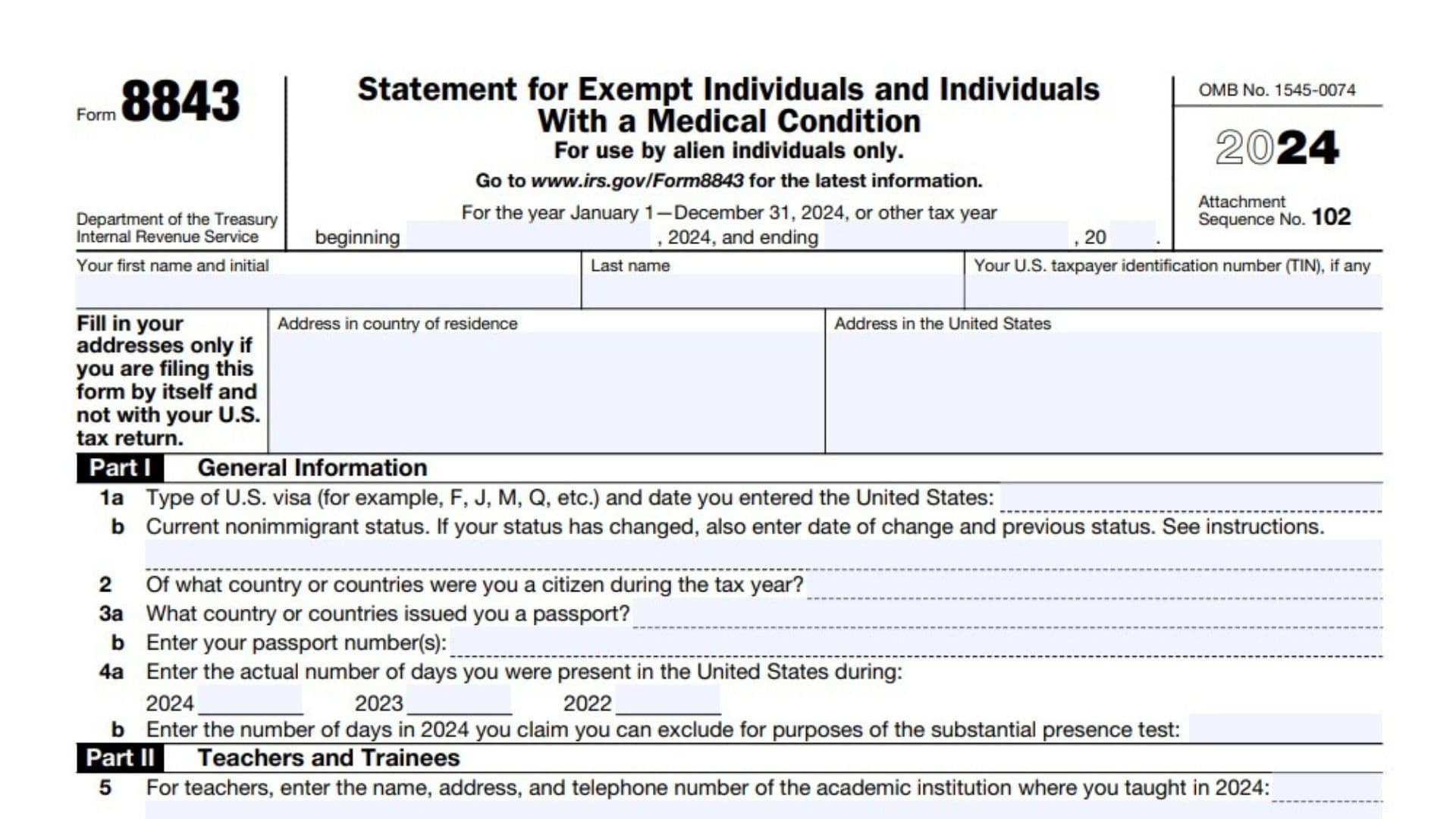

IRS Form 8843 is an important U.S. tax document required for certain alien individuals present in the United States. The form is used to explain why these individuals can exclude days of physical presence in the U.S. when applying the substantial presence test for tax residency purposes. It primarily applies to exempt individuals such as teachers, trainees, students, professional athletes competing in charitable events, and those who were unable to leave the U.S. due to medical conditions. Filing Form 8843 helps these individuals avoid being classified as U.S. residents for tax purposes when they meet specific visa and presence criteria. The form must be filed yearly, either attached to a tax return or separately if no return is required, to maintain clarity on their tax status with the IRS.

