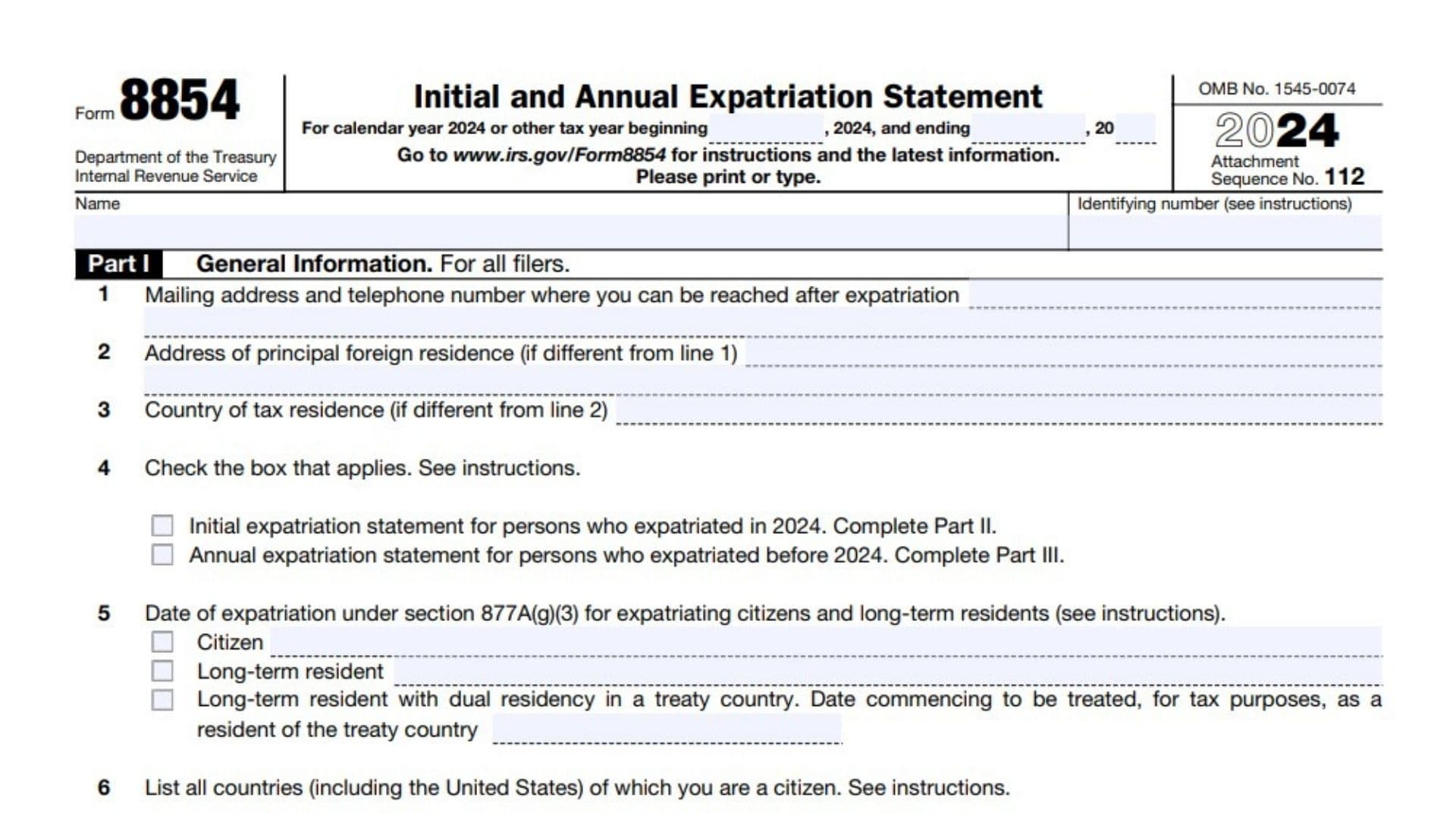

IRS Form 8854, officially titled the “Initial and Annual Expatriation Statement,” is a mandatory tax form for U.S. citizens who renounce their citizenship and certain long-term residents (Green Card holders who have held their status for at least 8 of the last 15 years) who terminate their U.S. residency. The form serves multiple purposes: it notifies the IRS of your expatriation, certifies your compliance with all U.S. federal tax obligations for the five years preceding expatriation, and determines whether you are a “covered expatriate” subject to the expatriation tax (exit tax) under sections 877 and 877A of the Internal Revenue Code. Filing Form 8854 is the IRS’s way of ensuring you have met your tax responsibilities before you officially sever ties with the U.S. tax system. Failure to file can result in severe penalties, including an automatic $10,000 fine and being treated as a covered expatriate, which may trigger the exit tax regardless of your actual income or asset levels.

How to File Form 8854

- When to File: Attach your initial Form 8854 to your income tax return (Form 1040, 1040-SR, or 1040-NR) for the year that includes your expatriation date, and file by the tax return due date (including extensions). If you are not required to file a tax return, mail Form 8854 to the IRS at the address provided in the instructions by the same deadline.

- Annual Filing: If you expatriated in a previous year and have deferred tax, eligible deferred compensation, or a nongrantor trust interest, file the annual statement (Part III) with your tax return each year these conditions apply.

- Who Must File: U.S. citizens who renounce citizenship and long-term residents ending residency must file, regardless of whether they are “covered expatriates” or not.

How to Complete Form 8854?

Heading

- Name: Enter your full legal name.

- Identifying Number: Enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- For calendar year 2024 or other tax year beginning ___, 2024, and ending , 20: Fill in the appropriate dates for the tax year covered.

Part I – General Information (For All Filers)

- Mailing address and telephone number where you can be reached after expatriation: Provide your current mailing address and a phone number.

- Address of principal foreign residence (if different from line 1): If your main residence abroad differs from your mailing address, enter it here.

