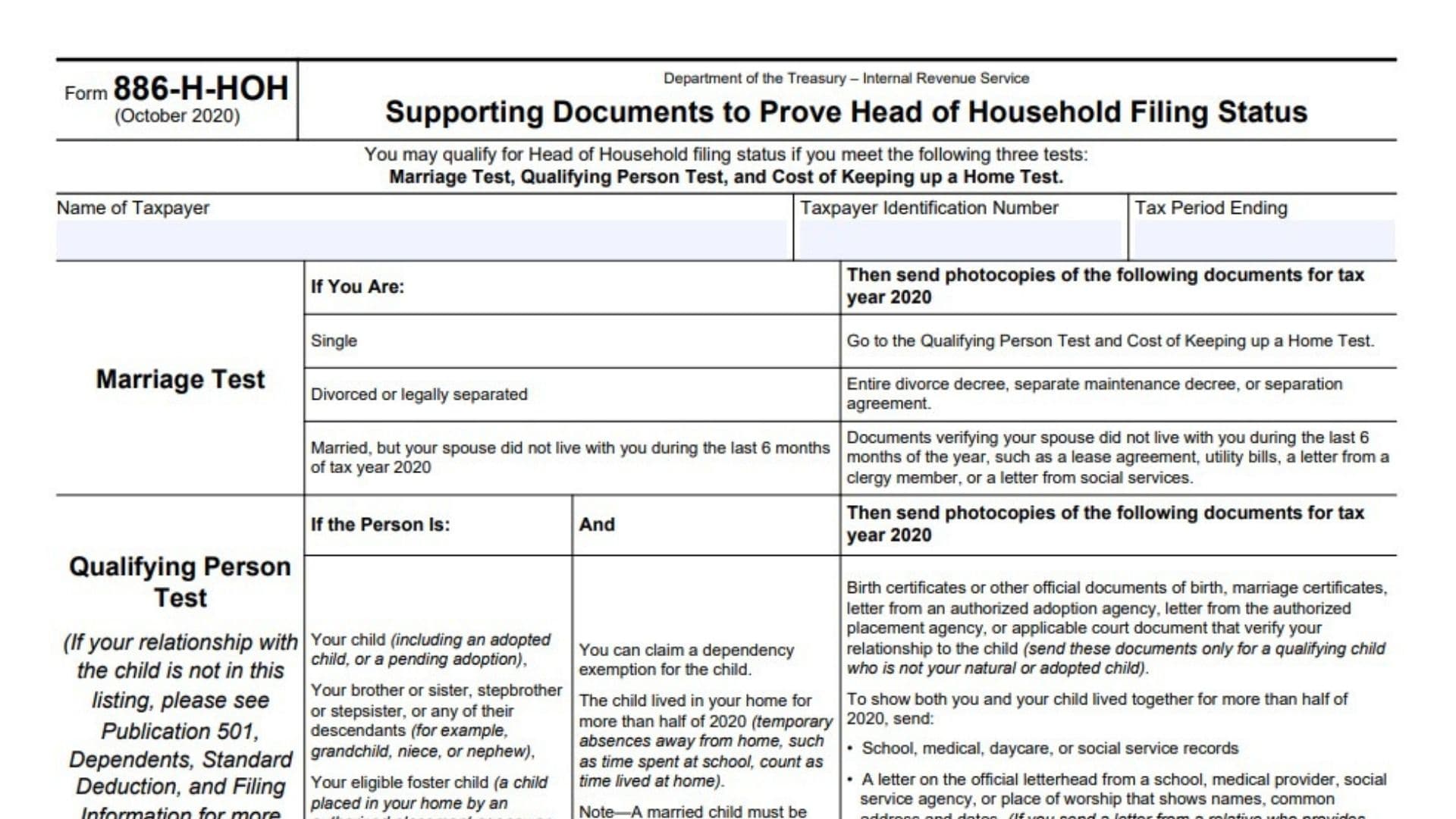

IRS Form 886-H-HOH, titled “Supporting Documents to Prove Head of Household Filing Status,” is a supplemental form that the IRS uses to verify whether a taxpayer is eligible to claim Head of Household (HOH) on their federal tax return. Being approved for Head of Household status often results in a higher standard deduction and potentially lower tax liability compared to filing as Single. However, to qualify, taxpayers must meet three important tests:

- Marriage Test – You must be unmarried or considered unmarried for tax purposes at the end of the year.

