Buying a home with the help of federal mortgage subsidies can provide financial relief, but it may also come with specific tax obligations when selling the property. One such obligation is the recapture tax, which applies when homeowners sell a property financed with tax-exempt mortgage bonds or a mortgage credit certificate (MCC). If this applies to you, the IRS Form 8828 (Recapture of Federal Mortgage Subsidy) is required to determine if you owe any additional tax. This form ensures the IRS recoups a portion of the benefits received from the subsidized mortgage if certain conditions apply, such as selling the home within a specified timeframe and earning above a certain income limit.

Understanding IRS Form 8828 is crucial for homeowners who have utilized federally subsidized mortgage assistance. In this guide, we will break down how to file and complete Form 8828 line by line, ensuring you meet IRS compliance requirements while minimizing any potential tax liability.

How to File IRS Form 8828?

Who Should File Form 8828?

You must file Form 8828 if:

✅ You sold (or transferred ownership of) a home financed with a federal mortgage subsidy.

✅ Your loan was subsidized through either:

- A tax-exempt bond program.

- A mortgage credit certificate (MCC).

✅ You sold the home within nine years of its purchase date.

✅ Your income increased beyond a certain threshold during ownership.

Who Is Exempt from Filing?

You do not need to file Form 8828 if:

❌ You did not use a federal subsidy for your mortgage.

❌ You owned the home for nine or more years before selling.

❌ Your income did not exceed the adjusted qualifying income limits.

❌ You incurred a loss on the sale of your home.

Where and When to File?

📌 Attach Form 8828 to your federal tax return (Form 1040) for the tax year in which you sold the home.

📌 File it by the standard tax deadline (April 15).

