IRS Form 8839, officially titled “Qualified Adoption Expenses,” is a tax form designed for individuals who have incurred adoption expenses and wish to claim the adoption credit or exclude employer-provided adoption benefits from their taxable income. This form enables taxpayers to reduce their federal income tax liability by accounting for qualified expenses related to adopting a child, including agency fees, court costs, and travel expenses. The form is particularly valuable for families adopting children with special needs, as they may be eligible for the full adoption credit regardless of expenses paid. Understanding how to file Form 8839 correctly ensures taxpayers can maximize these financial benefits while complying with IRS requirements.

How to File IRS Form 8839?

Form 8839 must be attached to your tax return (Form 1040, 1040-SR, or 1040-NR). Before filing, gather all necessary documentation related to the adoption, including receipts, employer-provided benefit details (if applicable), and the child’s identifying information. Visit the IRS website for the latest instructions and updates related to the form.

How to Complete Form 8839?

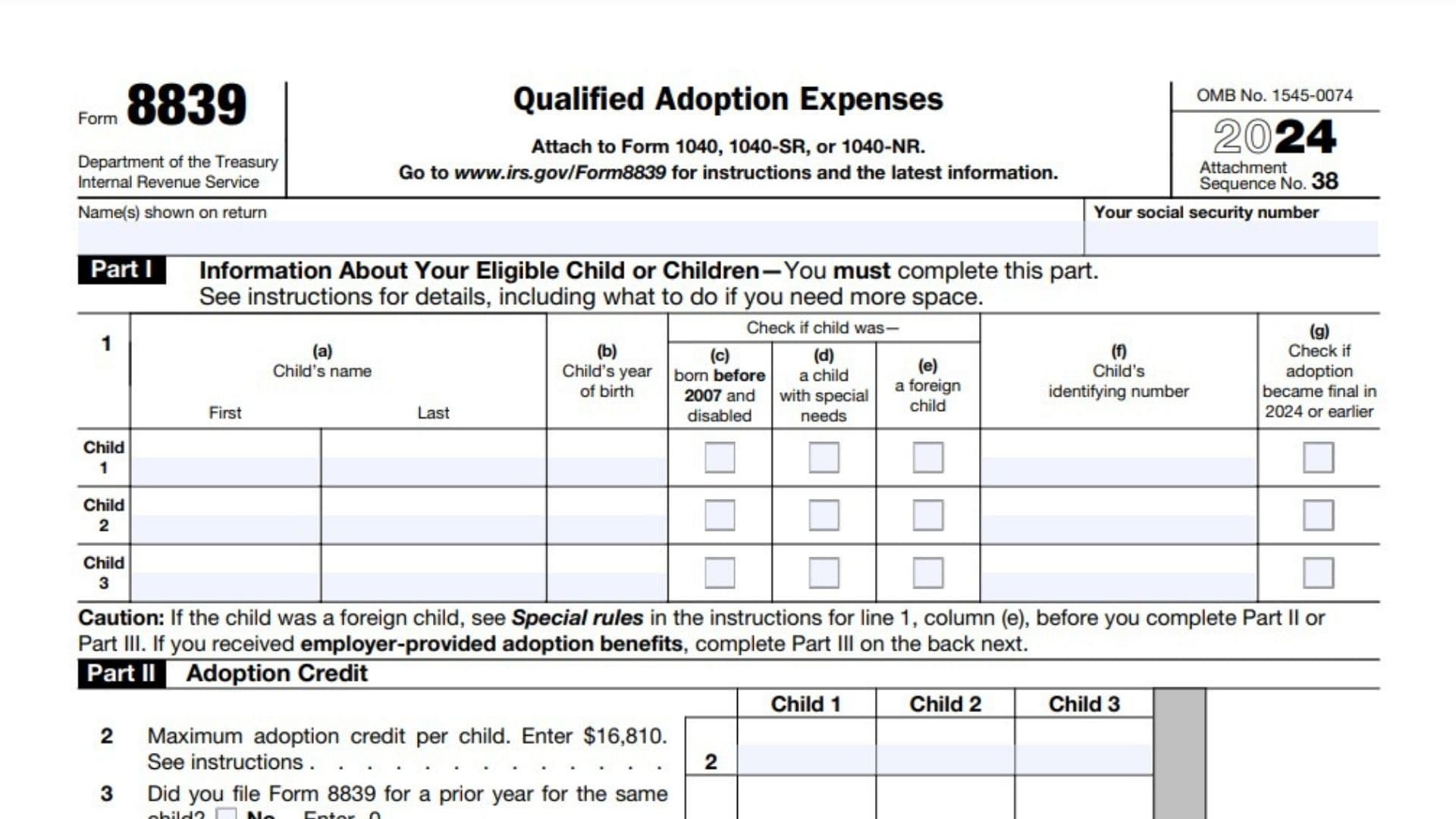

Part I – Information About Your Eligible Child

Line 1: Complete columns (a) through (g) for each adopted child:

- (a) Enter child’s full legal name

- (b) Enter child’s year of birth

- (c) Check if child was born before 2007 and is disabled

- (d) Check if child has special needs

- (e) Check if child is foreign-born

- (f) Enter child’s Social Security Number or ATIN

- (g) Check if adoption was finalized in 2024 or earlier

Part II – Adoption Credit

- Line 2: Enter $16,810 (maximum credit per child)

- Line 3: Enter previous credit amounts:

- No prior filing: Enter 0

- Prior filing: Enter amount from previous Form 8839

- Line 4: Subtract line 3 from line 2

- Line 5: Enter qualified adoption expenses paid

- Line 6: Enter smaller amount from line 4 or line 5

- Line 7: Enter modified adjusted gross income

- Line 8: If line 7 exceeds $252,150:

- Subtract $252,150 from line 7

- If not, enter 0

- Line 9: Divide line 8 by $40,000 (maximum 1.000)

- Line 10: Multiply line 6 by line 9

- Line 11: Subtract line 10 from line 6

- Line 12: Add all amounts on line 11

- Line 13: Enter credit carryforward from prior year

- Line 14: Add lines 12 and 13

- Line 15: Enter amount from Credit Limit Worksheet

- Line 16: Enter smaller amount from line 14 or 15

Part III – Employer-Provided Benefits

- Line 17: Enter $16,810 (maximum exclusion per child)

- Line 18: Enter prior year employer benefits:

- No prior benefits: Enter 0

- Prior benefits: Enter amount received

- Line 19: Subtract line 18 from line 17

- Line 20: Enter 2024 employer-provided benefits (Form W-2, Box 12, Code T)

- Line 21: Add amounts from line 20

- Line 22: Enter smaller amount from line 19 or 20 (unless special needs child)

- Line 23: Enter modified adjusted gross income

- Line 24: If line 23 exceeds $252,150:

- Subtract $252,150 from line 23

- If not, enter 0

- Line 25: Divide line 24 by $40,000 (maximum 1.000)

- Line 26: Multiply line 22 by line 25

- Line 27: Subtract line 26 from line 22

- Line 28: Add amounts on line 27

- Line 29: Calculate taxable benefits:

- If line 28 > line 21: Subtract line 21 from line 28 (enter as negative)

- If line 28 < line 21: Subtract line 28 from line 21 (enter as positive)