IRS Form 8863, titled “Education Credits,” is a vital document for taxpayers seeking to claim the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These education credits can significantly reduce tax liability for individuals who are paying for higher education expenses for themselves, their spouses, or their dependents. The AOTC is particularly beneficial for students in their first four years of postsecondary education, allowing for a refundable credit of up to $2,500 per eligible student. In contrast, the LLC provides a nonrefundable credit of up to $2,000 per tax return for qualified education expenses incurred by students enrolled in eligible institutions. To file Form 8863, taxpayers must provide detailed information about the educational institution attended, the student’s enrollment status, and the qualified expenses paid. Completing this form accurately is essential as it ensures compliance with IRS regulations and maximizes potential tax benefits associated with education costs.

How to Complete Form 8863?

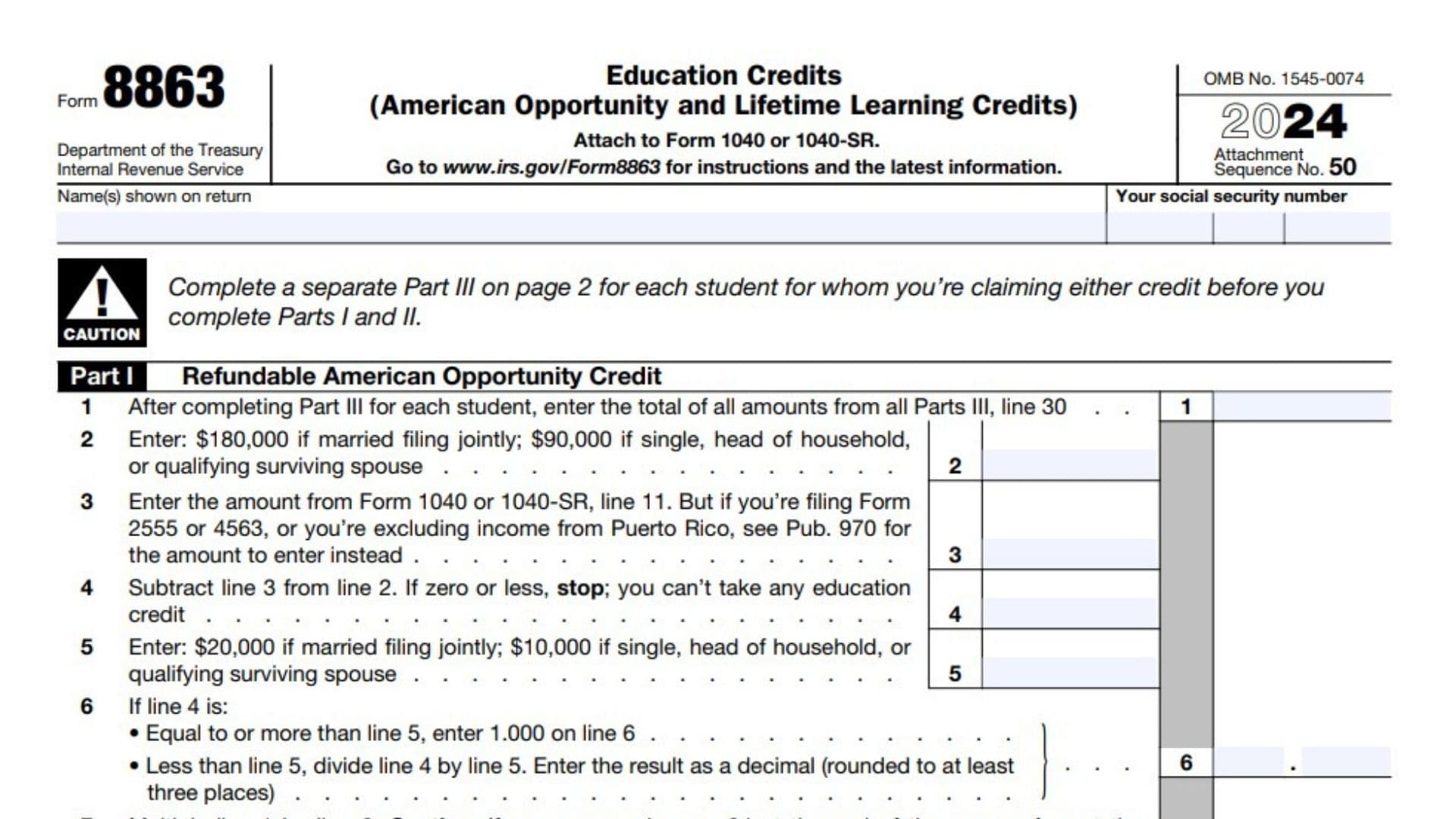

Part I: Refundable American Opportunity Credit

- Line 1: Enter the tax year for which you are filing this form (e.g., 2024).

- Line 2: Check the box for the credit(s) you are claiming: AOTC or LLC.

- Line 3: Enter your modified adjusted gross income (MAGI) from Form 1040 or 1040-SR.

- Line 4: Subtract Line 3 from the threshold amounts ($180,000 if married filing jointly; $90,000 if single).

- Line 5: Enter the maximum amount allowed based on your filing status.

- Line 6: If Line 4 is equal to or greater than Line 5, enter “1.000”; otherwise, divide Line 4 by Line 5 and enter as a decimal.

- Line 7: Multiply Line 1 by Line 6.

- Line 8: Calculate your refundable AOTC by multiplying Line 7 by 40% (0.40) and enter this amount.

Part II: Nonrefundable Education Credits

- Line 9: Subtract Line 8 from Line 7 and enter here.

- Line 10: After completing Part III for each student, enter the total of all amounts from Part III.

- Line 11: Enter the smaller of Line 10 or $10,000.

- Line 12: Multiply Line 11 by 20% (0.20).

- Line 13: Enter your MAGI threshold amount again.

- Line 14: Enter your amount from Form 1040 or 1040-SR.

- Line 15: Subtract Line 14 from Line 13.

- Line 16: Enter $20,000 if married filing jointly; otherwise enter $10,000.

- Line 17: If Line 15 is equal to or greater than Line 16, enter “1.000”; otherwise divide and enter as a decimal.

- Line 18: Multiply Line 12 by Line 17 and enter here.

- Line 19: Enter the amount from the Credit Limit Worksheet here and on Schedule 3 (Form 1040), line related to education credits.

Part III: Student and Educational Institution Information

20-31: For each student claimed for AOTC or LLC:

- Enter the student’s name and Social Security number.

- Provide details about the educational institution.

- Answer questions regarding enrollment status and eligibility.

- List adjusted qualified education expenses up to $4,000 for AOTC or total expenses for LLC.