- Country of tax residence (if different from line 2): If your country of tax residence is different from your principal foreign residence, specify here.

- Check the box that applies:

- Initial expatriation statement (if you expatriated in 2024, complete Part II).

- Annual expatriation statement (if you expatriated before 2024, complete Part III).

- Date of expatriation under section 877A(g)(3): Enter your expatriation date. Indicate if you are a citizen, long-term resident, or long-term resident with dual residency in a treaty country (and the date you began being treated as a resident of that country for tax purposes).

- List all countries (including the United States) of which you are a citizen:

- a. Name of country

- b. Date you became a citizen of each country listed.

- How you became a U.S. citizen: Check either “By birth” or “By naturalization.”

- a. Date you became a U.S. lawful permanent resident: Enter the date you received your Green Card.

b. Date your U.S. lawful permanent resident status was revoked or abandoned: Enter the date you lost permanent resident status.

c. Date you relinquished your permanent resident card: Enter the date you surrendered your Green Card.

Part II – Initial Expatriation Statement for Persons Who Expatriated in 2024

Section A – Expatriation Information

- Enter your U.S. income tax liability (after foreign tax credits) for the 5 tax years ending before the date of your expatriation: Fill in the tax liability for each of the five years.

- Enter your net worth on the date of your expatriation for tax purposes: State your net worth in U.S. dollars.

- Have there been significant changes in your assets and liabilities for the 5 years ending before the date of your expatriation? Check “Yes” or “No.” If “Yes,” attach an explanation.

- Did you become at birth a U.S. citizen and a citizen of another country, and do you continue to be a citizen of, and taxed as a resident of, that other country? Check “Yes” or “No.”

- If you answered “Yes” to question 4, have you been a resident of the United States for not more than 10 of the last 15 tax years (including the year of your expatriation)? Check “Yes” or “No.”

- Were you under age 18½ on the date you expatriated and have you been a U.S. resident for not more than 10 tax years? Check “Yes” or “No.”