- Qualifying Person Test – You must have a child or dependent relative who qualifies to live with you and for whom you can claim a dependency exemption.

- Cost of Keeping up a Home Test – You must have paid more than half the cost of maintaining the household for the tax year.

The purpose of Form 886-H-HOH is to prove with documentation that you meet these tests. When the IRS questions a taxpayer’s HOH claim, they may request this form and supporting evidence, such as divorce decrees, school records, utility bills, and birth certificates.

How To File Form 886-H-HOH

Filing this form is not the same as submitting your tax return electronically. Instead, you will typically receive a notice from the IRS requesting you to provide Form 886-H-HOH with supporting documents. The process works as follows:

- Receive IRS Notice – If the IRS doubts your Head of Household status, they will request this form.

- Gather Documents – Collect photocopies of documents listed on the form that prove your eligibility.

- Complete the Form – Fill in your identifying information (name, taxpayer identification number, tax year).

- Submit to IRS – Send the completed form with photocopies of supporting documentation to the IRS address provided in your notice. Do not send originals unless specifically requested.

How To Complete IRS Form 886-H-HOH

This section breaks down the form line by line so you don’t miss a single detail.

Header Information

- Catalog Number 35108X / www.irs.gov – Reference details, no action needed.

- Form 886-H-HOH (Rev. 10-2020) – Version and revision date. Ensure you’re using the correct form.

- Department of the Treasury – Internal Revenue Service – Issuing authority.

- Supporting Documents to Prove Head of Household Filing Status – The purpose of the form.

Initial Instructions

The form reminds you that to qualify for HOH status you must meet three tests:

- Marriage Test

- Qualifying Person Test

- Cost of Keeping Up a Home Test

Taxpayer Information

- Name of Taxpayer – Enter your full legal name as shown on your tax return.

- Taxpayer Identification Number – Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Tax Period Ending – Enter the ending date of the tax year (for example, December 31, 2020).

Marriage Test

- If You Are Single – Skip directly to the Qualifying Person Test and Cost of Keeping Up a Home Test.

- If You Are Divorced or Legally Separated – Send a photocopy of the entire divorce decree, separate maintenance decree, or separation agreement.

- If You Are Married but Your Spouse Did Not Live With You During the Last 6 Months of the Tax Year – Provide documents verifying that your spouse did not live with you. Acceptable examples include:

- Lease agreements

- Utility bills

- Letter from a clergy member

- Letter from social services

Qualifying Person Test

The form specifies who may be considered a qualifying person:

- Your child (biological, adopted, or pending adoption)

- Your brother or sister, stepbrother or stepsister, or their descendants (grandchild, niece, nephew)

- Your eligible foster child (placed by an authorized agency or court order)

Documentation requirements:

- Provide birth certificates, adoption agency letters, placement documents, or marriage certificates to verify relationship.

- To prove residency, send records showing the child lived with you more than half of the tax year, such as:

- School records

- Medical records

- Daycare or social service agency records

- A letter on official letterhead (school, medical provider, place of worship, or social service agency) with names, address, and dates.

Important Note: If a relative provides daycare, you must submit an additional letter from another official source.

Cost of Keeping Up a Home Test

- Requirement: You must pass both the marriage test and qualifying person test and show that you paid more than half the cost of keeping up your home for the tax year.

Documentation you may submit includes:

- Rent receipts

- Utility bills

- Grocery receipts

- Property tax bills

- Mortgage interest statements

- Repair and maintenance bills

- Property insurance statements

- Other household bills

Key Takeaways

- IRS Form 886-H-HOH is used to prove Head of Household eligibility.

- It requires photocopies of documents, not originals.

- You must demonstrate compliance with the marriage test, qualifying person test, and cost of keeping up a home test.

- The form is usually completed in response to an IRS request, not filed proactively with your tax return.