line 2: Enter Agri-biodiesel

Line 3: Renewable diesel

Line 4: Biodiesel (other than agri-biodiesel) included in a biodiesel mixture

Line 5: Agri-biodiesel included in a biodiesel mixture

Line 6: Renewable diesel included in a renewable diesel mixture

Line 7: Qualified agri-biodiesel production.

Line 8: Add lines 1-7. Include this amount in your income for the tax year. ( Include this amount in income under “other income” on the applicable line of your income tax return. )

Line 9: Biodiesel and renewable diesel fuels credit from partnerships, S corporations, cooperatives, estates, and trusts.

Line 10: Add lines 8 and 9. For cooperatives, estates, and trusts, go to line 11. Partnerships and S corporations, stop here and report this amount on Schedule K. All others, stop here and report this amount on the appropriate line of Form 3800

Line 11: Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust

Line 12: Cooperatives, estates, and trusts, subtract line 11 from line 10. Report this amount on the appropriate line of Form 3800.