How To File IRS Form 8843

- Attach to Form 1040-NR if Filing Tax Return: If you are filing the Form 1040-NR tax return, attach Form 8843 to it. Make sure to mail both by the due date, including extensions.

- File Separately if No Tax Return Required: If you don’t need to file a tax return, mail Form 8843 separately by the same due date to IRS Austin, TX address as indicated in the form instructions.

- File on Time: Filing on time is critical to exclude days of presence under the exemptions. Failure to file Form 8843 may cause you to be considered a U.S. resident under the substantial presence test.

- Keep Copies: Retain copies of the completed form and all supporting documents for your records.

How To Complete Form 8843

Part I: General Information

- Line 1a: Enter your U.S. visa type (e.g., F-1, J-1, M-1) and the date you last entered the United States.

- Line 1b: Write your current nonimmigrant status as of the last day of the tax year. If your status changed during the year, provide the previous status and the date of change.

- Line 2: Indicate all countries where you were a citizen during the tax year.

- Line 3a: List the country or countries that issued your passport.

- Line 3b: Enter your passport number(s).

- Line 4a: Report the total number of days you were physically present in the U.S. for the current year and the two preceding years (2024, 2023, and 2022).

- Line 4b: If applicable, enter the number of days you claim as excluded under the substantial presence test for 2024.

Part II: Teachers and Trainees (Complete Only If Applicable)

- Line 5: Name, address, and telephone number of the academic institution where you taught in 2024.

- Line 6: For trainees, enter the program director’s name, institution address, and telephone number for the specialized program participated in during 2024.

- Line 7: List all the calendar years from 2018 to 2023 during which you held a J or Q visa, noting any visa changes with corresponding dates.

- Line 8: Indicate if you were exempt as a teacher or trainee for any part of two of the last six calendar years. Check “Yes” or “No.” Note that if “Yes,” you may not exclude days unless specific exceptions apply.

Part III: Students (Complete Only If Applicable)

- Line 9: Provide the name, address, and telephone number of the academic institution attended in 2024.

- Line 10: Enter the name, address, and telephone number of the program director for your academic or cultural exchange program.

- Line 11: List your visa type (F, J, M, or Q) held each year from 2018 to 2023 and attach statements for any visa type changes.

- Line 12: State whether you were exempt as a student, teacher, or trainee for more than five calendar years by marking “Yes” or “No.” Note special reporting and intent to not reside permanently in the U.S. if “Yes.”

- Line 13: Indicate if you applied for or took steps toward lawful permanent resident status in 2024 by marking “Yes” or “No.”

- Line 14: If “Yes” on Line 13, explain the details of your application or status change.

Part IV: Professional Athletes (Complete Only If Applicable)

- Line 15: Enter the name(s) of the charitable sports event(s) competed in during 2024 and their dates.

- Line 16: List the charitable organization(s) that received the net proceeds from the sports event(s), including their employer identification numbers. Attach a statement verifying that the proceeds were donated.

Part V: Individuals With a Medical Condition or Medical Problem (Complete Only If Applicable)

- Line 17a: Describe the medical condition or problem that prevented your departure from the U.S.

- Line 17b: Enter the date you originally intended to leave before the medical problem occurred.

- Line 17c: Enter the actual date you left the United States, if applicable.

- Line 18: Have your physician or medical official complete this section by certifying your inability to leave, providing their name, address, telephone number, signature, and date.

Signature

- Sign and date the form if filing Form 8843 by itself (not attached to a U.S. tax return).

Important Notes and Exceptions

- Days you exclude under these exemptions do not count towards the substantial presence test for U.S. residency.

- You cannot exclude days if you entered for the purpose of medical treatment or if the medical condition existed prior to arrival.

- Teachers or trainees who were exempt for two or more prior years may lose exclusion privileges unless an exception applies.

- Students who have been exempt for more than five years must provide evidence they do not intend to reside permanently in the U.S.

- Always refer to IRS Publication 519 and form instructions for additional guidance.