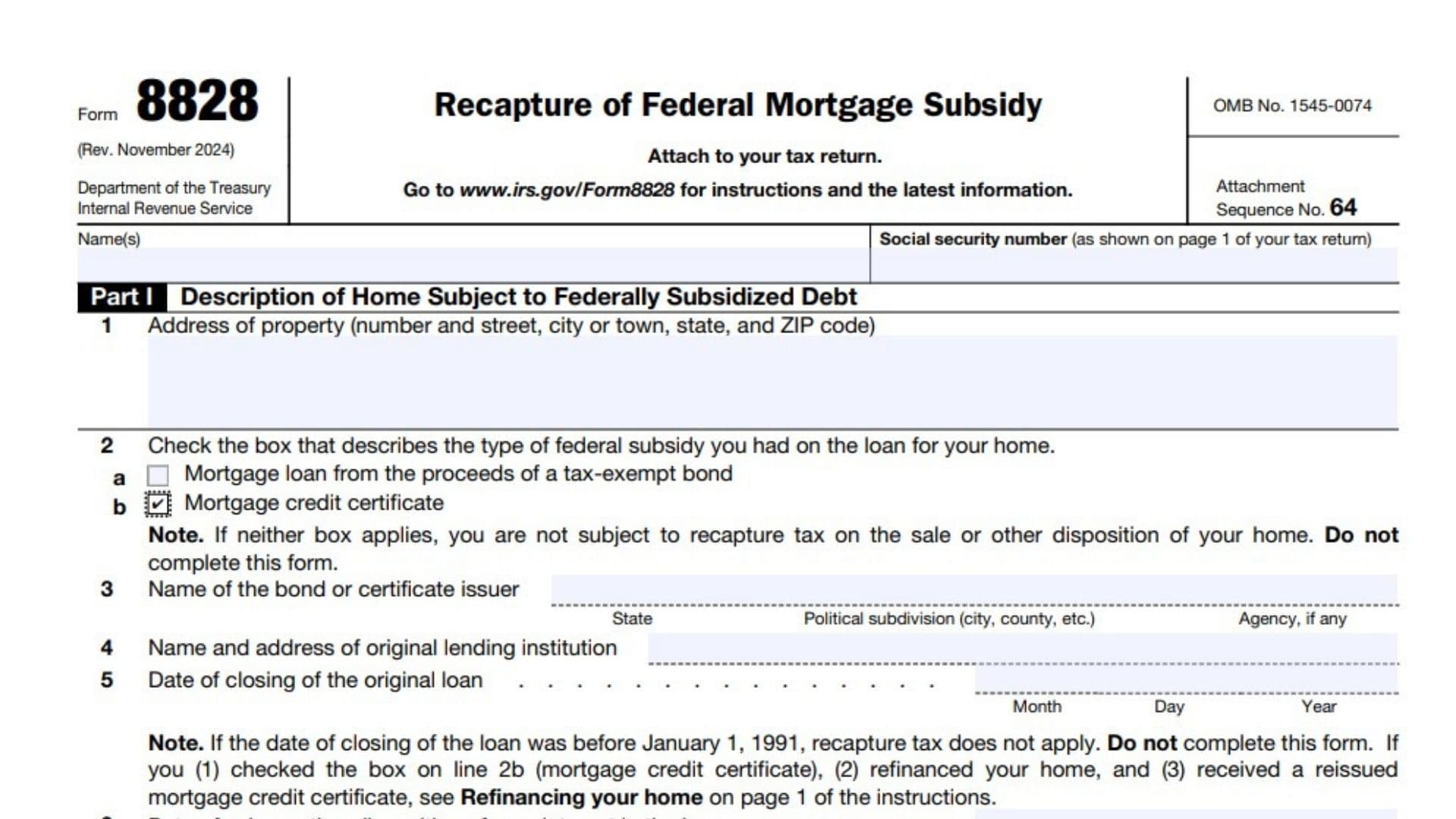

How to Complete Form 8828?

Part I: Description of Home Subject to Federally Subsidized Debt

Line 1: Property Address

📍 Enter the full address of the property, including street, city, state, and ZIP code.

Line 2: Type of Federal Subsidy

☑ Check one box to indicate whether your loan was financed through:

- Tax-Exempt Bond (check box 2a)

- Mortgage Credit Certificate (MCC) (check box 2b)

💡 If neither box applies, STOP! You do not owe recapture tax and do not need to file Form 8828.

Line 3: Issuer of Bond or MCC

✍ Provide the name of the bond or MCC issuer, including:

- State of issuance

- Political subdivision (city, county, etc.)

- Any agency involved in issuing the subsidy

Line 4: Original Lending Institution

🏦 Enter the name and full address of the institution that provided the original mortgage loan.

Line 5: Original Loan Closing Date

📅 Enter the exact date (MM/DD/YYYY) when your original mortgage closed.

💡 If your mortgage closed before January 1, 1991, STOP! You are not subject to recapture tax.

Line 6: Date of Home Sale or Other Disposition

📅 Enter the date you sold, transferred, or disposed of the home.

Line 7: Number of Years Owned

🕰️ Calculate the number of years and full months between the original closing date (Line 5) and the date of sale (Line 6).

Line 8: Date of Full Loan Repayment

📅 If you fully repaid or refinanced your mortgage (excluding certain refinanced MCC loans), enter the date of repayment.

Part II: Computation of Recapture Tax

Step 1: Calculate the Gain from Sale

Line 9: Sales Price

💰 Enter the total sales price (excluding seller-paid closing costs).

Line 10: Expenses of Sale

💼 List all expenses directly related to selling the home, such as:

- Real estate commissions

- Legal fees

- Advertising costs

Line 11: Amount Realized

📊 Formula: Line 9 – Line 10 = Amount Realized

Line 12: Adjusted Basis of Home

🏠 The adjusted basis is usually the original purchase price, plus any capital improvements, minus any depreciation.

Line 13: Gain (or Loss) from Sale

📊 Formula: Line 11 – Line 12 = Gain or Loss

💡 If this is a loss, STOP! You do not owe recapture tax.

Step 2: Determine If You Owe Recapture Tax

Line 14: Multiply Gain by 50%

📝 If you have a gain, multiply Line 13 by 50% (0.50).

Line 15: Modified Adjusted Gross Income (MAGI)

💰 Enter your total income as calculated for tax purposes.

Line 16: Adjusted Qualifying Income

📊 Refer to the IRS instructions to determine the qualifying income threshold.

Line 17: Subtract Line 16 from Line 15

📊 Formula: Line 15 – Line 16

💡 If this is zero or less, STOP! No recapture tax is owed.

Line 18: Income Percentage

📈 If Line 17 is $5,000 or more, enter 100%. Otherwise, calculate (Line 17 ÷ $5,000) × 100.

Line 19: Federally Subsidized Amount

📜 Use the original loan documents to determine the federal subsidy received.

Line 20: Holding Period Percentage

⏳ The recapture tax decreases the longer you own the home. Refer to IRS guidelines for your holding period percentage.

Line 21: Multiply Line 19 by Line 20

📊 Formula: Line 19 × Line 20

Line 22: Multiply Line 21 by Line 18

📊 Formula: Line 21 × Line 18

Final Calculation

Line 23: Recapture Tax Amount

💸 Enter the smaller of Line 14 or Line 22. This is your final recapture tax amount, which must be reported on Schedule 2 (Form 1040), Line 17b.