- Do you certify under penalties of perjury that you have complied with all of your tax obligations for the 5 preceding tax years? Check “Yes” or “No.”

Section B – Balance Sheet

List in U.S. dollars the fair market value (FMV) and U.S. adjusted basis of your assets and liabilities as of your expatriation date.

Assets

- Cash, including bank deposits

- Marketable stock and securities issued by U.S. companies

- Marketable stock and securities issued by foreign companies

- Nonmarketable stock and securities issued by U.S. companies

- Nonmarketable stock and securities issued by foreign companies

a. Separately state stock issued by foreign companies that would be controlled foreign corporations if you were still a U.S. citizen or permanent resident.

b. Provide the name, address, and EIN (if any) of any such company. - Pensions or similar retirement arrangements (both U.S. and foreign)

- Deferred compensation (including stock options)

- Partnership interests

- Assets held in trust

- Beneficial interests in trusts not included in line 9

- Intangibles used in the United States

- Intangibles used outside the United States

- Loans to U.S. persons

- Loans to foreign persons

- Real property located in the United States

- Real property located outside the United States

- Business property located in the United States

- Business property located outside the United States

- Other assets (describe)

- Total assets (add lines 1–5 and 6–19; do not include amounts on line 5a)

Liabilities

21. Installment obligations

22. Mortgages, etc.

23. Other liabilities (describe)

24. Total liabilities (add lines 21–23)

25. Net worth (subtract line 24 from line 20, column (a))

Section C – Property Owned on Date of Expatriation

Do not complete this section if you meet certain exceptions (see form instructions).

1a. Do you have any eligible deferred compensation items? (Checking “Yes” is an irrevocable waiver of any right to claim treaty benefits on withholding.)

1b. Do you have any ineligible deferred compensation items?

1c. Do you have an interest in a specified tax deferred account?

1d. Are you a beneficiary of a nongrantor trust? (Check box to elect to be treated as having received the value of your entire interest in the trust.)

2. Recognition of gain or loss on the deemed sale of mark-to-market property:

- (a) Description of property

- (b) FMV on day before expatriation

- (c) Cost or other basis

- (d) Gain or (loss) (subtract (c) from (b))

- (e) Gain after allocation of the exclusion amount

- (f) Form or schedule on which gain or loss is reported

- (g) Amount of tax deferred (attach computations)

- Total (add amounts in columns (d) and (e))

- Total tax deferred (add amounts in column (g); also enter in Section D, line 5)

Section D – Deferral of Tax

- Are you electing to defer tax under section 877A(b)? (Checking “Yes” is an irrevocable waiver of treaty rights to prevent assessment or collection of tax.)

- Enter the total tax you would have reported, absent the deferral election, on Form 1040 or 1040-SR, line 24, for the part of the year including the day before expatriation.

- Enter the total tax for the same period, excluding amounts attributable to section 877A(a) (attach computation).

- Subtract line 3 from line 2 (amount of tax eligible for deferral).

- Enter the total tax deferred from Section C, line 4, column (g).

Part III – Annual Expatriation Statement for Persons Who Expatriated Before 2024

Complete if you deferred tax, have eligible deferred compensation, or are a beneficiary of a nongrantor trust.

- For all property on which you deferred tax on a prior year Form 8854, list:

- (a) Description of property

- (b) Amount of mark-to-market gain or (loss) reported on prior year Form 8854

- (c) Amount of tax deferred on prior year Form 8854

- (d) Date of disposition (if any)

- Did you receive any distributions of eligible deferred compensation items for 2024? If “Yes,” enter:

- Amount of distribution

- Amount withheld at source, if any

- Did you receive any distributions from a nongrantor trust for 2024? If “Yes,” enter:

- Amount of distribution

- Amount withheld at source, if any

Signature

- Your signature and date: Sign and date the form.

- Preparer’s information: If applicable, include the preparer’s name, signature, PTIN, firm name, EIN, address, and phone number.