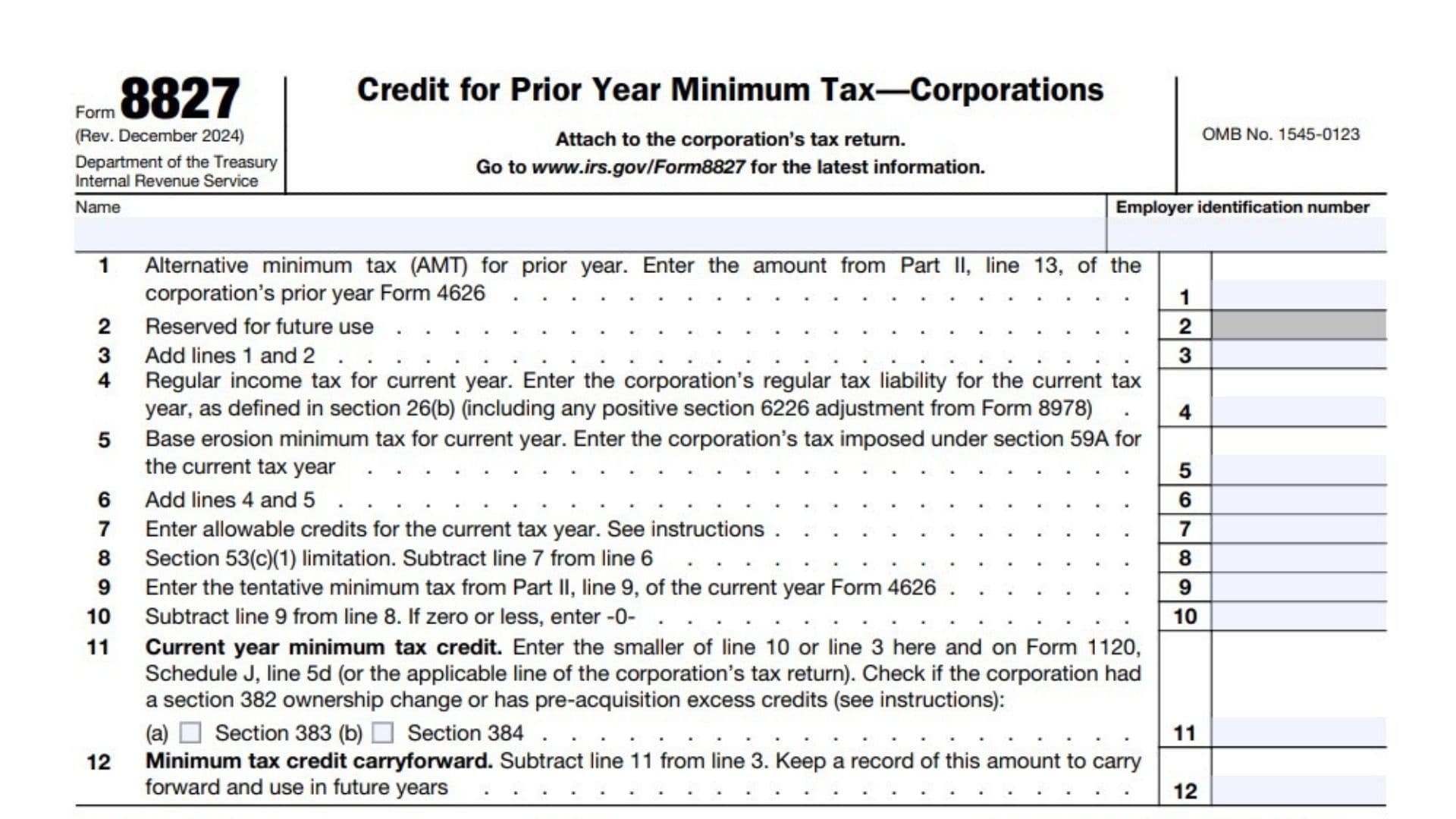

Form 8827 is used by corporations to determine and claim a credit for prior-year alternative minimum tax (AMT). This form is essential for corporations that have previously incurred AMT liabilities and need to calculate any minimum tax credit they can carry forward to future years. The credit calculated on this form reduces the corporation’s tax liability in future years, helping businesses recover AMT paid in prior years. The form also considers various factors like regular tax liabilities, minimum tax, available credits, and carryforward of unused credits.

How to Complete Form 8827?

- Start with General Information:

- Enter the corporation’s name and employer identification number (EIN) as they appear on the tax return.

- Line 1 – Enter the prior year AMT:

- You’ll need to reference Form 4626, specifically line 13, from the previous year. This amount represents the AMT paid in the prior year.

- Line 2 – Reserved for future use:

- This field is currently reserved, and no information should be entered here.

- Line 3 – Add lines 1 and 2:

- Simply add the value from line 1 (prior year AMT) and line 2 (which is blank) to get the total amount of prior year tax credits.

- Line 4 – Enter the corporation’s regular income tax for the current year:

- This amount should include the regular income tax liability as defined in section 26(b), plus any adjustments from Form 8978 (if applicable).

- Line 5 – Base erosion minimum tax for the current year:

- If the corporation is subject to base erosion tax, enter that amount here.

- Line 6 – Add lines 4 and 5:

- Add the regular income tax and base erosion tax together.

- Line 7 – Enter allowable credits for the current tax year:

- This is where you enter any credits the corporation can claim for the current tax year, as provided under the Internal Revenue Code.

- Line 8 – Subtract line 7 from line 6:

- Calculate this subtraction to figure out the available tax after credits.

- Line 9 – Tentative minimum tax for the current year:

- Enter the tentative minimum tax from Form 4626, line 9.

- Line 10 – Subtract line 9 from line 8:

- If the result is zero or less, enter zero. This shows the tentative excess tax.

- Line 11 – Current year minimum tax credit:

- Enter the smaller of line 10 or line 3. This is the amount the corporation can claim as the current year’s minimum tax credit.

- Line 12 – Minimum tax credit carryforward:

- Subtract line 11 from line 3. This is the unused minimum tax credit that can be carried forward to future years.